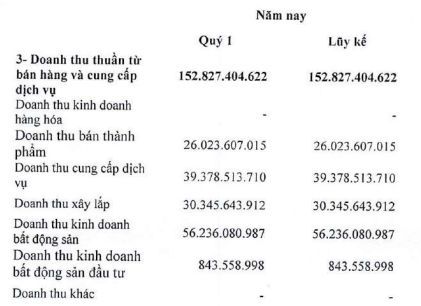

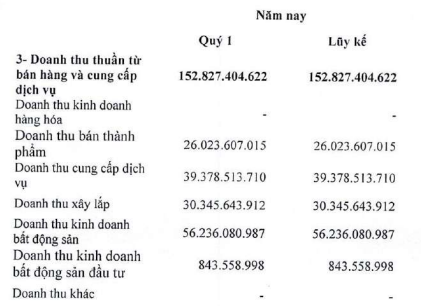

The BCTC consolidated for Q1 of 2025 shows that DIG’s net revenue reached nearly VND 153 billion, with revenue from real estate business still accounting for the largest proportion, at over VND 56 billion, followed by service provision revenue of more than VND 39 billion. In the same period last year, the net revenue was less than VND 500 million due to the recognition of VND 186 billion in returned goods.

|

Revenue structure of DIG in Q1/2025

Source: DIG

|

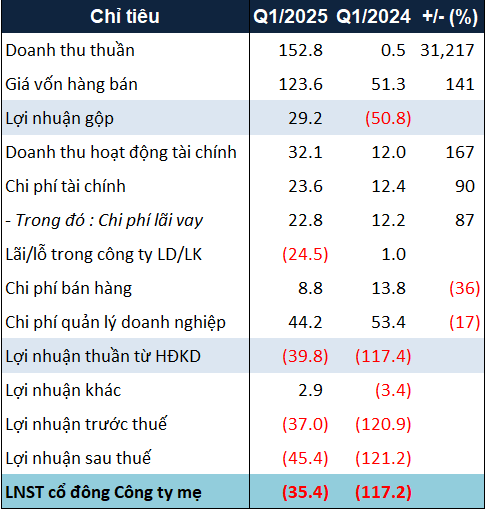

DIG’s financial revenue this period was 2.7 times higher than the previous year, reaching over VND 32 billion, thanks to the realization of over VND 25 billion from the sale of investments.

It is known that in late December 2024, the Board of Directors of DIG approved the divestment from two affiliated companies, Commercial Development Joint Stock Company and DIC Holdings Construction Joint Stock Company (HOSE: DC4), by selling 1.78 million shares of Thien Quang and 16.26 million shares of DC4. As of March 31, 2025, DIG is no longer a shareholder of Thien Quang but still holds 28.39% of DC4’s capital.

DIG has sold only 40% of DC4 shares out of the registered amount of over 16.2 million shares

Despite positive revenue, DIG incurred a loss of nearly VND 35 billion in Q1/2025 due to losses from joint ventures and associates of nearly VND 25 billion and a 90% increase in financial expenses.

This result comes as a surprise as at the 2025 Annual General Meeting of Shareholders, Chairman of the Board, Nguyen Hung Cuong, stated that the company made a profit of about VND 10 billion in Q1. He also estimated that the company would achieve its record pre-tax profit target of VND 718 billion for 2025 by mid-year, instead of waiting until Q3 or Q4.

|

Financial statements of DIG in Q1/2025. Unit: Billion VND

Source: VietstockFinance

|

On the balance sheet, DIG’s total assets as of March 31, 2025, were recorded at over VND 18,900 billion, up 2% from the beginning of the year. Most of the difference came from an 11% increase in inventory value, to nearly VND 9,100 billion, due to a nearly VND 545 billion increase in production and business expenses for the Lam Ha Center Point project, totaling more than VND 798 billion. This year, DIG plans to invest VND 1,218 billion in this project.

Notably, DIG’s short-term cash holdings decreased by 24%, to nearly VND 1,300 billion.

On the other hand, payables increased by 4%, to over VND 10,900 billion, due to the occurrence of other payables of more than VND 563 billion related to Ha Nam Sun Joint Stock Company. Meanwhile, total debt decreased by 13%, to nearly VND 3,400 billion, thanks to a significant reduction in short-term bank loans.

– 10:43 05/03/2025

Coteccons Bags 250 Billion VND Profit in 9 Months of FY 2025, Secures 23 Trillion VND in Contracts

Impacted by the global economic fluctuations, Coteccons Construction Joint Stock Company (HOSE: CTD) witnessed a 46% decline in its profit for the third quarter of the financial year 2025. However, for the first nine months, Coteccons posted a profit of VND 255 billion, a 6% increase compared to the same period last year.

The Power of Persuasive Writing: Crafting Captivating Content for the Win

At the recent 2025 Annual General Meeting (for the 2024 financial year), held on the morning of April 29th, Gia Lai Electricity Joint Stock Company (HOSE: GEG) revealed ambitious growth plans. The company also announced its first-quarter financial statements for 2025, showcasing a significant improvement. This impressive performance is attributed to successful electricity price negotiations, with an astounding 89% of the annual profit plan achieved in just one quarter.

The Brokerage Segment’s Thin Margins and Surging Provision Costs: A Look at FPTS’ 8% Drop in Q1 Net Profit

In Q1 2025, FPT Securities Joint Stock Company (FPTS, HOSE: FTS) recorded revenue and pre-tax profit of nearly VND 314 billion and over VND 100 billion, respectively, equivalent to 31% and 20% of the yearly plan. The profit showed a slight decrease compared to the same period last year due to modest profits in the brokerage segment and a significant increase in provision expenses.

The Power of Words: Crafting a Compelling Title

“The SC5 Shareholder’s Meeting: Vice-Chairman’s Ambition to Increase Ownership and Cancel 2024 Dividends”

Mr. Nguyen Dinh Dung, Vice Chairman of the Board of Directors and CEO of Construction Joint Stock Company No. 5 (HOSE: SC5), shared that the construction industry continues to face challenges due to volatile and unstable material prices, which drive up costs. Despite these difficulties, the Company ensures a sufficient backlog of work to cushion its plans for the coming years.