VinaCapital Joint Stock Fund Management Company (VinaCapital) has recently issued documents notifying its purchase of shares of Khang Dien House Trading and Investment Joint Stock Company (Code: KDH, HoSE floor).

Accordingly, the member fund under VinaCapital, Hung Thinh VinaCapital Stock Investment Fund, has registered to buy 850,000 KDH shares for the purpose of restructuring its investment portfolio. The transaction is expected to take place via matching and/or agreement from August 12, 2025, to September 10, 2025.

If the transaction is successful, the fund will increase its holding of KDH shares from 616,410 shares to nearly 1.5 million shares, equivalent to an increase in ownership ratio from 0.0549% to 0.1307% of Khang Dien House’s capital.

Illustrative image

Assuming the price of KDH shares based on the trading session on the morning of August 7, 2025, at VND 29,250/share, it is estimated that Hung Thinh VinaCapital Stock Investment Fund will have to spend nearly VND 25 billion to purchase the registered amount of shares mentioned above.

On the opposite side, Mr. Huynh Chi Tam, the person in charge of Company Administration, Secretary of the Board of Directors, and the authorized person for information disclosure of Khang Dien House, has recently registered to sell 60,000 KDH shares to address personal financial needs.

The transaction is expected to take place via matching orders from August 7, 2025, to September 5, 2025.

Before the transaction, Mr. Tam owned 358,400 KDH shares, equivalent to 0.032% of Khang Dien House’s charter capital. If the transaction is successful, the number of shares will decrease to 298,400 shares, equivalent to a decrease in ownership ratio to 0.027%.

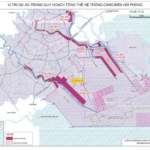

In another development, Khang Dien House has recently announced the resolution of its Board of Directors regarding the additional capital contribution to increase the charter capital of its subsidiary, Phuc Thong Real Estate Business Company Limited.

Accordingly, the charter capital of Phuc Thong Real Estate was increased from VND 20 billion to VND 500 billion, in which Khang Dien House contributed an additional VND 475.2 billion.

The total capital of Khang Dien House after the additional contribution is VND 495 billion, equivalent to a 99% ownership ratio of Phuc Thong Real Estate Business Company Limited’s charter capital.

It is known that Phuc Thong Real Estate Business Company Limited was established according to Resolution No. 21.2024/NQ-HQD dated July 4, 2024, of Khang Dien House, with the main business lines being real estate business and land use rights of the owner or lessee.

155 Masan Employees Get a Great Deal on ESOP Shares

“Masan has concluded its distribution of 7.56 million ESOP shares to 155 employees. The offering price was VND 10,000 per share, a significant 86% discount on the market price. This move underscores Masan’s commitment to recognizing and rewarding its talented workforce, fostering a culture of ownership and long-term commitment to the company’s success.”

“WCS Shares 20% Profit, Hits Quarterly Earnings Peak as HNX’s Priciest Stock”

In Q2 of 2025, Western Bus Terminal Joint Stock Company (HNX: WCS) reported a record-breaking profit of over VND 22 billion. The company also announced a 20% stock dividend, increasing its charter capital to VND 30 billion to meet the minimum capital requirements for public companies. WCS’s share price soared to VND 411,000 per share, the highest on the HNX exchange.

VinaCapital: Three Key Sectors to Benefit from Vietnam’s Policy Tailwinds

Vietnam is embarking on an era of Doi Moi 2.0, a rapid transformation from policy statements to tangible outcomes. This is evidenced by the 34 laws passed in June 2025, alongside extensive administrative reforms.