Although blue-chips remained the driving force behind today’s indices, profit-taking pressures kept prices in check for many stocks. Meanwhile, the heat intensified in the mid- and small-cap space, with several stocks hitting the ceiling.

Both the VN-Index and VN30-Index fluctuated between gains and losses this afternoon, only gaining some momentum towards the end of the session. In contrast, the Midcap and Smallcap indices trended upwards consistently, with the Smallcap index outperforming towards the close. The VN-Index closed up 0.51% (+8.1 points), while the VN30-Index gained 0.67%. The Midcap and Smallcap indices rose 1.07% and 1.3%, respectively.

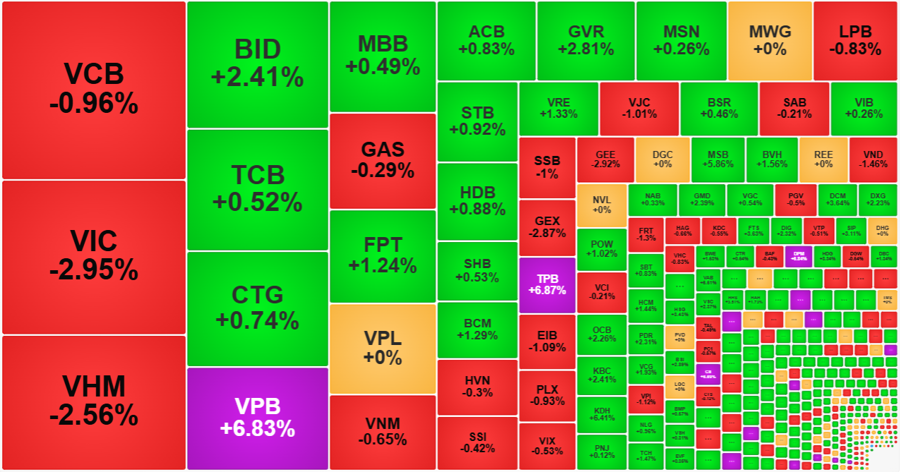

Fifteen stocks on the HoSE exchange closed at the ceiling, while the VN30 basket contributed only two: VPB and TPB. Out of the 80 stocks that gained over 2%, only five were from the blue-chip group, underscoring the strength in the mid- and small-cap segment.

Notably, the Smallcap index witnessed a significant surge in liquidity, with a 35.4% increase in trading volume compared to the previous session, amounting to VND3,683 billion. The VN30 and Midcap indices also experienced boosts in liquidity, with increases of 15.6% and 12.2%, respectively.

Several Smallcap stocks, such as VDS, FCN, ORS, and LCG, witnessed dramatic surges in both price and liquidity, with each recording transactions worth hundreds of billions of dong. It is uncommon for stocks in this segment to attain such high liquidity due to the absence of large investors. Nevertheless, numerous stocks in this category attracted impressive trading volumes with substantial increases in price: KSB rose 4.52% with VND120.3 billion in volume; HHS climbed 3.51% with VND204.5 billion; KHG jumped 2.95% with VND158.8 billion; and TCM advanced 1.98% with VND116.6 billion. Numerous other stocks witnessed trading volumes of several dozen billion dong with gains surpassing 1%.

Today’s session also witnessed mid-cap stocks hitting the ceiling with substantial trading volumes, including CII, ANV, DXS, and DPM. Additionally, stocks like DIG, VSC, HCM, DXG, DCM, HHV, and GMD recorded transactions ranging from VND 300 billion to VND 500 billion.

