The World of Mobile: Not Just a Retail Giant but a Savvy Money Trader

While it is known for its retail business, Mobile World Investment Corporation (MWG) has also made a name for itself as a skilled money trader. With its large enterprise status and access to cheap capital, MWG has, for many years, engaged in lending practices, profiting from interest rate differentials.

In parallel, with cash reserves reaching billions of dollars, the company’s annual profits from this “money trading” venture exceed VND 1,000 billion.

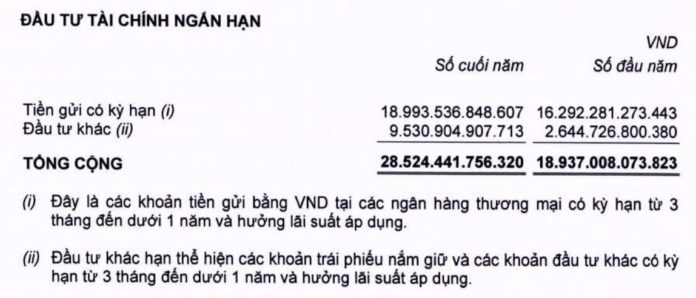

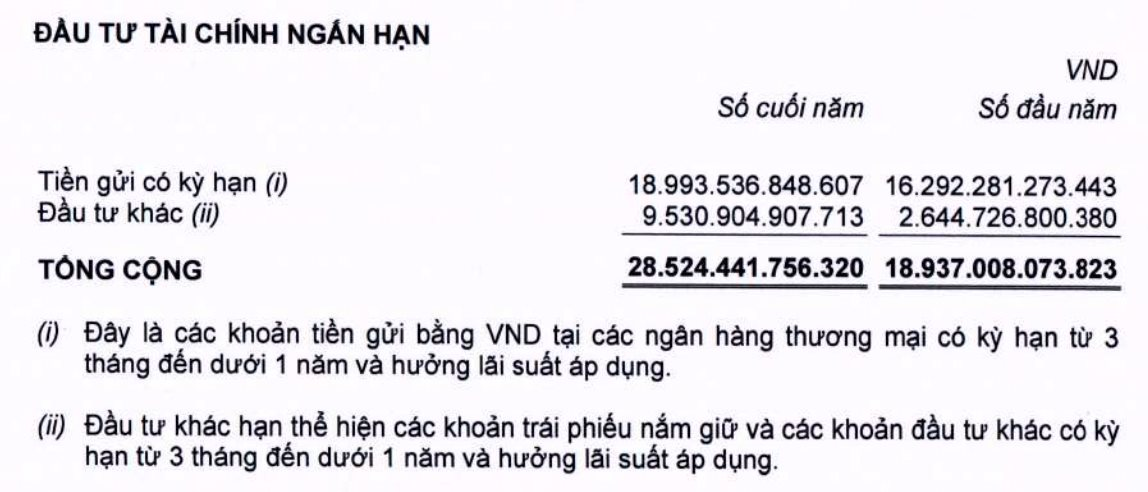

According to the 2024 Consolidated Financial Statements, the company holds VND 34,221 billion in cash and bank deposits, the highest level in recent years.

Notably, bank deposits and short-term bond investments have surged by VND 10,000 billion in the past year.

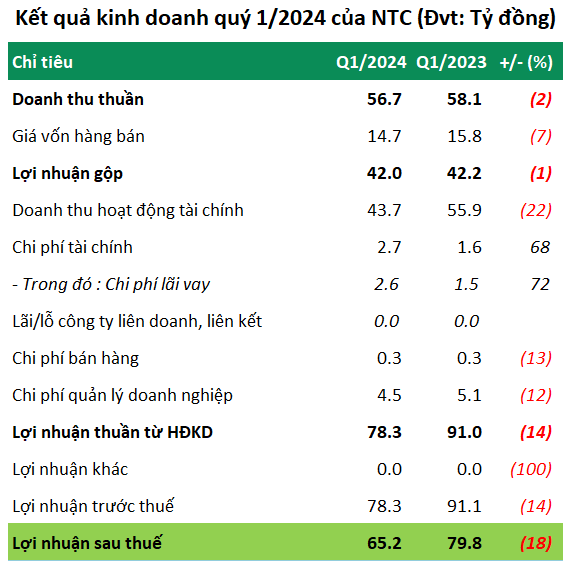

MWG’s financial performance (Source: CafeF)

