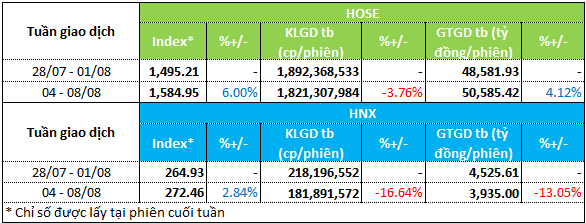

The latest surge pushed the VN-Index to close the week at 1,584.95 points, a 6% weekly gain. The HNX-Index also witnessed a positive scenario, rising nearly 2.84% to 272.46 points.

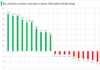

The HOSE‘s average trading value during the week increased by 4.12%, reaching nearly VND 50.6 trillion per session. However, the average trading volume decreased by 3.76%, recording over 1.8 billion units per session.

On the HNX, both value and volume declined. Specifically, the average trading value decreased by 13.05% to more than VND 3.9 trillion per session, along with a 16.64% drop in the average trading volume, standing at nearly 182 million units per session.

Last week also witnessed a record liquidity session on August 5, with a trading value of nearly VND 85.8 trillion (across the three exchanges HOSE, HNX, and UPCoM). In terms of volume, more than 3.2 billion units changed hands.

|

Weekly Liquidity Overview for August 4-8

|

Source: VietstockFinance

|

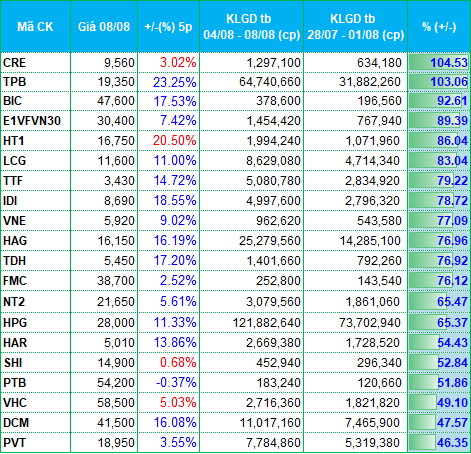

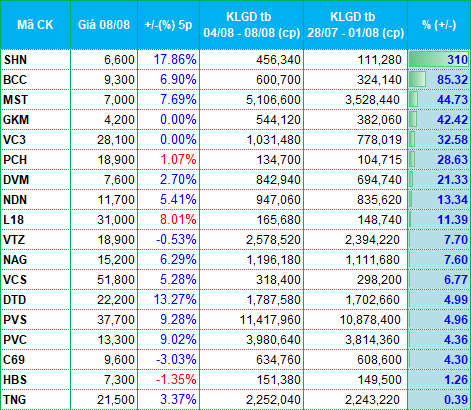

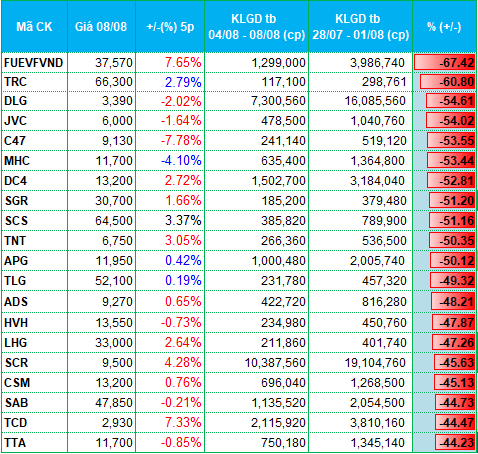

SHN was the leader on the HNX and the market in terms of liquidity growth, more than quadrupling the previous week’s level. Looking at the broader picture, capital tended to be divergent across various sectors last week.

On the HOSE and HNX exchanges, several sectors attracted capital attention, including seafood, oil and gas, and chemicals.

Notably, the seafood sector contributed three names, including industry giant VHC, which surged more than 49%, along with FMC and IDI, which rose 76% and 79%, respectively. In the oil and gas industry, PVT on the HOSE climbed over 46%, while PVS and PVC were among the leaders on the HNX. The chemical sector also experienced strong capital inflows, with DCM surging 48%, PCH up 29%, and VTZ gaining 8%. However, PLC fell 29% and was among the stocks with the sharpest decline in liquidity.

Several large-cap financial stocks witnessed significant liquidity growth, including TPB, which surged 103%, and BIC, which rose 93%. Not only did these two stocks experience increases in liquidity, but their share prices also recorded impressive gains of 23% and 16%, respectively.

The market observed several sectors with divergent liquidity trends, including real estate, construction and building materials, and electricity.

Specifically, in the real estate sector, several stocks witnessed robust liquidity growth, such as CRE, TDH, HAR, VC3, NDN, and DTD. Notably, CRE led the entire market with a nearly 105% surge in liquidity. In contrast, stocks like SGR, LHG, and SCR were among those with the sharpest declines in liquidity.

In the construction and building materials sector, stocks that experienced significant liquidity increases included HT1, LCG, HPG, BCC, MST, L18, and VCS. Notably, the steel giant HPG experienced a memorable trading session on August 5, with nearly 216 million shares changing hands, surpassing the previous record set on November 18, 2022.

On the other hand, stocks like C47, DC4, TNT, HVH, TCD, SJE, S99, ITQ, LIG, and VC2 witnessed notable declines in liquidity.

In the electricity sector, while NT2 and VNE grew strongly by 65% and 77%, respectively, DL1 and TTA were among those with the sharpest declines, falling nearly 29% and over 44%, respectively.

Last week, several securities stocks witnessed sharp declines in liquidity, including APG, WSS, VIG, TVC, and MBS. Conversely, HBS was a rare securities stock that made it to the top liquidity gainers list, although it only inched up slightly by over 1%.

|

Top 20 Stocks with the Highest Liquidity Growth/Decline on the HOSE

|

|

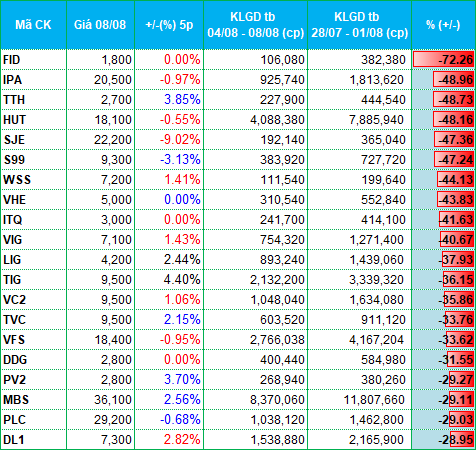

Top 20 Stocks with the Highest Liquidity Growth/Decline on the HNX

|

The lists of stocks with the highest and lowest liquidity growth/decline are based on those with average trading volume above 100,000 units per session.

– 19:28 11/08/2025

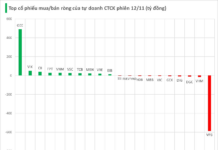

The Smart Money is Back: Brokerages “Accumulate” Stocks in Surprising Friday Trading

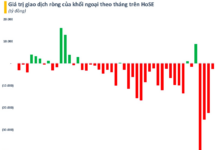

The domestic investment community went against the flow of foreign investors, with securities companies returning to net buying with hundreds of billions of dong on the HoSE exchange.

“How Fideco Can Recover From Stock Market Warnings”

Introducing Fideco: Taking Charge of Their Future

Fideco takes center stage as they address recent developments regarding their stock (FDC) being placed on a watchlist. In a comprehensive statement, they outline their plans to rectify the situation and reassure investors.