Source: VietstockFinance

|

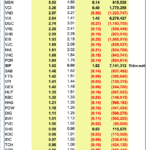

As of August 11, 2025, MSN stock has risen over 17% year-to-date, with an average daily trading volume of more than 6 million shares.

| Price movement of MSN stock since the beginning of the year |

|

|

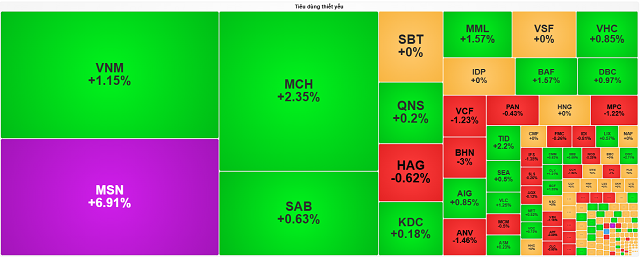

The upward momentum was fueled by a series of positive news, bolstering investor confidence not only in MSN but also in the essential consumer goods sector: VNM (+1.15%), MCH (+2.35%), MML (+1.57%), etc.

Source: VietstockFinance

|

Strong financial performance in the first half of 2025

Despite macroeconomic challenges, Masan reported impressive profit growth for the second quarter and the first six months of 2025, with net profits of 1,619 billion VND and 2,602 billion VND, respectively – almost double the figures from the same period last year and exceeding 50% of the full-year plan.

This growth was largely driven by two strategic business segments: retail and meat. In the first half of 2025, WinCommerce (WCM), with its WinMart/WinMart+ retail chain, achieved revenue of 17,915 billion VND, a 13% increase year-over-year. Net profit reached 68 billion VND, driven by LFL sales growth and network expansion in rural areas.

Masan MEATLife (MML) recorded revenue of 2,340 billion VND, a 31% increase, propelled by robust double-digit growth in both its livestock (+66%) and meat (+21%) segments. Net profit for the second quarter of 2025 stood at 249 billion VND, maintaining its upward trajectory.

In addition to the remarkable financial results, Masan’s decision to increase its ownership stake in The CrownX from 84.9% to 92.8% significantly boosted investor sentiment. The CrownX is a consolidated platform that combines the consumer goods segment (Masan Consumer Holdings) and the retail segment (WinCommerce), currently contributing the lion’s share of the group’s revenue and profit.

Positive macroeconomic outlook

The government’s extension of the VAT reduction policy is expected to stimulate domestic consumption and directly benefit companies in the consumer goods and retail sectors, such as Masan. As the economy recovers, household incomes improve, leading to increased spending on consumer goods. According to the Ministry of Finance, investment continues to be a key driver, and there is still much potential to further boost the economy and achieve higher growth rates in the second half of 2025. This will also create new production capacities and opportunities, setting the stage for a 10% or higher growth target in 2026.

Moreover, experts predict that pork prices are likely to remain high due to supply constraints following disease outbreaks, while demand typically surges during the year-end and Lunar New Year holidays. Large-scale livestock companies that employ safe biotechnology and have strong disease control capabilities, such as Dabaco (DBC), Masan MEATLife (MML), and BaF Vietnam (BAF), are expected to benefit from sustained high prices.

– 13:28 11/08/2025

The Market Beat: Transport Sector Shines Amid Dull Liquidity

The market closed with the VN-Index up 2.83 points (0.23%) at 1,257.5, while the HNX-Index fell 0.47 points (-0.21%) to 227.07. The market breadth tilted towards gainers with 452 advancing stocks against 284 declining stocks. The VN30 basket saw a slight dominance of green with 14 gainers, 12 losers, and 4 stocks unchanged.

Stock Market Week of 12/16/2024 – 12/20/2024: Caution Prevails

The VN-Index edged higher last week, with alternating sessions of gains and losses. While this indicates a cautious investor sentiment, the below-average trading volume suggests a hesitant market. Moreover, with foreign investors continuing their net-selling streak, the short-term outlook remains subdued.

SIP into VNM ETF, Adding Over 2.2 Million New Shares

In the Q4 2024 review, released in the early hours of December 14, 2024, MarketVector Indexes added just one stock, SIP, to the MarketVector Vietnam Local Index – the benchmark for the hundred-million-dollar VanEck Vectors Vietnam ETF (VNM ETF). Notably, no stocks were removed.