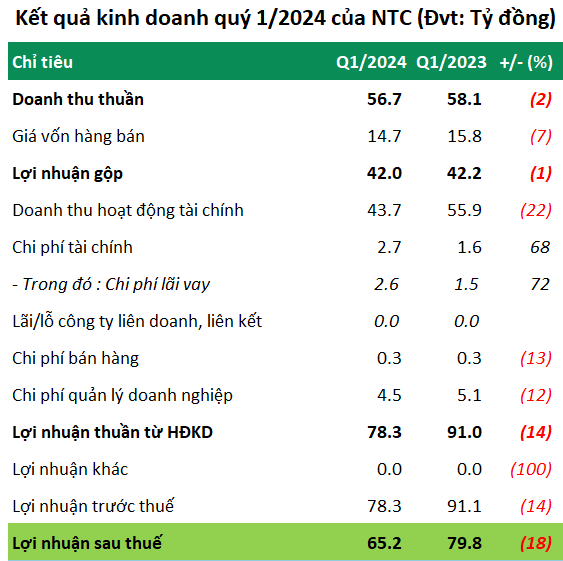

The company attributes the profit drop in Q1/2024 to an approximately 22% decrease in financial activities revenue, down to nearly VND 44 billion, primarily due to dividends received from external invested companies.

An insignificant 68% increase in financial expenses to nearly VND 3 billion (primarily interest expense) was observed. Notably, management expenses saw a 12% reduction to over VND 4 billion compared to the same period last year.

Source: VietstockFinance

|

As of the end of March, NTC’s total assets reached over VND 4,578 billion, showing minimal fluctuation since the beginning of the year. The most significant portion is the held-to-maturity investments of over VND 1,523 billion, accounting for 33% of total assets; of which, time deposits with a term of less than 12 months amounted to nearly VND 1,106 billion, and time deposits with a term of over 12 months exceeded VND 417 billion.

Construction in progress was close to VND 172 billion, unchanged from the beginning of the period and primarily concentrated in the Nam Tan Uyen Industrial Park expansion project (Phase 2). The company stated that this project is still in its early stages, involving consulting, design surveys, and site clearance and compensation. The project covers an area of 345.86 hectares, with a total investment of nearly VND 872 billion.

On the other side of the balance sheet, NTC has about VND 3,553 billion in liabilities, a slight 1% decrease from the beginning of the year. Short-term borrowings were over VND 226 billion, down 18%, while unearned revenue totaled nearly VND 2,981 billion, a modest 1% decrease, largely consisting of advance payments received for long-term land and infrastructure rentals in the industrial park.