I. VIETNAM STOCK MARKET WEEK 11-15/08/2025

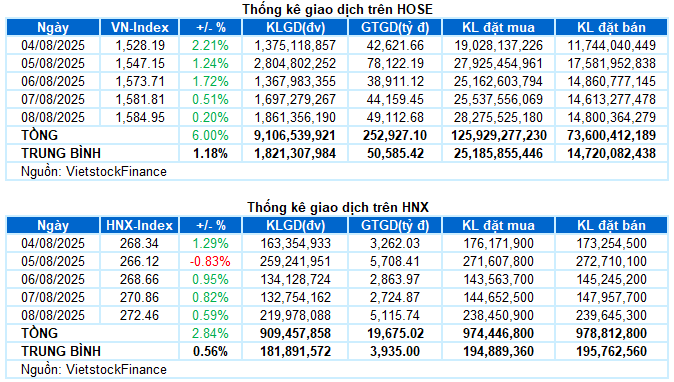

Trading: The main indices continued to rise in the last session of the week. VN-Index ended the week at 1,584.95 points, up 0.2% from the previous session; HNX-Index also increased by 0.59% to 272.46 points. For the whole week, the VN-Index gained a total of 89.74 points (+6%), while the HNX-Index added 7.53 points (+2.84%).

After a strong correction in the previous week, the Vietnamese stock market quickly returned to an upward trajectory with five consecutive positive sessions. Despite facing strong pressure when approaching new highs, buying power remained robust, supporting the VN-Index‘s upward trend. The VN-Index ended the week at 1,584.95, a significant 6% increase from the previous week.

In terms of impact, VIC played a leading role, contributing 1.8 points to the VN-Index‘s gain. This was followed by VPB, GEE, and GEX, which added a total of 2.5 points. On the other hand, BID, TCB, and HPG were the biggest detractors, causing the index to lose nearly 3 points in the final session.

The majority of sectors maintained their upward momentum. Notably, the media and communications sector led the market with a 4.48% increase, mainly driven by VGI (+6.27%), CTR (+1.4%), YEG (+1.01%), VNZ (+0.98%), and VTK (+2.86%).

The energy sector was also a notable bright spot in the final session, rising by 3.55%. The gains were broad-based, with prominent names such as BSR (+2.74%), PLX (+2.96%), PVS (+8.96%), OIL (+3.25%), PVT (+4.12%), PVC (+7.26%), and PVD hitting the ceiling price. Additionally, the real estate sector contributed significantly to the overall index due to its large market capitalization. Strong buying interest was observed in CEO (+7.56%), DIG (+3.4%), DXG (+3.88%), VIC (+1.74%), TCH (+2.69%), KDH (+6.02%), and PDR, which also hit its upper limit.

On the flip side, the non-essential consumer sector witnessed the most substantial decline due to notable adjustments in several stocks, including VPL (-1.06%), DGW (-1.4%), MSH (-1.36%), VGT (-1.53%), TCM (-1.2%), HAX (-2.96%), and GIL (-2.03%).

