US Dollar (USD). (Photo: AFP/ VNA)

|

On August 11, 2025, the exchange rate of the Vietnamese Dong (VND) against the US Dollar (USD) at commercial banks saw a slight increase, while the exchange rate for the Chinese Yuan (CNY) remained unchanged.

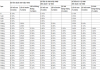

Specifically, the State Bank of Vietnam set the daily reference exchange rate at 25,231 VND per USD, an increase of 3 VND compared to August 8.

With a permitted variation of +/- 5%, the ceiling and floor rates applicable for the day are 26,492 VND/USD and 23,969 VND/USD, respectively.

At the State Bank of Vietnam’s exchange rate, the buying and selling rates are 24,017 VND/USD and 26,439 VND/USD, respectively.

As of 9:00 AM on August 11, Vietcombank and BIDV listed the buying rate for USD at 26,040 VND/USD and the selling rate at 26,400 VND/USD, marking a rise of 10 VND in both rates compared to August 8.

Regarding the Chinese Yuan, Vietcombank maintained the buying and selling rates at 3,593 VND/CNY and 3,708 VND/CNY, respectively, the same as on August 8.

Similarly, BIDV kept the buying and selling rates for the Chinese Yuan unchanged at 3,601 VND/CNY and 3,699 VND/CNY, respectively.

– 09:12 11/08/2025

The Vietnamese Dong’s Future: Navigating the Volatile USD Waters

The USD is showing signs of weakening but remains stubbornly above the 26,000 VND mark. However, experts suggest that the pressure on Vietnam’s exchange rate is easing, with predictions of a modest 3-4% depreciation for the Vietnamese Dong this year.

“Credit to Real Estate and Securities: SBV Assures Close Monitoring of Safety Index”

Amid concerns of a surge in credit flow into the real estate and securities sectors, Governor of the State Bank of Vietnam, Nguyen Thi Hong, has provided insightful analysis and clarification on pertinent issues.