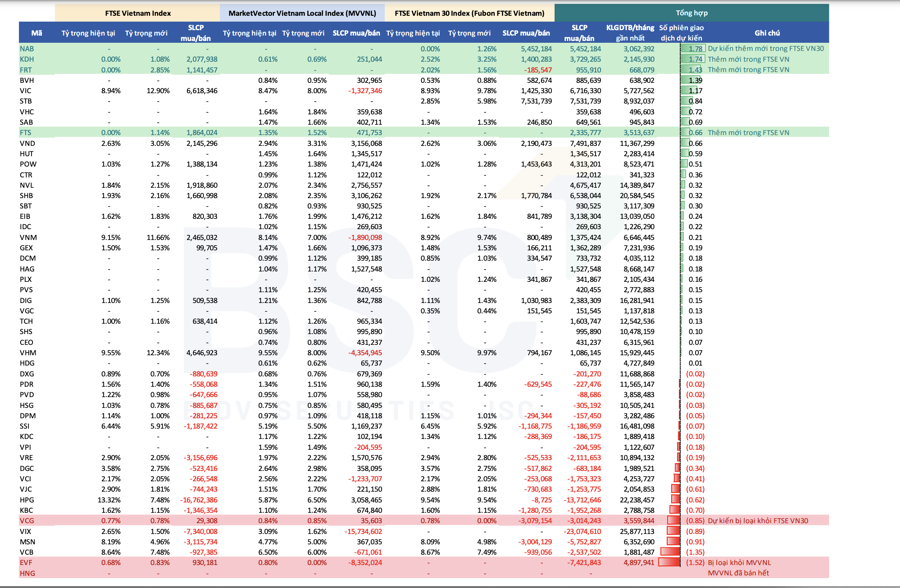

Despite the impressive price performance of mid- and small-cap stocks, their contribution to the indices’ uplift was limited. Only KDH and MSB made it into the top 10 stocks contributing to the VN-Index’s gain, and their impact was negligible. The VN30-Index rose 0.67%, but with a narrow breadth of 17 gainers versus 11 losers. The three largest stocks by market capitalization—VCB, VIC, and VHM—were in the red, with VCB declining 0.96%, VIC falling 2.95%, and VHM dropping 2.56%.

VPB and TPB witnessed a dramatic surge in momentum this afternoon. VPB’s liquidity for the second trading session alone reached VND 1,177.4 billion, with a total daily volume of over VND 1,762 billion. After a robust 2.95% gain in the morning session, VPB soared to the ceiling in the afternoon. This stock has become one of the hottest in the market, rivaling small-cap speculative stocks. Since the beginning of July, VPB has climbed an impressive 56.9%. Although TPB’s liquidity was not as high as VPB’s, it still recorded nearly VND 1,392 billion in trading volume for the day. TPB hit the ceiling earlier than VPB, and its buying pressure was strong enough to clear the sell orders, leaving millions of buy orders at the ceiling price. In contrast, VPB had sell orders totaling 4.7 million shares at the ceiling price.

Aside from these two banking stocks, other large-cap stocks that contributed positively included HPG, which rose 5.17%, BID up 2.41%, GVR climbing 2.81%, and FPT gaining 1.24%. Overall, the VN30 basket faced price constraints throughout the session, except for the two stocks that closed at the ceiling. This lack of consensus among large-cap stocks prevented the VN-Index from breaking out and limited its upside potential.

On a positive note, strong liquidity persisted, with a shift towards mid- and small-cap stocks today. The total matched orders on the two exchanges increased by 11% compared to the previous day, amounting to VND 44,100 billion. When compared to T+ day liquidity, today’s volume represented a 44% decrease, indicating that investors remain optimistic and are willing to hold onto their positions.

Stock Market Blog: Bulls Run Wild, the Party’s Not Over Yet

The flow of capital is shifting towards speculative opportunities, while the blue-chip group is experiencing a divergence. If VCB, VIC, and VHM had not been restrained today, VNI and VN30 could have further boosted market sentiment.

“Undervalued Bank Stocks with Positive Growth Prospects Attract Cash Flow”

“In the past 1-3 months, a select few bank stocks have witnessed an impressive surge, with gains of several dozen percentage points. These stocks share common traits: they boast low to medium price-to-book ratios compared to the industry average, demonstrate improved financial indicators, and possess unique catalysts that set them apart. These factors have likely contributed to their outstanding performance, catching the eye of discerning investors.”