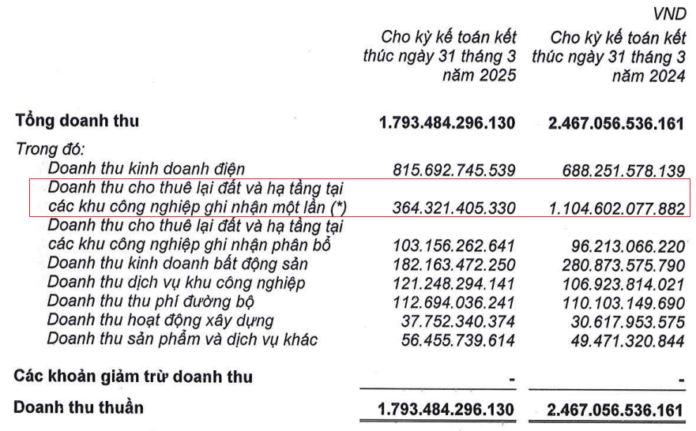

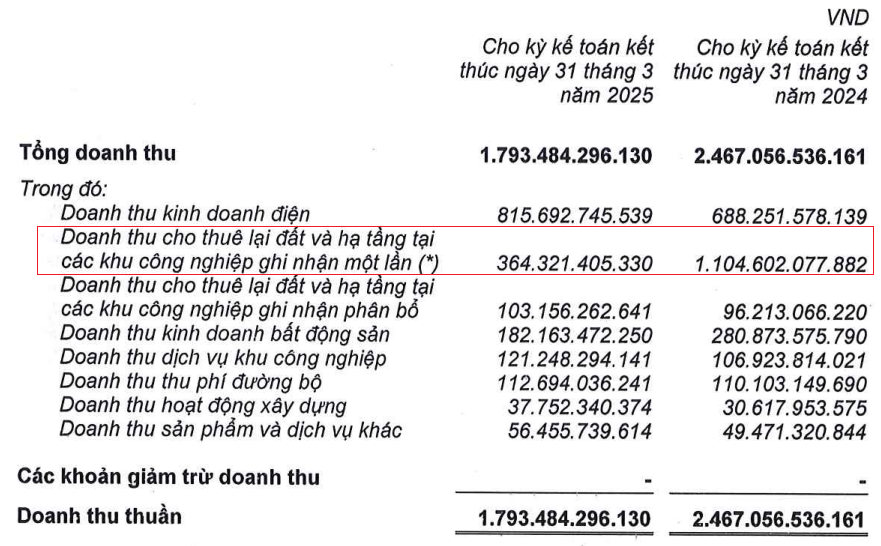

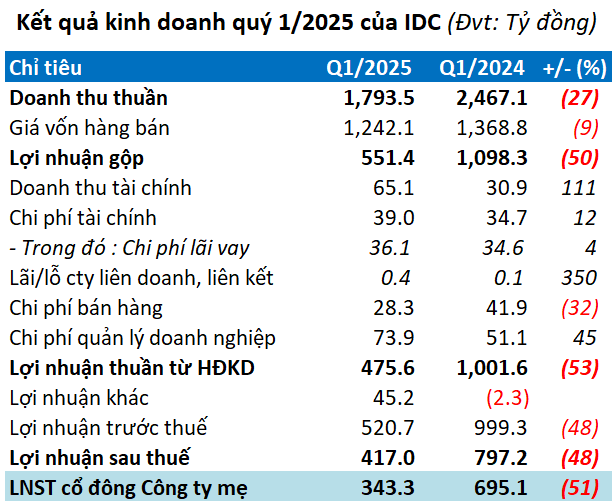

In the first quarter, IDICO recorded a 27% year-on-year decline in revenue, amounting to over VND 1,793 billion. This decrease was primarily due to a significant 67% drop in land and industrial infrastructure leasing activities, totaling VND 364 billion.

