On August 7, 2025, Novaland’s Extraordinary General Meeting of Shareholders for 2025 was held at NovaWorld Phan Thiet, where several key decisions were made. The meeting approved a proposal to issue private placement shares to settle debts with shareholders and bond principal balances. It also authorized a convertible loan agreement and elected additional members to the Board of Directors.

A panoramic view of Novaland Group’s 2025 Extraordinary General Meeting of Shareholders.

Issuing approximately 320 million shares to settle debts totaling over VND 8,719 billion

The meeting approved the issuance of over 168 million private placement shares at a price of VND 15,746 per share to settle a total debt of more than VND 2,645 billion to three creditors: NovaGroup (VND 2,527 billion), Diamond Properties (VND 111.7 billion), and Ms. Hoang Thu Chau (VND 6.676 billion).

The share allocation is expected to be as follows: 160.492 million shares for NovaGroup, over 7 million shares for Diamond Properties, and 424,000 shares for Ms. Chau. The issuance is planned for the 4th quarter of 2025 to the 1st quarter of 2026, pending approval from the State Securities Commission.

This settlement resolves debts owed to the three creditors who had pledged their shares as collateral for secured loans, enabling Novaland to fulfill its payment obligations. The creditors have agreed in principle to the debt-for-equity swap.

The meeting also approved the issuance of 151.8 million shares at a price of VND 40,000 per share to settle the entire principal amount of 13 bond codes. These bonds were issued in 2021 and 2022, with maturities mainly in 2023-2025, and have a total outstanding principal of VND 6,074 billion.

This issuance addresses the outstanding private bond principal balances from 2023.

Following the successful implementation of these issuance plans, Novaland’s chartered capital is expected to increase to nearly VND 22,700 billion, with the ratio of issued shares to total outstanding shares at 16.4%.

Post-issuance, the combined ownership ratio of the major shareholder groups (NovaGroup and Diamond Properties) and the family of Mr. Bui Thanh Nhon is expected to reach 39.59%.

Convertible loan agreement for up to VND 5,000 billion

The meeting approved a convertible loan agreement with a maximum limit of VND 5,000 billion, with a term of 5 years from the disbursement date and repayment due at maturity. The lender has the right to request the conversion of part or all of the outstanding principal into the Company’s common shares.

The conversion price will be determined based on market prices, balancing the interests of all parties. The Company will negotiate with the lender to ensure that the conversion price is not lower than the minimum level approved by the General Meeting of Shareholders, which is 115% multiplied by the closing price of NVL shares on the last trading day, including the fifth working day before and the day of the final disbursement.

More detailed plans will be submitted to the Board of Directors for approval in accordance with their authority for future implementation.

The meeting also accepted the resignation of Mr. Doan Minh Truong due to personal reasons and elected Ms. Pham Thi Hong Nhung as a new member of the Board of Directors.

Mr. Duong Van Bac, Member of the Board of Directors and General Director of Novaland Group, presents flowers to Ms. Pham Thi Hong Nhung, the newly elected member of the Board of Directors, who received the trust and votes of the General Meeting.

Novaland’s challenges in the first half of the year and its debt resolution strategy

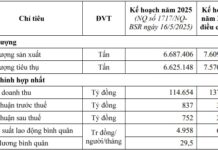

In the first half of 2025, Novaland recorded consolidated revenue of VND 3,715 billion from sales and services; however, it incurred a consolidated after-tax loss of VND 666 billion, mainly due to foreign exchange losses and other activities. As of June 30, 2025, the Group’s total assets amounted to over VND 238,619 billion, with total loans of over VND 61,000 billion, of which approximately VND 32,000 billion will mature within the next 12 months.

During the first two quarters, Novaland delivered 522 products, achieving 34% of its 2025 delivery target. In Ho Chi Minh City, the Group issued nearly 1,300 pink books for projects such as Sunrise Riverside, The Sun Avenue, and Kingston Residences, completing 18% of its 2025 target.

With slower-than-expected delivery progress, Novaland is seeking additional capital to continue construction and complete all projects. This includes key projects like NovaWorld Phan Thiet, Aqua City, and NovaWorld Ho Tram, which achieved significant legal milestones in the second quarter of 2025.

In late July 2025, The Park Avenue, one of Novaland’s prime projects in central Ho Chi Minh City, received a construction permit after years of obstacles.

Extraordinary General Meeting 2025: Novaland Approves Share Issuance to Swap Over $360 Million Debt

On August 7, 2025, the extraordinary General Meeting of Shareholders of Novaland Investment Corporation (Novaland, HOSE: NVL) took place at NovaWorld Phan Thiet. The meeting approved a plan to issue private shares to swap debt for equity and bond principal debt. The shareholders also approved a convertible loan agreement and elected additional members to the Board of Directors.

“PV Power Plans First Capital Increase Since 2018, Shares Near 3-Year High”

For the first time since its privatization, PV Power is discussing a hike in its charter capital to fuel its capital-intensive key projects. This development comes amidst a strong H1 financial performance and a robust recovery in its stock price.

“Novaland Proposes Extraordinary General Meeting to Discuss the Issuance of Over 168 Million Private Placement Shares to Settle Debt”

The Board of Directors of No Va Real Estate Investment Group Joint Stock Company (HOSE: NVL) has unveiled two proposals for private placements to be discussed at the upcoming extraordinary general meeting on August 7. The proposals involve issuing shares to swap debt and execute a convertible loan facility.