SJ Group Joint Stock Company (Code: SJS, HoSE) has just released a report on the results of its dividend payout in shares and issuance of shares to increase charter capital from equity sources.

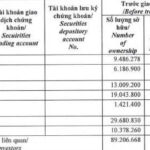

Specifically, as of the end of the issuance on July 31, 2025, SJ Group distributed over 182.6 million bonus shares as dividends for the years 2018, 2019, 2020, 2021, and 2024, and bonus shares to 2,302 shareholders. The remaining 1,021 fractional shares will be canceled.

The entitlement ratio was 100:159, meaning that for every 100 shares owned on the record date, shareholders will receive 159 new bonus shares. These shares are freely transferable. The expected date for the share transfer is August 29, 2025.

SJ Group’s Nam An Khanh New Urban Area Project

The total value of the issuance, at par value, was nearly VND 1,826.2 billion. The source of capital for the issuance of dividend payout shares came from undistributed post-tax profits in the audited 2024 consolidated financial statements. Meanwhile, the capital for the issuance of shares to increase charter capital was sourced from the investment fund and capital surplus.

Following this issuance, SJ Group’s outstanding shares increased from nearly 114.9 million to nearly 297.5 million, equivalent to a charter capital increase from nearly VND 1,149 billion to nearly VND 2,975 billion.

SJ Group, formerly known as Song Da Urban and Industrial Development Investment Joint Stock Company (Sudico), was established in 2001 and primarily operates in the real estate industry.

SJ Group is renowned for its development of numerous large-scale projects, including the expanded Nam An Khanh project, the Nam An Khanh New Urban Area project, the Van La Residential Area project, the Song Da – Ngoc Vung Eco-Tourism Area project, the Tien Xuan New Urban Area project, and the Hoa Hai – Da Nang project, among others.

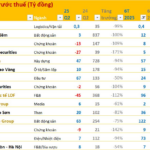

In terms of business performance, according to the consolidated financial statements for Q2 2025, SJ Group recorded net revenue of nearly VND 193.9 billion, a 60.6% increase compared to the same period last year. After deducting taxes and fees, the company reported a net profit of VND 103.8 billion, marking a 101.9% increase.

For the first six months of 2025, SJ Group achieved net revenue of over VND 337.2 billion, a 42.2% increase compared to the same period in 2024. The after-tax profit reached VND 171.2 billion, a 76.3% surge.

As of June 30, 2025, the company’s total assets increased by VND 120 billion from the beginning of the year to nearly VND 7,964.3 billion. Inventories accounted for VND 4,270.8 billion, or 53.6% of total assets, while long-term assets under construction were valued at nearly VND 2,439.5 billion, comprising 30.6% of total assets.

On the liabilities side of the balance sheet, total liabilities stood at nearly VND 4,790.3 billion, a slight decrease of VND 60.1 billion from the beginning of the year. Long-term payables accounted for 39.4% of total liabilities, amounting to nearly VND 1,889.5 billion, while loans totaled over VND 782.2 billion, representing 16.3% of total liabilities.

“Novaland Proposes Extraordinary General Meeting to Discuss the Issuance of Over 168 Million Private Placement Shares to Settle Debt”

The Board of Directors of No Va Real Estate Investment Group Joint Stock Company (HOSE: NVL) has unveiled two proposals for private placements to be discussed at the upcoming extraordinary general meeting on August 7. The proposals involve issuing shares to swap debt and execute a convertible loan facility.