The VN-Index has witnessed a historic boom in terms of points and liquidity, with trading values reaching up to $2.5 billion in a single session when the index surpassed the 1,500-point mark. Despite this, compared to the present, the money is more than double, with trading values of up to VND 87,000 billion in a session.

Inflowing money pushes stocks higher, even those without good business results or even losses still increase “unreasonably” to investors. A typical example is the case of NVL stock.

Calculated from the April 2025 bottom to the end of the session on August 7, this real estate stock has nearly tripled from VND 7,000/share to VND 18,200/share. Notably, NVL stock surged despite gloomy Q2 2025 business results.

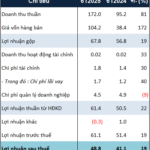

According to the Q2 2025 consolidated financial statements, NVL recorded a gross revenue of more than VND 3,700 billion in the first six months, up 63% over the same period. Of which, revenue from real estate transfers reached nearly VND 3,400 billion, up 81%, thanks to the recognition of handover at projects such as NovaWorld Phan Thiet, NovaWorld Ho Tram, Aqua City, Sunrise Riverside, Palm City…

After deducting the cost of goods sold, the company’s gross profit was over VND 1,300 billion, an improvement from a loss of more than VND 1,400 billion in the first half of 2024. Financial revenue decreased by 29%, to over VND 1,000 billion, due to a 24% decrease in investment cooperation contract interest and no longer having a gain of VND 275 billion from trading securities business as in the same period. Financial expenses also decreased by 44% thanks to reduced interest expenses and no longer recording a loss of more than VND 797 billion from the divestment of the subsidiary.

After deducting expenses, NVL recorded a net loss of nearly VND 604 billion in the first half of 2025.

Commenting on NVL and similar stocks, Mr. Tran Hoang Son, VPBankS expert, said that in the period of 2021 – 2022, NVL fluctuated at a very high price range, from VND 70,000 – VND 80,000/share. During this period, NVL had not yet faced difficulties in the bond market, and the company’s debt and projects were all doing well.

Then, at the end of 2022 and early 2023, the Vietnamese bond market faced challenges, and the global stock market experienced a strong downward trend. As a result, the price of NVL decreased from an average of VND 80,000/share to a low of below VND 10,000/share, reflecting the common difficulties faced by many real estate companies.

The strong increase in NVL from the April 2025 bottom was driven by the successful restructuring of the company. First, NVL’s revenue has shown signs of recovery, with a 155% increase in Q1, a 22% increase in Q2, and a 62.6% increase in the first six months. In terms of profitability, in the first six months of 2024, NVL lost VND 7,300 billion, but in the first six months of 2025, the loss narrowed to VND 600 billion, indicating that the worst was passing.

NVL’s business results are expected to improve in the coming period. Stocks that overcome challenges are often seen as speculative opportunities by investors. To maintain the upward momentum, profit and revenue stories need to continue to align with stock price trends. If revenue and profits do not meet investors’ expectations, the growth phase will slow down or stagnate.

NVL has gradually restructured its debt by successfully extending VND 24,000 billion, and projects are restarting, creating a brighter picture, like a light at the end of the tunnel. However, in the medium term, profit results will remain the illuminating factor for the stock’s upward momentum.

Therefore, in the short term, investors can trade, but in the long term, they need to carefully consider whether to choose fundamentally strong stocks or stocks that still face challenges.

Mr. Son also mentioned that there are many “penny stocks” on the stock market. During a super wave, these stocks can multiply in value several times. This creates waves and greed, causing investors to forget about potential risks.

“I always emphasize that price increases are only a manifestation. Investors need to pay attention to the underlying reasons, business results, good news, improved finances, or price manipulation,” said the VPBankS expert.

In an uptrend, investors should allocate most of their assets to stocks with strong fundamentals and growing business results. We need to be selective in our investments, understanding the stocks we choose so that we can feel secure during market corrections.

Once we find a good stock, we need to “hold onto it tightly,” and for “penny stocks,” we can participate in the uptrend but must consider when to buy and when not to. If we get too caught up, after a period of hot price increases, stock creators may sell these “penny stocks,” and investors will not be able to offload them. The crash of 2022-2023 left many lessons, and we must not forget them.

“Taking the Plunge”: Embracing Contrarian Strategies for Profitable Trading

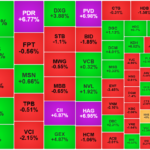

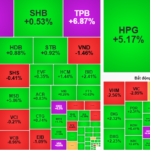

The morning sell-off sent the VN-Index plunging over 16 points (-1.03%), indicating a potential disappointing end to the week. However, a resilient bottom-fishing cash flow in the afternoon session pulled the index back up, resulting in a positive close with a gain of 3.14 points (+0.2%).

Stock Market Outlook for Tomorrow, August 8: As VN-Index Hits New Highs, What Should Investors Do?

Despite the sell-off pressure in the session on August 7-8 not being too significant, Dragon Vietnam Securities Joint Stock Company forecasts that the session on August 8 will see strong competition between supply and demand for stocks.

“NHA Seeks to Raise $66 Million for Ninh Binh Residential Project”

The Board of Directors of the Southern Hanoi Urban and Industrial Development Corporation (HOSE: NHA) on August 6 approved a plan to offer nearly 16.2 million shares to existing shareholders. The offering price is VND 10,000 per share, nearly 40% of the closing price on August 8 (VND 25,100 per share).