Preliminary statistics from the General Department of Vietnam Customs reveal that the country’s imports of confectionery and cereal products reached over $48.3 million in June 2025. For the first half of the year, imports of these items totaled $288 million, marking a nearly 8% increase compared to the same period in 2024.

Historically, the three largest markets supplying confectionery and cereal products to Vietnam have been China, Indonesia, and Thailand. Imports from these markets have all increased over the past six months.

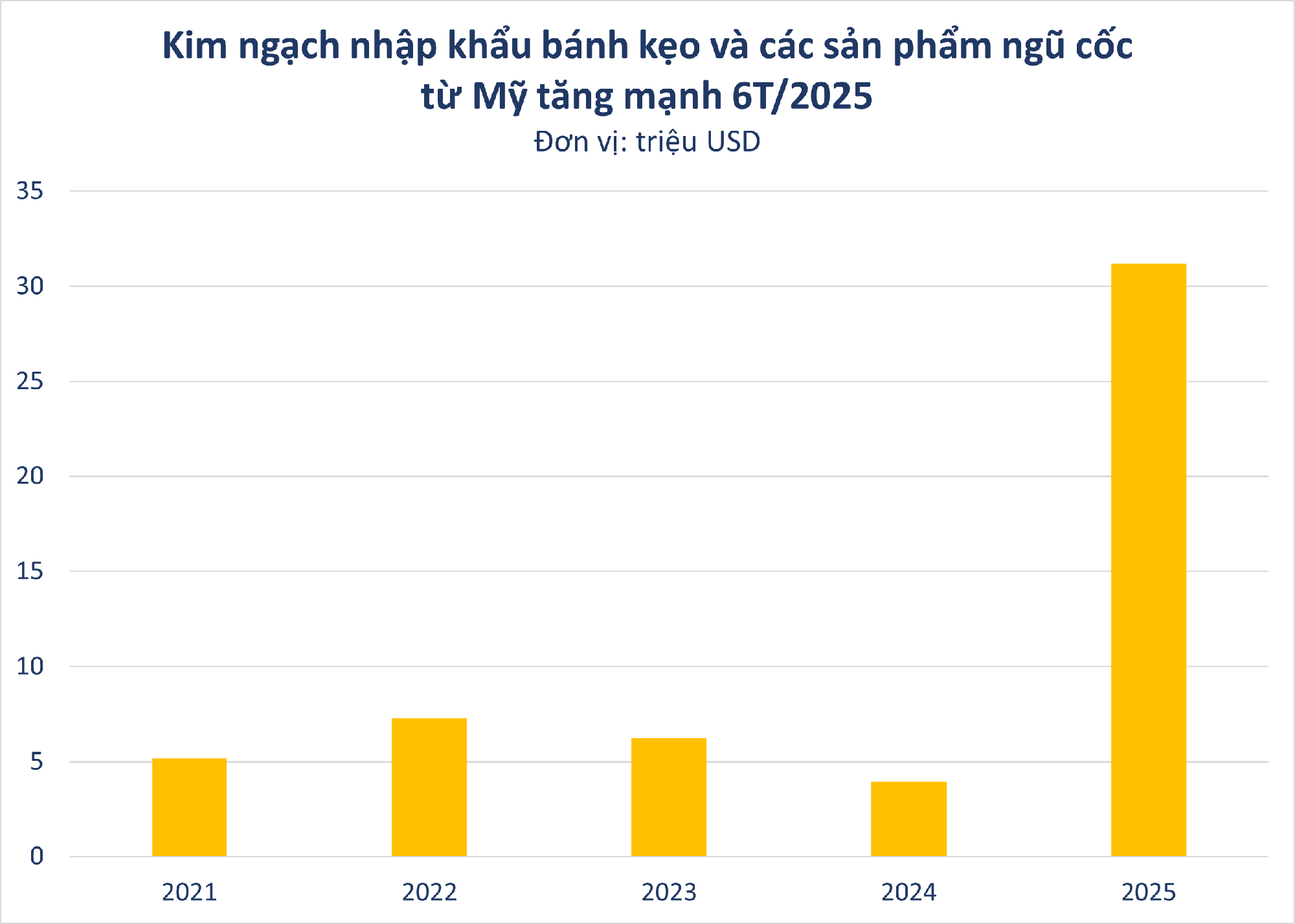

However, a notable shift has occurred since the beginning of 2025, with a significant growth in imports of these products from the United States. Specifically, in June, imports from the US surged by 354% year-on-year. For the first six months, the US exported $31.2 million worth of confectionery and cereal products to Vietnam, reflecting a remarkable 690% increase compared to the same period last year. This is the highest level seen in over five years.

Vietnam’s imported confectionery market used to be dominated by products from ASEAN countries, benefiting from their proximity and preferential tariffs under the ASEAN Trade in Goods Agreement (ATIGA). However, the rapid increase in imports from the US indicates a noticeable shift in consumer preferences.

This shift may be attributed to various factors. Firstly, the superior quality and diversity of US confectionery products play a significant role. The stringent production standards, appealing presentation, and flavors that cater to a wide range of tastes have increasingly won over Vietnamese consumers, particularly the youth and urban dwellers.

Additionally, some of Vietnam’s large distribution companies have expanded their direct import networks from US partners, contributing to more competitive pricing for these products.

On the other hand, Vietnam’s exports of these products are also showing positive signs. Statistics indicate that for the first half of 2025, the country’s exports of confectionery and cereal products reached $593 million, a 7.5% increase compared to the same period last year.

Notably, the US has emerged as Vietnam’s largest export market for confectionery, surpassing traditional partners such as Japan and China. This positive development is a result of Vietnamese enterprises’ efforts in market expansion, product diversification, and proactive trade promotion activities.

According to the Ministry of Industry and Trade, the signing and implementation of multiple FTAs with major partners, including the EU, the US, Japan, South Korea, and ASEAN, have led to an 85-90% reduction in import tariffs for Vietnamese confectionery products, enhancing their competitiveness in international markets.

Furthermore, Vietnam’s confectionery industry benefits from inherent advantages in raw material supply. As an agricultural country, Vietnam boasts an abundant supply of essential raw materials such as sugarcane, cocoa, rice, and various cereals. This not only helps businesses control costs but also results in products with a higher domestic value-added ratio, an aspect increasingly valued by international importers.

The US Imposes 20% Tariff on Vietnamese Exports: Textile and Seafood Industries Seek New Opportunities to Maintain Market Share

The recent announcement of a 20% tariff on Vietnamese goods entering the US market has left the textile and seafood industries concerned. This additional cost will undoubtedly impact businesses’ competitiveness and increase their financial burden. However, there is a silver lining; businesses can still thrive by optimizing their operations and expanding their reach into new markets. It is a challenging yet opportune time for companies to showcase their resilience and adaptability.

The Vietnam’s Business Move as US Officially Enforces Countervailing Duties

Many businesses are assessing the impact and competitive landscape with rival exporting nations to the US market, following President Donald Trump’s announcement of retaliatory tariffs. Companies are re-strategizing their business plans to navigate this new terrain.