Latest Update

Discussion:

Why doesn’t the bank pay cash dividends?

Mr. Tran Ngoc Tam: Over the past year, Nam A Bank has been listed on the HOSE, demonstrating its transparency and providing shareholders with the liquidity of NAB shares. Therefore, we propose a stock dividend to enhance our financial capacity.

What is NAB‘s strategy in opening representative offices internationally?

Mr. Tran Khai Hoan – Acting General Director: As we aim to expand our reach globally, NAB will be opening representative offices in countries like the US, Europe, and Japan. With a large number of overseas Vietnamese worldwide, especially in the US, we want to facilitate their investments in Vietnam and also promote our bank’s brand internationally.

The 2025 Annual General Meeting of Nam A Bank was held on the morning of March 28, 2025.

|

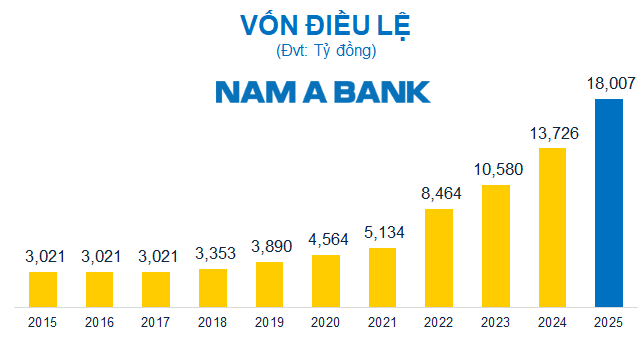

Proposed increase in charter capital to VND 18,007 billion

Mr. Tran Ngoc Tam, Vice Chairman of the Board of Directors, shared at the meeting.

|

At the meeting, Mr. Tran Ngoc Tam, Vice Chairman of the Board of Directors, announced that Nam A Bank plans to issue more than 343 million shares to increase its charter capital from its own capital sources as of December 31, 2024, equivalent to a 25% ratio, raising a maximum of VND 3,431 billion. The issuance is expected to take place in 2025 after obtaining permission from the authorities.

At the same time, the bank also plans to issue 85 million shares under the Employee Stock Ownership Plan (ESOP), increasing its capital by VND 850 billion. Shares issued under the ESOP program will be restricted from transfer for 100% within one year from the end of the issuance and 50% of the shares in the following year. The expected timeline for this issuance is 2025, after completing the capital increase from owned capital sources.

Thus, in 2025, the charter capital is expected to increase by a maximum of VND 4,281 billion, raising it from VND 13,725 billion to VND 18,007 billion.

The total proceeds from the share issuances to increase charter capital are expected to be used for the purchase of fixed assets and tools; construction of facilities for current and future business units; and supplementation of capital for business activities.