The investment real estate sector also witnessed a 35% downturn, reaching over VND 182 billion, while the electricity business shone with a 19% increase to nearly VND 816 billion. Financial revenue doubled from the previous year, surpassing VND 65 billion, but remained insignificant.

|

Breakdown of IDC’s Q1 2025 revenue

Source: IDC

|

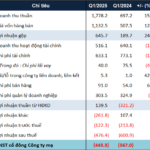

Total operating expenses for the period rose by 11% to over VND 141 billion, mainly driven by a substantial 45% surge in enterprise management expenses, totaling nearly VND 74 billion. This eroded IDC’s profit, which stood at over VND 343 billion, marking a 51% decrease compared to the previous year.

IDICO’s 2025 business plan is cautiously optimistic, targeting consolidated revenue of VND 8,918 billion and pre-tax profit of VND 2,596 billion, representing a 1% and 13% decline, respectively, from the previous year’s performance. After the first quarter, the company has achieved approximately 20% of its annual plan.

The company also aims to lease 123.5 hectares of industrial infrastructure land and nearly 33.3 thousand square meters of factory space. In 2024, IDICO leased over 100 hectares of industrial land and approximately 38.7 thousand square meters of factory space.

According to the company, this year’s profit decline is attributed to fluctuations in revenue from industrial infrastructure leasing contracts, which are subject to one-time recognition conditions as per regulations.

Source: VietstockFinance

|

As of the end of March 2025, IDC’s total assets exceeded VND 19,410 billion, reflecting a 3% increase from the beginning of the year. This includes a substantial cash balance of nearly VND 2,300 billion, up by 5%. Held-to-maturity investments also rose by 28% to over VND 2,908 billion, predominantly comprising term deposits of over VND 2,700 billion. Inventory stood at over VND 1,352 billion, a 4% decrease, with the Hựu Thạnh worker housing project accounting for the majority at over VND 810 billion.

Payables totaled nearly VND 12,281 billion, a 6% increase. Advance payments from customers and unearned revenue accounted for nearly VND 6,136 billion, a slight 1% increase, constituting 50% of total liabilities. Financial borrowings amounted to VND 3,413 billion, a 9% increase, representing 28% of total liabilities.

During the Annual General Meeting of IDC held on April 25, 2025, General Director Đặng Chính Trung acknowledged the impact of global trade tensions on foreign investors’ decisions. While some investors with signed contracts continued their projects, those in the negotiation or deposit stage exhibited heightened caution.

Chairman Nguyễn Thị Như Mai conceded that Vietnam’s competitive edge among foreign investors is under pressure, sparking concerns about the prospects for industrial land leasing. However, she emphasized that this activity accounts for only about 39% of the company’s revenue, with the majority stemming from other sectors such as electricity and real estate, thus maintaining relative stability amidst market fluctuations.

IDICO Chairman: Trade War Uncertainty Leads to Cautious Approach in Dividend Planning

– 15:03 02/05/2025

Introducing the Future of Living: TTC Plaza Da Nang’s DualKey Concept

Dual-key apartments at TTC Plaza Da Nang present an innovative approach to urban living, offering both flexibility and income potential. With a rising demand for multifunctional spaces, these apartments provide an ingenious solution.

The Art of Crafting Profitable Headlines: “Unraveling the Mystery Behind Vinaconex’s Narrow Gross Profit Margin in Construction”

On the morning of April 21, Vinaconex, a leading Vietnamese construction and trading company listed on the Ho Chi Minh Stock Exchange (HOSE) under the ticker symbol VCG, held its annual general meeting for the year 2025. The key agenda items included discussing the company’s business plan, dividend distribution, capital increase, and the election of additional members to the board of directors.

“Patience is Key: ADTD Shareholders Refrain from Dividends, Awaiting Project Permits”

The sluggish market conditions in the real estate sector prompted HAR to focus on financial cost-cutting measures and refrain from paying dividends. While a significant portion of the company’s capital is tied up in uninitiated projects, the leadership assures that the permitting process is currently delayed and advises shareholders to “exercise patience.”