HOSE has announced the addition of TAL – Taseco Real Estate Investment Joint Stock Company – to the list of securities ineligible for margin trading due to its listing period being less than six months.

Specifically, nearly 312 million TAL shares began trading on HoSE on August 1st, with a reference price of VND 25,500/share during their first trading session. Prior to this, TAL shares were traded on UPCoM. On its HoSE debut, TAL surged by the maximum allowed limit of 20%. As of the close on August 6th, the market price stood at VND 30,800/share, representing a gain of nearly 21%, with a market capitalization surpassing VND 9,600 billion.

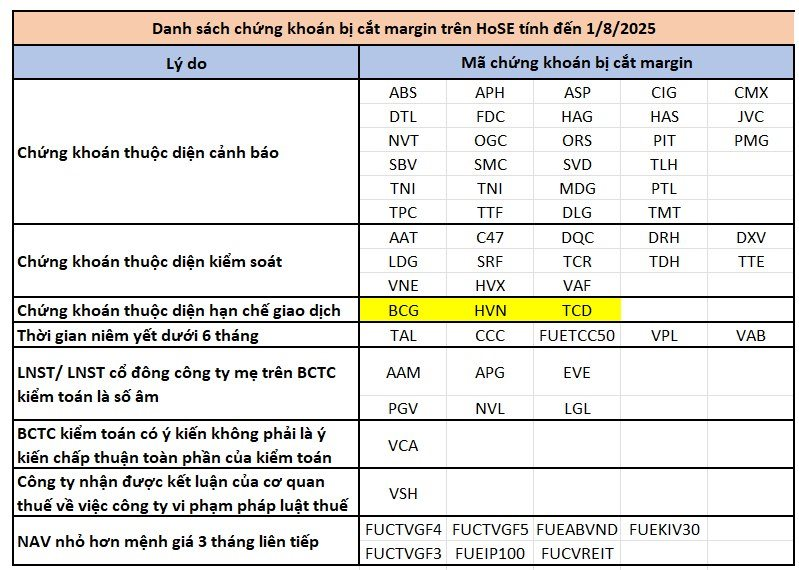

As of August 1st, 2025, there were 62 stocks on the HoSE that were ineligible for margin trading. Some notable names on this list include HAG, NVL, LDG, BCG, HVN, VPL, and ORS.

Highlighted in yellow are reasons with more than one factor

According to HoSE’s regulations, investors will not be able to utilize margin credit (financial leverage) provided by securities companies to purchase these 62 stocks that have been deemed ineligible for margin trading.

The Purple BSR Ceiling: A New Peak for the VN-Index Era

“The VN-Index soared to a record high of 1,573.71 points on August 6, 2025, marking a significant surge of 26.56 points or 1.72% from the previous trading session. This remarkable performance highlights the resilience and growth of Vietnam’s stock market. Among the few stocks that reached the maximum upward limit on the HOSE was Binh Son Refining and Petrochemical Joint Stock Company (HOSE: BSR), a standout performer and the sole representative of Petrovietnam on the exchange.”

Riding the Market’s Wave: Will History Repeat Itself?

The VN-Index witnessed a sharp uptick in the last 30 minutes of the morning session, rebounding to near yesterday’s high. The notable difference was the HoSE’s liquidity, which dropped by 42% compared to the previous morning’s session, hitting a nine-session low.