Source: VietstockFinance

|

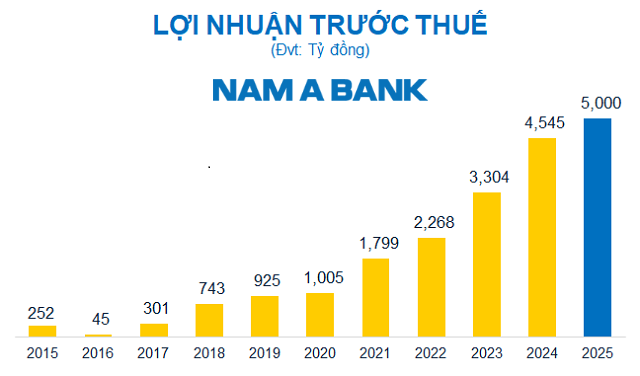

Target of VND 5,000 billion in pre-tax profit for 2025

Source: NAB

|

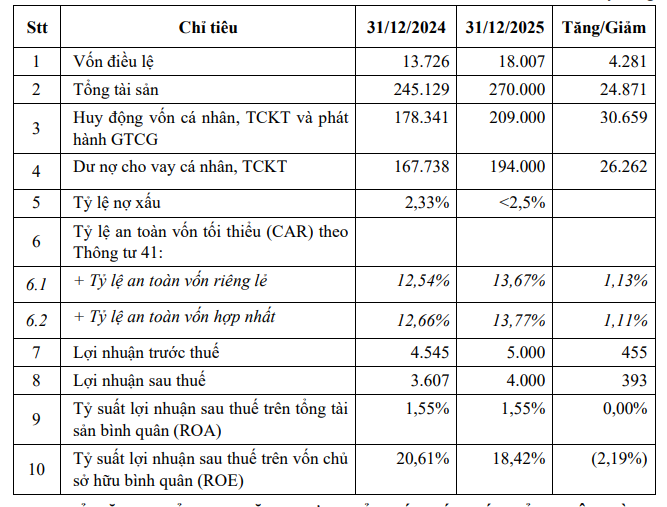

Based on the increased capital, NAB proposed a business plan for 2025 with total assets of VND 270,000 billion, a 10% increase compared to 2024; individual and economic organization capital mobilization and issuance of papers valued at VND 209,000 billion, a 17% increase; and individual and economic organization loan balances of VND 194,000 billion, a 16% increase. The bank aims to maintain its bad debt ratio below 2.5%.

The consolidated pre-tax profit target is set at VND 5,000 billion, a 10% increase compared to the 2024 results.

Source: VietstockFinance

|

In addition, to encourage units to exceed the assigned profit targets, NAB proposed a policy to allocate 20% of the consolidated pre-tax profit exceeding the plan to motivate and encourage NAB staff, to be recorded as personnel expenses in the bank’s operations.

Issuance of private placement bonds worth VND 2,000 billion

NAB plans to privately place a maximum of 20,000 convertible bonds, totaling a maximum value of VND 2,000 billion, to be issued once or multiple times depending on the authorization given by the Annual General Meeting of Shareholders to the Board of Directors at the time of issuance.

These are convertible bonds without warrants or collateral, with a maximum term of 5 years from the issuance date. The interest rate will be fixed and/or floating, depending on market conditions at the time of issuance. The bonds will be offered in the domestic and/or international markets through issuance agents and/or underwriters and/or direct sales to investors. The expected timeline for this issuance is 2025 or 2026.

Regarding the increased capital from the bond issuance, NAB plans to use it to expand its operating capital and supplement medium and long-term capital to meet medium and long-term credit demands.

Profit of over VND 900 billion in the first two months of the year

Updating the business results for the first months of 2025, Nam A Bank, for the first time, reached a total asset scale of over USD 10 billion, equivalent to VND 266,000 billion, an increase of 8.5% compared to the beginning of the year. Other business indicators also showed growth: Total capital mobilization from economic organizations and individuals exceeded VND 201,000 billion (up 13%); loan balances reached nearly VND 175,000 billion (up 4%); investment in papers reached nearly VND 27,400 billion (up 31%). Profit for the first two months of 2025 exceeded VND 900 billion, an increase of 30% over the same period last year, achieving 18% of the full-year target of VND 5,000 billion.

In terms of attracting capital from foreign financial institutions, Nam A Bank has met international standards (Basel III risk standards, IFRS international financial reporting standards, Fitch Ratings and Moody’s Ratings, ESG, Sustainability Report…). This year, the bank plans to continue attracting USD 200 million from foreign financial institutions, and discussions with potential partners have been completed.

At the end of the meeting, all proposals were passed.

– 10:34 28/03/2025

VNM ETF: New Buy on NAB, VCB Stock Soars

For the period of March 10–17, 2025, the VanEck Vectors Vietnam ETF (VNM ETF) witnessed minimal fluctuations in its portfolio. Only two stocks experienced upward movement, including NAB, which was added to the portfolio following the first quarterly review of 2025 for the MarketVector Vietnam Local Index, the reference index for the VNM ETF.

The Ultimate Guide to a Happy Holiday: Happy Lady Credit Card Offers up to 20% Cashback

Understanding the increased spending during the festive season and the upcoming Lunar New Year, Nam A Bank introduces an exclusive offer for its Happy Lady credit cardholders, with a focus on rewarding women. The promotion includes a generous cashback offer of up to 20%, along with a range of exciting benefits, ensuring a rewarding and advantageous experience for all cardholders.

Technical Analysis for the Session on December 12: Risk Signals Persist

The VN-Index and HNX-Index rose in tandem, with trading volume also showing significant improvement during the morning session, indicating a renewed sense of optimism among investors.