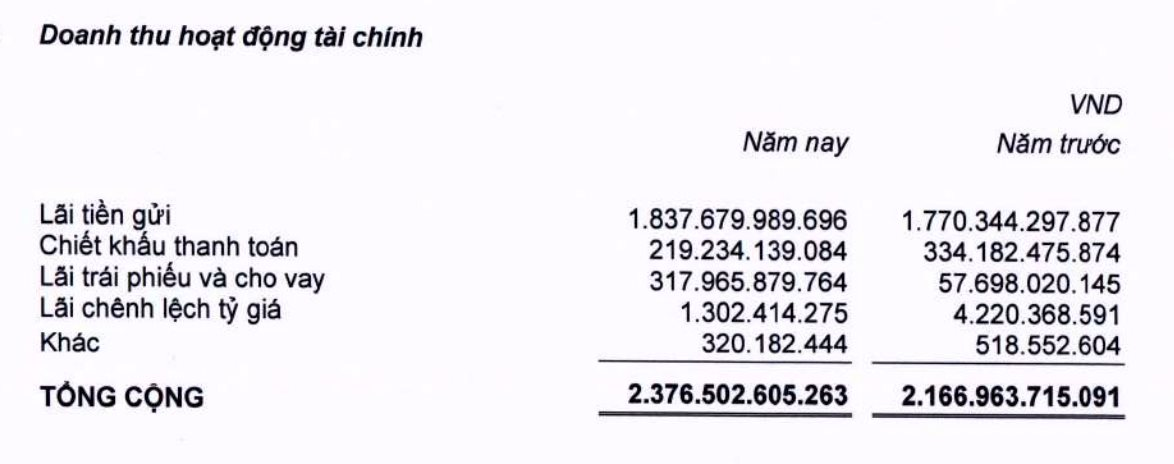

The financial investment activities have yielded significant results. In 2024, MWG recorded a record-high profit of nearly VND 2,200 billion from bank deposits, loans, and bonds.

In addition to its financial activities directly related to money, as a leading retailer in the market, The Gioi Di Dong (Mobile World) also benefits from an additional VND 200-300 billion in “payment discounts” accounted for as financial revenue each year.

MWG’s cash and cash equivalents (Source: CafeF)

This additional business has served as a profit “cushion” for MWG over the years. Compared to the company’s annual after-tax profit, financial gains contribute about one-third of the total.

Notably, in late 2024, the “money trading” activities became more evident as MWG partnered with VPBank to launch the “ATM tree” model in over 3,000 The Gioi Di Dong and Dien May Xanh stores. As shared by Mr. Doan Van Hieu Em, a member of the Board of Directors, after just one month of operation, the company recorded transactions worth more than VND 1,000 billion, with nearly 150,000 transactions.