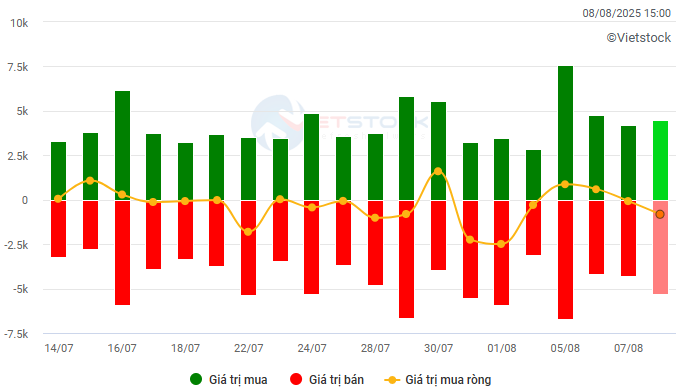

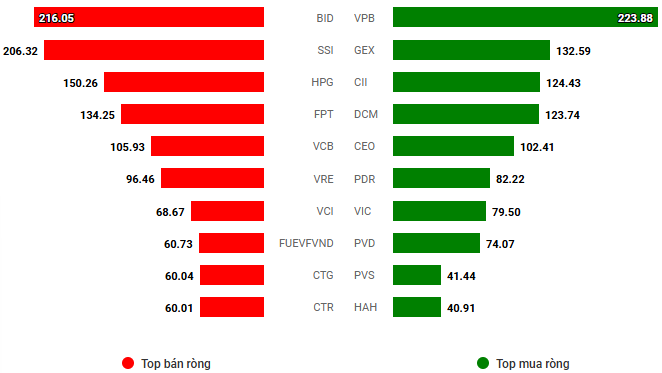

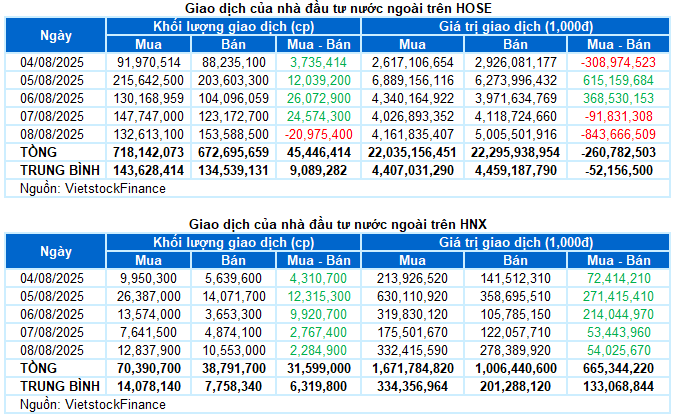

Foreign investors recorded net buying with a value of over 404 billion VND on both exchanges during the week. While they net sold nearly 261 billion VND on the HOSE exchange, they net bought more than 665 billion VND on the HNX exchange.

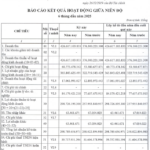

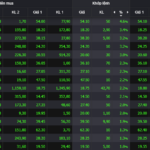

Trading value of foreign investors on HOSE, HNX, and UPCOM by day. Unit: Billion VND

Net trading value by stock code. Unit: Billion VND

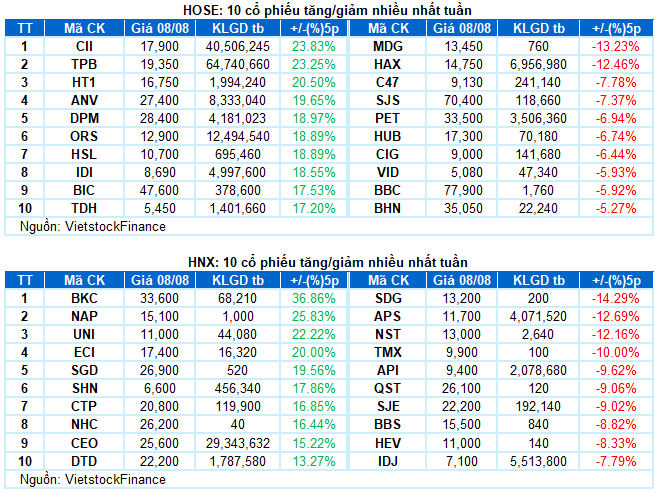

Stocks with notable performance during the week: CII

CII rose 23.83%: CII formed a Rising Window candlestick pattern and concluded a vibrant trading week with five consecutive strong gains. The trading volume remained high compared to the 20-session average, reflecting investors’ optimistic sentiment.

Currently, the MACD indicator continues to widen the gap with the Signal Line since generating a buy signal in early July 2025, suggesting that the stock’s uptrend is being reinforced.

Stock with the most significant decline during the week: HAX

HAX fell 12.46%: After dropping below the Middle Bollinger Band, the price trend weakened further as it crossed below the SMA 50-day and SMA 200-day moving averages.

Meanwhile, the MACD indicator maintained its downward trajectory after providing a sell signal, and the gap with the Signal Line continued to widen. Risks may increase if this indicator falls below the zero line in the coming period.

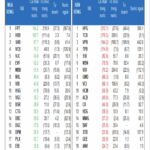

II. STOCK MARKET STATISTICS FOR THE PAST WEEK

Economic and Market Strategy Division, Vietstock Consulting

– 17:10 08/08/2025

Technical Analysis for August 8: Profits May Be Slim, But Opportunities Are There

The VN-Index and HNX-Index witnessed a decline, accompanied by rising trading liquidity in the morning session, indicating investors’ pessimistic sentiment. As the session progressed, the indices were expected to surpass average trading volumes, signifying a potential increase in negative investor sentiment.

The VN-Index Hits Record Highs, While Stock Exchange and Securities Depository See Mixed Fortunes

The VN-Index surged by 110 points, an impressive 8.6%, in the first half of the year, despite a period of intense adjustment due to tariff fluctuations. This contrasting performance was observed when comparing the business situation of the Vietnam Securities Depository and Settlement Corporation and the Vietnam Stock Exchange.

“High-End Demand Weakens, Market Awaits Massive “Account Shock” Influx”

The morning session witnessed a notable dip in excitement, possibly due in part to concerns over the massive volume of stocks on August 5th and their settlement on the afternoon of the same day. Both the VN-Index and stock prices peaked early on, only to gradually weaken as trading volume increased by nearly 9% compared to yesterday’s morning session.

The Soloist’s Sell-Off Symphony

The proprietary trading arm was net sellers again today, offloading a total of VND637.3 billion, with VND215.8 billion in matched orders alone.

The VN-Index: A Stunning Performance

The stock market continued its record-breaking streak on today’s trading session (August 6th), with the VN-Index surging over 26 points to reach a new high of 1,573. Banking stocks rallied across the board, led by TCB, which extended its gains following news of its subsidiary’s initial public offering (IPO). Notably, foreign investors returned as net buyers, injecting further momentum into the market’s upward trajectory.