The Board of Directors of Hoang Quan Trading Consulting Services JSC (HOSE: HQC) has approved a plan to issue private shares to swap debt, following the plan approved at the annual general meeting of shareholders (AGM) in May this year.

Specifically, HQC plans to issue 50 million private shares to swap VND 500 billion of debt, with a swap ratio of 10,000 VND debt for 1 newly issued share. The issuance targets are creditors, thereby increasing the charter capital to approximately VND 6,266 billion. The issued shares will be restricted from transfer for a minimum of 1 year.

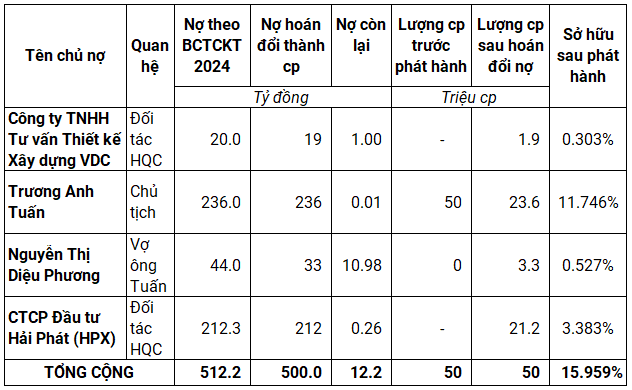

According to the previously published list, there are 4 creditors who will swap HQC shares, including VDC Construction Consulting Design Co., Ltd. swapping VND 19 billion of debt for 1.9 million shares. If successful, the remaining debt will be nearly VND 1 billion; Mr. Truong Anh Tuan – Chairman of the Board of Directors of HQC swapped VND 236 billion of debt for 23.6 million shares, with nearly VND 11 million of debt remaining; Mrs. Nguyen Thi Dieu Phuong (Mr. Tuan’s wife) swapped VND 33 billion for 3.3 million shares, HQC still owes nearly VND 11 billion; finally, Hai Phat Investment Joint Stock Company (HOSE: HPX) swapped VND 212 billion of debt for 21.2 million shares, expected to hold 3.383% of HQC’s charter capital after issuance, with a remaining debt of over VND 256 million.

|

List of expected creditors to be issued shares for debt swap

Compiled by Vietstock Finance

|

In case a creditor refuses to swap a part or the entire debt that has been approved by the AGM, the Board of Directors will reduce the number of shares issued based on the actual swap amount, based on the swap agreement with the creditors.

The debts after being swapped will be canceled accordingly with the value of the swapped debts. The remaining debt that is not swapped will be paid by the Company in accordance with the agreement with the creditors. The creditor will become a shareholder owning shares of HQC and having full rights and obligations of a shareholder from the date of completion of the issuance of shares for debt swap.

As of June 30, 2025, HQC had over VND 4,472 billion in payables, down 5% from the beginning of the year, with financial debt of over VND 1,729 billion, up 5% and accounting for 39% of total debt.

In March last year, HQC completed the issuance of 100 million private shares to strategic shareholders, at a price of VND 10,000/share, while the market price was only around VND 4,000-5,000/share, attracting VND 1,000 billion, charter capital increased to VND 5,766 billion as at present. However, the list and proportion of ownership of investors buying shares were not disclosed. Up to now, these shares have been allowed to be freely transferred after 1 year from the completion of the issuance.

At the closing price on August 08, HQC share price stood at VND 4,060/share, up 30% compared to the beginning of the year, with an average liquidity of more than 6.8 million shares/day.

| HQC share price movement from March 2024 up to now |

Sales return, HQC escapes Q2 loss thanks to other income

Chairman Truong Anh Tuan increases ownership in HQC to nearly 8.7%

– 08:14 11/08/2025

“SJ Group Successfully Issues Over 182 Million Shares as Dividend and Bonus Payout”

On July 31, 2025, SJ Group concluded its distribution of over 182.6 million shares as dividends to its 2,302 shareholders. This issuance of shares has increased the total number of outstanding shares to nearly 297.5 million.

MBB Stock Surges Ahead of Dividend Payout

Military Commercial Joint Stock Bank (MB, HOSE: MBB) has announced that August 14th is the ex-dividend date for shareholders to receive a combination of stock and cash dividends for the fiscal year 2024. Ensure you are a shareholder by the end of the trading day on August 13th to be eligible for this dividend payment.