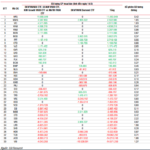

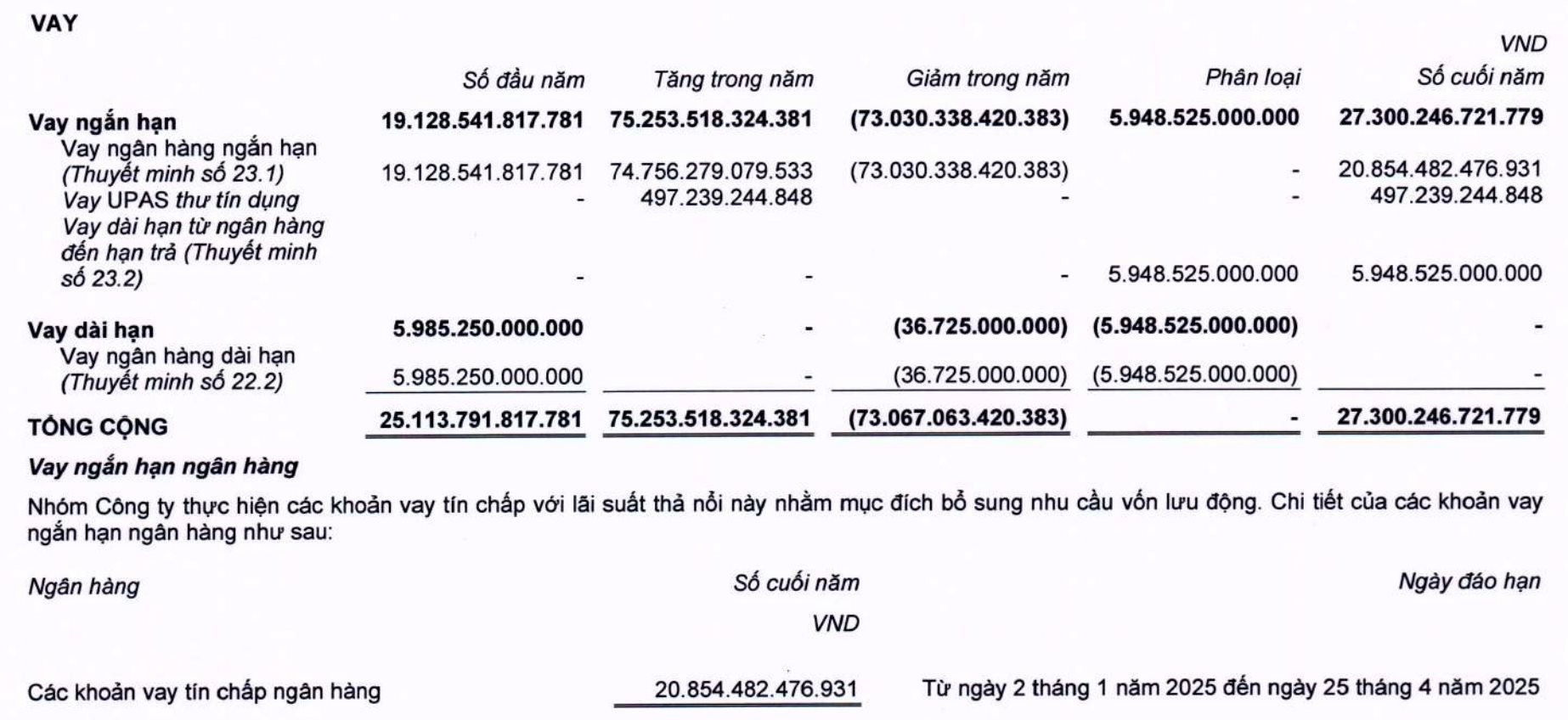

The 2024 financial statements also revealed a significant increase in MWG’s short-term borrowings, with over VND 20,800 billion in unsecured loans. This raises questions about the company’s ambitions in the consumer credit sector.

MWG’s short-term borrowings (Source: CafeF)

Overall, as competition intensifies among retail chains and amid weakening overall demand, the retail giant’s expansion into financial services has drawn significant attention.

VNDiamond and VN30 Basket Re-balancing: Will There Be a Sell-off in the Banking Sector?

The upcoming portfolio restructuring of domestic ETFs in April 2025 is noteworthy, as the VN30 and VNDiamond indices undergo their periodic review. With a cut-off date of March 31st, the results will be announced on April 16th, and the restructuring will be completed by April 29th.

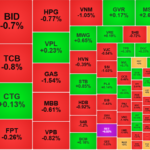

Market Beat: Effort Rewarded, VN-Index Closes Above 1,270

The VN-Index extended its recovery efforts from the latter half of the morning session into the afternoon, posting a gain of 3.44 points to close at 1,270.35 on February 13. This came despite a notable corrective phase just before 2 pm. The HNX-Index and UPCoM also ended the session in positive territory, with the former climbing 0.2 points to 229.52 and the latter advancing 0.93 points to 97.74.

“Home Credit and The Gioi Di Dong: A Comprehensive Partnership”

As part of a comprehensive partnership strategy, Home Credit and The Gioi Di Dong’s collaboration on the “buy now, pay later” model, Home PayLater, aims to provide practical benefits to consumers and boost digital payment habits in Vietnam. With a revenue target of VND 15,000 billion, this partnership is expected to be a significant step forward in the digital payment landscape in the country.

“The Mystique of Real Estate Credit: Unveiling the Enigmatic Power of Finance”

“This is the opinion of Dr. Vu Dinh Anh, an economist at the seminar ‘New Opportunities from the Prosperous Port City,’ which took place on the morning of December 14th.”