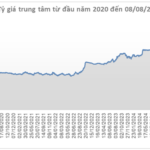

On July 30, 2025, the State Bank of Vietnam increased the central exchange rate by 22 VND/USD to 25,228 VND per 1 USD.

Over the past few years, many people have considered VND to be a very weak currency. This perception stems from rankings that evaluate the strength or weakness of currencies based on their exchange rates against the USD at a specific point in time.

For instance, a ranking in 2024 suggested that the Iranian Rial was the weakest currency in the world, as it took 42,000 Rial to exchange for 1 USD, while VND was ranked as the second weakest due to its exchange rate of 25,000 VND/USD.

Many social media rankings consider VND as a weak currency solely based on its high exchange rate against the USD.

|

Currency reform to lower the exchange rate

Firstly, it’s important to understand that a country can determine the nominal value of its currency through technical measures, including currency reform.

Historical records show that many countries have implemented currency reforms to create the illusion of a stronger currency. For example, France, following World War II, conducted two monetary reforms. In 1960, France introduced a new franc with a value 100 times higher than the old franc.

Similarly, in 2005, Turkey removed six zeros from the old lira to introduce the new lira, reducing the exchange rate from 1 million lira per 1 USD to 1 lira per 1 USD overnight.

While these actions make the currency appear “stronger,” they do not reflect any improvement in purchasing power, international payment capacity, or the intrinsic strength of the economy.

If it were that easy to strengthen a currency by simply reforming it, countries around the world would be doing it continuously.

Criteria for a strong currency

There are currencies with higher exchange rates than 1 USD, yet they are not considered “strong.” For instance, the Kuwaiti Dinar (approximately 3.25 USD per dinar), the Bahraini Dinar, and the Omani Rial (both approximately 2.6 USD) are not referred to as strong currencies. In fact, most people have likely never heard of or seen these currencies.

While a country can make one unit of its currency worth more than 1 USD, it cannot easily make its currency popular in international trade or widely held as a reserve by major central banks. In other words, nominal value does not reflect true strength.

Currently, there is no quantitative index or measure to compare the strength of currencies against each other in a point-based system.

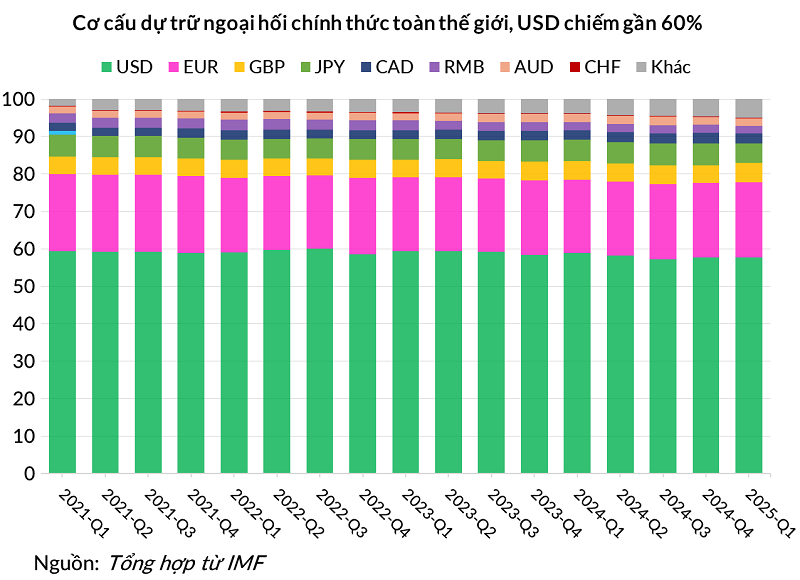

Internationally, a currency is considered “strong” or a “hard currency” when it meets three conditions: it maintains relative stability over time, is widely accepted as a means of payment or reserve by other countries, and is issued by a country with a large, politically stable economy.

Examples of hard currencies include USD, EUR, and JPY, which are not only widely traded in global financial markets but also serve as important reserve assets for many central banks.

|

In addition to qualitative criteria, the concept of a strong or weak currency can also be assessed based on the depreciation or appreciation rate of a currency against another over a specific period.

For instance, if Country A’s currency depreciates by 30% against the USD in five years while Country B’s currency remains stable, it’s evident that Country A’s currency is weaker, regardless of the exchange rate at a specific time.

Reputable economic and financial news sources often compare the depreciation rates of currencies against the USD to evaluate their strength. For example, an article published on March 19, 2025, by Bloomberg stated that the Tanzanian Shilling was the weakest currency globally due to its 8.9% depreciation since the beginning of 2025, followed by the Liberian Dollar with an 8.7% slide against the USD. This comparison relies on exchange rate fluctuations between two points in time, not just a single point.

——————

This article does not aim to debate the strength or weakness of the Vietnamese currency but to clarify a common misunderstanding about how a currency’s strength is assessed.

A currency’s strength lies not in the exchange rate number but in its ability to maintain value, its acceptance in international trade, and the economic and political foundation of the issuing country. A high exchange rate does not equate to a weak currency, and a low rate does not make it strong. The exchange rate of 26,000 VND/USD only signifies that 26,000 VND is equivalent to 1 USD in the foreign exchange market.

– 13:00 11/08/2025

The Greenback Retreats

“The US dollar weakened in the week of August 4–8, 2025, as markets reacted to President Donald Trump’s new tariff policies and disappointing jobs data that fueled expectations for an interest rate cut. “

Vinaship Offloads Aging Fleet to Stem Losses

The shareholders of Vinaship Ocean Shipping JSC (UPCoM: VNA) have agreed to sell the 27-year-old bulk carrier, Vinaship Sea, in a strategic move to reduce maintenance costs and avert prolonged losses. By offloading the aging vessel, the company aims to generate capital for investing in younger, more efficient ships, thereby positioning itself for improved performance and profitability.