Accordingly, the expected number of shares to be transferred is equivalent to 55.23% of DXMT’s charter capital. If the deal is successful, DXMT will become a subsidiary of DXS.

The expected value of the deal is a maximum of over VND 22.6 billion, equivalent to a ceiling price of VND 10,000/share. The transaction is expected to be completed in the second quarter of 2025.

The DXS Board of Directors authorized Mr. Nguyen Hoang Duc and Mr. Nguyen Bao Toan to represent the entire shareholding of DXS in DXMT after the transfer is completed. It is known that Mr. Duc is the authorized person to disclose information and is in charge of the administration of Dat Xanh Group (HOSE: DXG) – the parent company of DXS.

Regarding the transferring party, Cara Group JSC (formerly Western Land Services and Investment JSC) is currently a subsidiary of DXS with a 61% ownership rate.

Along with the acquisition of DXMT, the DXS Board of Directors approved the cancellation of the capital contribution plan to establish a subsidiary in the Resolution dated March 3, 2025. According to the Resolution, the DXS leaders wanted to establish a subsidiary named Opus Realty JSC, with a charter capital of VND 10 billion (in which DXS holds 51%). The main business lines are real estate business and consulting, brokerage, real estate auction, and land auction.

The acquisition of DXMT by DXS was mentioned by the Company’s General Director, Tran Quoc Thinh, at the 2025 Annual General Meeting of Shareholders on April 24, 2025. Specifically, Mr. Thinh said that in 2025, DXS had bought back the shares of Dat Xanh Trung from Regal Group. The Company will continue to buy Dat Xanh Tay from Cara Group. Then, DXS will separate the service segment from the main business. Previously, these companies had capital from investment units, so they were not focused on the service segment. This concentration will create a corridor for the development of DXS‘s real estate service segment.

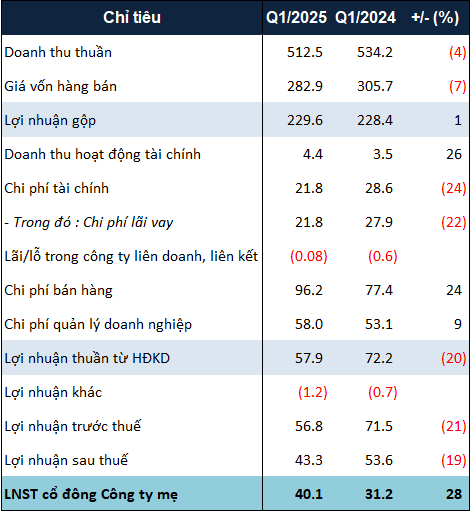

Net profit in Q1 decreased by 19%

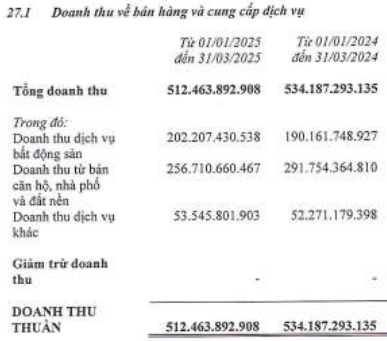

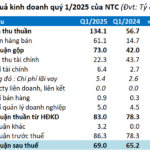

According to the Q1/2025 consolidated financial statements, DXS‘s net revenue was nearly VND 513 billion, down 4% over the same period last year. Of which, the activity with the highest proportion was real estate transfer revenue, which decreased by 12%, to nearly VND 257 billion. In contrast, revenue from the real estate service segment increased by 6%, to over VND 202 billion.

|

Revenue structure in Q1/2025 of DXS. Unit: VND

Source: DXS

|

Regarding expenses, although financial expenses decreased by 24%, selling expenses increased by the same rate, along with a 9% increase in management expenses. As a result, DXS‘s total expenses in Q1/2025 increased compared to the same period.

As a result, DXS posted a net profit of over VND 43 billion, down 19%. However, thanks to the sharp decrease in net profit attributable to non-controlling shareholders, the Company’s net profit was over VND 40 billion, up 28%. This profit of VND 40 billion is equivalent to nearly 10% of DXS‘s profit target for 2025.

|

Business results in Q1/2025 of DXS. Unit: Billion VND

Source: VietstockFinance

|

As of March 31, 2025, DXS‘s total assets were recorded at over VND 15,400 billion, up 2% from the beginning of the year, mainly due to a 5% increase in short-term receivables to over VND 9,600 billion. On the other hand, short-term cash holdings decreased by 23%, to nearly VND 381 billion.

On the other side of the balance sheet, payables increased by 5%, to nearly VND 7,100 billion. This was mainly due to an increase in prepayments from buyers, which stood at nearly VND 929 billion, 2.3 times higher than at the beginning of the year. Meanwhile, loans decreased by 11%, to nearly VND 2,000 billion.

– 15:33 05/02/2025

The Brokerage Segment’s Thin Margins and Surging Provision Costs: A Look at FPTS’ 8% Drop in Q1 Net Profit

In Q1 2025, FPT Securities Joint Stock Company (FPTS, HOSE: FTS) recorded revenue and pre-tax profit of nearly VND 314 billion and over VND 100 billion, respectively, equivalent to 31% and 20% of the yearly plan. The profit showed a slight decrease compared to the same period last year due to modest profits in the brokerage segment and a significant increase in provision expenses.

A Slight Rise in NTC’s First-Quarter Profit, Expansion of Factory Rental Services

Despite a strong revenue growth, a loss of dividend income, coupled with elevated expenses, resulted in a modest 6% year-over-year increase in net profit for Tan Uyen Industrial Park Joint Stock Company (UPCoM: NTC) in Q1 2025.

The Hunt for Shark Money: Proprietary and Foreign Institutions Unite in Buying Spree, but Diverge on VIX

The April 18th session concluded with a net buying consensus from both proprietary securities companies and foreign investors, with respective figures of over VND 261 billion and VND 11 billion. VIX attracted attention as it was the top net buying stock for proprietary firms but led in foreign net selling.