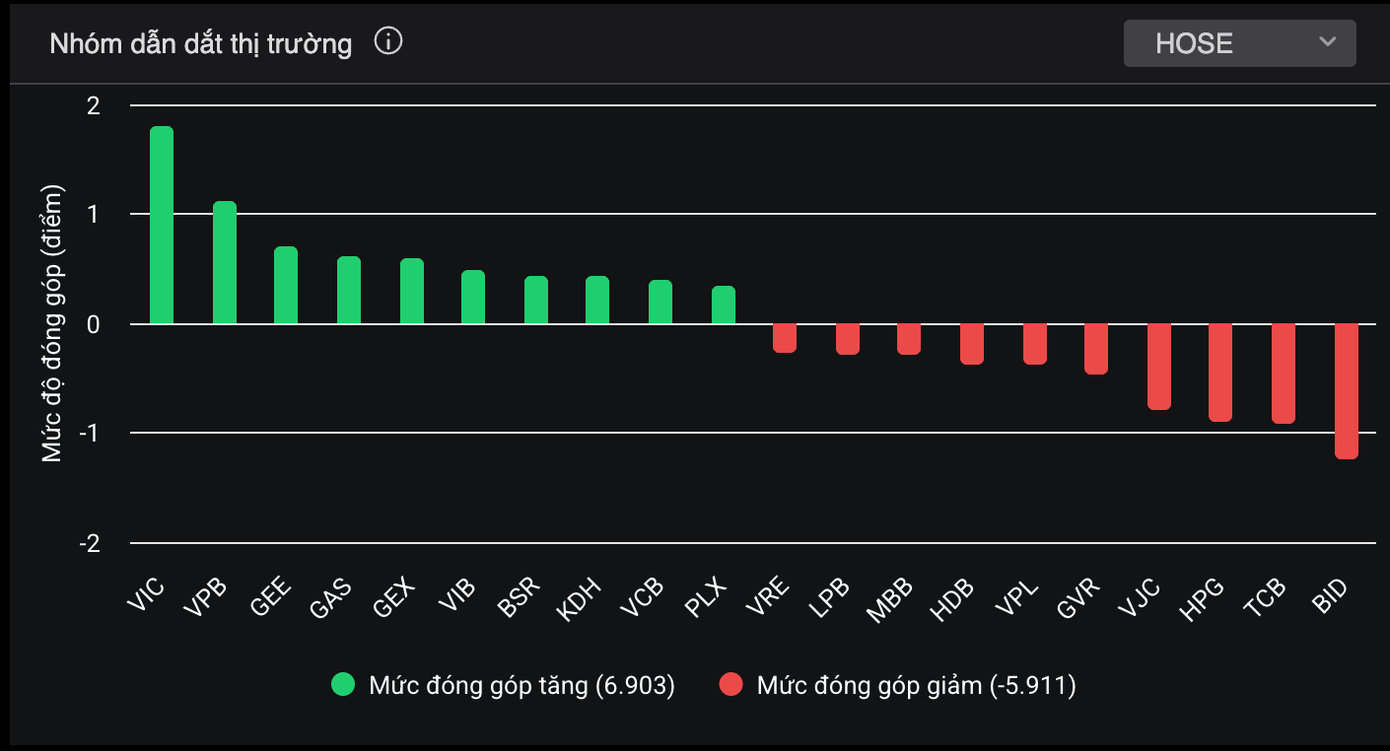

The stock market experienced another volatile trading session, with the large-cap stocks facing corrective pressures, hindering the VN-Index’s upward momentum. The VN30 basket witnessed a dominant red trend, with 18 out of 30 stocks declining.

Notably, VJC witnessed the sharpest decline of 4.9%, while BID and TCB were the most significant negative influencers on the main index. BID shaved off nearly 2 points from the VN-Index, followed by TCB and HPG, each contributing over 1 negative point. The banking sector faced distinct profit-taking pressures, with stocks such as HDB, MBB, LPB, and VIB witnessing adjustments. This reflected investors’ cautious sentiment ahead of the technical resistance zone.

Trading session dynamics on August 8th.

On the flip side, VIC stood out with a contribution of nearly 1.8 points, serving as the market’s primary support. Stocks such as VPB, GEE, and GAS also lent their support to the index. Several stocks in the oil and gas (BSR, PLX) and real estate (GEX, KDH) sectors displayed positive momentum.

Amidst the market’s tug-of-war, the real estate sector made waves, with numerous stocks like TDC, HTN, CII, and PDR hitting the ceiling price, while DXG, DXS, DIG, GEX, and KDH witnessed a 3% surge. Trading volume remained robust, especially for SSI (3.429 trillion VND), which topped the exchange. VIX and VND also featured among the most actively traded stocks.

Today marked the debut trading session for F88 on the UPCoM exchange, and it soared to the daily maximum surge of 40%, reaching 888,000 VND per share, despite only 400 shares being traded, making it the stock with the highest market price.

At the close of the trading session, the VN-Index climbed 3.14 points (0.2%) to 1,584.95, while the HNX-Index and UPCoM-Index also ended in positive territory, gaining 1.6 points (0.59%) and 0.62 points (0.57%), respectively. Trading volume increased, with the value of transactions on HoSE nearing 49 trillion VND. Foreign investors net sold over 816 billion VND, focusing on BID, SSI, HPG, FPT, and VCB.

SSI Research Eyes VN-Index Marching Towards 1,800 Points

SSI maintains high hopes that Vietnam will be upgraded to Emerging Market status by FTSE Russell in October 2025. This anticipated upgrade could potentially attract approximately $1 billion in capital inflows from index-tracking ETF funds.

Stock Market Week of 04-08/08/2025: Holding the Line

The VN-Index remained in positive territory despite a volatile session to end the week, capping off a strong performance with a near 90-point gain. While foreign investors have been net sellers in recent sessions, a reversal of this trend in the coming week could further bolster the current upward momentum and propel the index to new highs.

The Power of Persuasion: Crafting Compelling Headlines

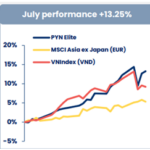

“Unleashing the Potential: PYN Elite’s Stellar Performance with Two Stock Codes”

In July 2025, PYN Elite Fund, a foreign-owned investment fund, boasted an impressive 13.25% return, the highest it has seen in 55 months since January 2021. This remarkable performance surpasses the VN-Index’s 9.2% gain, which peaked at a historic high of 1,557 points on July 28.