Surging Prices

According to CBRE Vietnam’s Q2 2025 real estate market report, compared to the same period last year, the supply of landed homes in Ho Chi Minh City increased by 2.8 times. However, while new supply remains limited, secondary asking prices for landed homes increased by 9% year-on-year.

Regarding primary selling prices of landed homes in the city during the past quarter, CBRE Vietnam representatives stated that the average selling price in the market reached approximately VND 303 million per square meter.

Panorama of the villa area in the Saroma Villa project in Thu Thiem. Photo: Pham Nguyen.

Similarly, Avison Young Vietnam reported that in Q2 2025, the market recorded an additional 132 townhouses from a project in An Lac Ward (former Binh Tan District) and 74 townhouses in a project in the south of Ho Chi Minh City.

In the East area, there are 226 riverside villas and low-rise townhouses in Gladia, a project developed by Khang Dien and Keppel Land, with a total area of 11.8 hectares, divided into three subdivisions: The Grand, The Grace, and The Posh. The diverse range of products, from garden-linked, twin, single to quadruple houses, are priced from VND 38-43 billion per unit, while townhouses are priced from VND 25-30 billion per unit.

If we include the markets of the former provinces of Binh Duong and Ba Ria-Vung Tau, only one new landed project has been launched in each area so far this year, supplying a total of nearly 600 products.

In the gateway area west of Ho Chi Minh City, the landed property market in Long An (former province) is very vibrant with a series of projects being offered for sale, significantly contributing to the increase in supply.

For example, 2,000 products at Vinhomes Green City and nearly 700 low-rise units at La Home. In the land plot segment, the market also recorded 1,000 products from The Solia project.

For the high-end segment, Avison Young Vietnam assessed that prices in Q2 2025 remained relatively stable. This reflects the price-holding psychology of investors as well as the existing demand for owner-occupied homes. Leading the market is the Saroma Villa project in Thu Thiem New Urban Area, with reference transaction prices close to VND 1 billion per square meter. According to Avison Young’s forecast, this price will continue to be maintained for at least the next two years.

The Rivus Elie Saab project by Masterise Homes recorded an asking price of about VND 300 million per square meter. Since the products here have large areas, ranging from 500 to 1,300 square meters per unit, the total selling price can go up to VND 200-700 billion per unit.

Avison Young also recorded selling prices ranging from VND 250-300 million per square meter in some other projects such as The Global City, Van Phuc City, and Khang Dien Residential Area.

Villa and townhouse prices in Ho Chi Minh City, with asking prices increasing by about 3 to over 5%. Photo: Tran Ut.

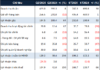

A survey by the Ministry of Construction at some projects in Ho Chi Minh City shows that villa and townhouse prices in some areas and projects have asking prices increased by about 3 to over 5%. Specifically, An Phu An Khanh has an asking price of about VND 220-229 million per square meter, Him Lam Kenh Te has an asking price of about VND 233-240 million per square meter, Phu My Residential Area has an asking price of about 147-152 million per square meter, Verosa Park has an asking price of about VND 150-159 million per square meter, Lucasta Villa has an asking price of about VND 132-141 million per square meter, The 9 Stellars has an asking price of about VND 147-155 million per square meter, and The Manhattan has an asking price of about VND 167-176 million per square meter.

Maintaining Recovery Momentum

Evaluating the Q2 2025 market, Avison Young Vietnam said that Ho Chi Minh City continues to play a central role with many quality products, while neighboring provinces have large land funds and more affordable prices.

According to Avison Young, the strong development of projects in the former Binh Duong province not only reflects the urbanization expansion trend but also shows the shift in demand to the suburbs – where buyers are increasingly concerned about the quality of life, the open environment, and long-term profit potential.

Ms. Duong Thuy Dung, Executive Director of CBRE Vietnam, assessed that while Ho Chi Minh City’s housing prices are continuously increasing, the market is recording many new projects in neighboring areas such as Long An (former province) and Dong Nai. This trend is not new but is becoming more and more obvious.

The villa and townhouse market in Ho Chi Minh City and neighboring areas in Q3 2025 will continue to maintain its recovery momentum. Photo: Tran Ut.

“These projects are located 25-35 km from the center of Ho Chi Minh City, many projects have a large scale and are developed according to the model of a multi-functional urban area. When put into operation, they will contribute to promoting the need to expand the population to the outskirts,” said Ms. Dung.

CBRE Vietnam forecasts that in the second half of this year, in addition to the former Binh Duong province, the supply of housing adjacent to Ho Chi Minh City will mainly come from Long An (former province) and Dong Nai. With prices 50-80% lower than Ho Chi Minh City for apartments and landed homes respectively, these markets still have a lot of room for growth. In the next 3 years, apartment prices are expected to increase by an average of 9-11%/year, while landed homes will increase by 6-12%/year.

Mr. Vo Hong Thang, Investment Director of DKRA Group, said that the villa and townhouse market in Ho Chi Minh City and neighboring areas in Q3 2025 will continue to maintain its recovery momentum. It is expected that there will be 2,000-3,000 new products launched in the market, mainly in Long An (former province) and Binh Duong (former province).

“The primary selling price level will remain high due to the imbalance between supply and demand. The secondary selling price level is expected to grow, and liquidity will mainly come from projects that have completed legal procedures, have favorable regional connections, and are diverse in utilities,” said Mr. Thang.

Symlife – A Fresh Take on Urban Living for Millennials in Northeast Ho Chi Minh City

In the midst of soaring property prices in Ho Chi Minh City, the dream of home ownership for young people seems increasingly out of reach. However, the arrival of Symlife in the city’s northeast offers a fresh perspective tailored for the youth, seamlessly blending convenient living spaces with sustainable value enhancement prospects.

The Japanese ‘Big Boss’ Partners with Billionaire Pham Nhat Vuong: A Peek into Their Vietnamese Ventures

Nomura Real Estate Strengthens Vietnam Footprint with Vinhomes Partnership.

A strategic MOU between Nomura Real Estate and Vinhomes will see the former bolster its investment in Vietnam’s thriving urban landscape. With a focus on sustainable and innovative development, this partnership is set to elevate the country’s real estate sector.

“Not as Vibrant as the 2018-2019 Phase, But the Real Estate Market is Now Experiencing a Strong Price Uptick.”

“It was an honor to have Dr. Nguyen Van Dinh, Vice President of the Vietnam Real Estate Association, grace us with his presence and insights at the event, ‘Discover the Most Livable Project in Viet Tri City,’ held on November 30, 2024. His expertise and knowledge contributed immensely to the success of the event and enlightened all attendees on the latest trends and developments in the real estate landscape of Viet Tri City and beyond.”

The Once-Renowned Trung Thuy Group: What’s Their Business Doing Now?

The Trung Thuy Group soared to great heights during its rapid expansion, but its fortunes took a turn for the worse in later years.