The VN-Index maintained its upward trajectory throughout the trading session, with large-cap stocks providing strong upward momentum. 28 out of 30 stocks in the VN30 index rose, with TCB being the top performer, contributing nearly 2 points to the VN-Index. Following the announcement of the expected IPO price by Techcom Securities (TCBS), TCB shares have been on a consistent upward trend, rising 3.2% today to reach 38,200 VND per share.

Banking stocks dominated the market leaders, with VCB, MBB, CTG, BID, and VPB among the top performers. The performance of oil and gas, and fertilizer stocks was also noteworthy. In the oil and gas sector, BSR hit the daily limit-up, while PVC, PVS, PVD, PLX, and GAS also saw gains. These companies have recently reported strong profit growth.

Banking stocks witnessed a strong rally.

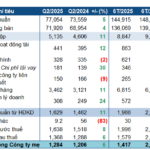

Vietnam National Gas Corporation (PV GAS) reported a 40% year-on-year increase in after-tax profit for the second quarter, reaching VND 4,808 billion. Petrolimex, with the code PLX, posted an after-tax profit of VND 1,368 billion. BSR’s financial statements for the second quarter showed an after-tax profit of VND 846.9 billion, the highest quarterly profit in the last five quarters since the second quarter of 2024.

At the end of the trading session, the VN-Index climbed 26.56 points (1.72%) to close at 1,573.71 points. The HNX-Index gained 2.54 points (0.95%) to reach 268.66 points, while the UPCoM-Index dipped 0.04 points (0.04%) to close at 107.46 points. Market liquidity decreased significantly from the previous record-breaking session, with the trading value on HoSE exceeding VND 37,900 billion. Foreign investors net bought VND 754 billion, focusing on STB, SHS, MWG, VIX, and VPB.

The VN-Index: A Stunning Surprise

The stock market continued its upward trajectory on today’s trading session (August 6th), with the VN-Index surging over 26 points to reach a new high of 1,573. Banking stocks witnessed a collective rally, led by TCB, which extended its gains following the announcement of its subsidiary’s initial public offering (IPO). Notably, foreign investors returned as net buyers, injecting optimism into the market.

How to Value Stocks of Securities Companies Ahead of TCBS’s IPO?

The brokerage stocks group is generally not a bargain basement, but there’s plenty of potential left and valuation is just one of the factors to consider when picking stocks.