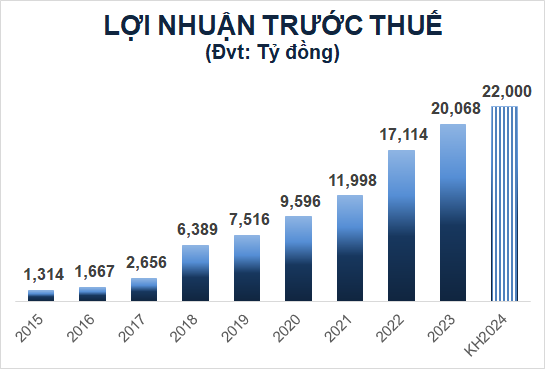

ACB has set its plan for 2024 with a pre-tax profit target of 22,000 billion VND, an increase of 10%.

Anticipating the early recovery of business production in the enterprise sector and the production and consumption demand of households in the region, ACB has set its 2024 direction to increase credit growth for the whole year at a level instructed by the State Bank, improve the proportion of fee income to revenue, develop customer base to enable customers to transact in the digital environment, and increase the number of transactions through digital channels.

ACB’s plan for the end of 2024 is to reach total assets of 805,050 billion VND, an increase of 12% compared to the beginning of the year. Customer deposits and valuable papers are expected to reach 593,779 billion VND, an increase of 11%; customer loans are expected to reach 555,866 billion VND, an increase of 14%. ACB’s plan for pre-tax profit in 2024 is 22,000 billion VND, a 10% increase compared to the results of 2023. The non-performing loan ratio is controlled at less than 2%.

Source: VietstockFinance

|

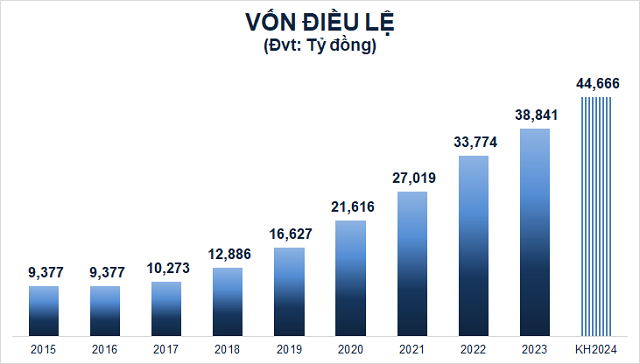

Increasing capital, distributing dividends in cash and shares at a total rate of 25%

Regarding the profit distribution plan for 2023, ACB plans to distribute dividends at a total rate of 25%, of which 15% is in shares and 10% is in cash. The profit that can be used for dividend distribution in 2023 is 19,886 billion VND. After using 9,710 billion VND to distribute dividends in 2023, ACB’s remaining profit is 10,176 billion VND.

Specifically, in the plan to increase capital through dividend distribution, ACB plans to issue over 582.6 million shares to existing shareholders, at a rate of 15% (shareholders owning 100 shares will receive an additional 15 shares). After a successful issuance, ACB’s charter capital will increase from 38,840 billion VND to 44,666 billion VND.

The source of funds to be used for dividend distribution is the profit that can be used for dividend distribution after fully setting aside all reserves and the remaining profit not yet distributed as of December 31, 2023, with the dividend in shares equivalent to 5,826 billion VND.

The common shares issued to pay dividends to existing shareholders will be distributed through the implementation of rights. The time to increase charter capital is expected in the third quarter of 2024.

According to ACB, increasing charter capital is necessary to increase long-term capital for credit activities, invest in government bonds, increase capital for investment in infrastructure, strategic projects of the bank, and enhance financial capacity.

The profit distribution plan for 2024 is also expected to be similar to 2023.

Source: VietstockFinance

|

The remuneration for the Board of Directors and the Supervisory Board in 2023 is expected to be proposed at a rate of 0.6% of after-tax profit, equivalent to 80.99 billion VND. The remuneration for the Board of Directors and the Supervisory Board in 2024 is also expected to be proposed at 0.6% of after-tax profit.

ACB’s Annual General Meeting of Shareholders 2024 is expected to be held on April 4 in Ho Chi Minh City.

On the HOSE exchange, as of the end of March 14, 2024, ACB’s stock price stopped at 27,250 VND/share, an increase of 14% compared to the beginning of the year. The average liquidity is nearly 12 million shares/day.

| ACB stock price movement from the beginning of the year until now |