The first half of 2025 witnessed a starkly contrasting performance in the stock market, with VNC, the stock code of Vinacontrol Joint Stock Company, standing out to investors due to its stable growth trajectory. Once a relatively quiet stock with trading volumes hovering around 30,000 VND/share and a few hundred shares per session, VNC experienced a spectacular surge to over 70,000 VND/share within a few months, before retreating to the 32,000 VND range.

This positive momentum was further bolstered by Vinacontrol’s announcement to issue nearly 10.5 million bonus shares in a 1:1 ratio, increasing its charter capital to 210 billion VND. Notably, all these shares are freely transferable, facilitating liquidity and enhancing the attractiveness of the VNC ticker.

Vinacontrol’s transparent financial policies, coupled with its strategic reinvestment in core capabilities, reflect the prudent steps of a seasoned yet dynamic enterprise. But what underpins Vinacontrol’s enduring allure and preparedness for the next phase of growth?

A Legacy of Pioneer Brand

Established in 1957 by the government’s directive, Vinacontrol was entrusted with a special mission: to conduct commodity inspection and quality control for import-export activities, safeguarding national interests in the nascent economy’s commercial endeavors. As Vietnam’s first inspection organization, Vinacontrol not only laid the foundation for the country’s conformity assessment sector but also steadfastly led the industry for decades.

In 2005, Vinacontrol underwent privatization and was listed on the HNX exchange under the ticker VNC, ushering in a new era of development marked by transparency, professionalism, and alignment with market mechanisms. To date, Vinacontrol remains the sole inspection, testing, certification, and conformity assessment organization listed on Vietnam’s stock exchange. Moreover, it boasts the industry’s most extensive network, encompassing over 40 branches and laboratories nationwide. Vinacontrol’s multi-sector expertise covers critical areas such as agriculture, industry, food, logistics, environmental sustainability, and more.

Vinacontrol: The Sole Conformity Assessment Organization Listed on Vietnam’s Stock Exchange

Expanding Professional Competence

In recent years, Vinacontrol has embarked on a transformative journey, embracing sustainable development, technological innovation, service digitization, and expansion into high-value-added domains. Transcending traditional inspection services, Vinacontrol has diversified its portfolio to include conformity assessment, conformity certification, ISO certification, environmental analysis, greenhouse gas inventory, ESG consulting, and technical barrier mitigation for exporting enterprises. Each service offering fortifies the quality, safety, and sustainability of Vietnamese businesses and their products.

Additionally, the company is strategically investing in modernizing its infrastructure and equipment, enhancing its testing capabilities to international standards, and cultivating a high-caliber workforce to meet the demands of international markets, including the US, EU, and Japan.

Vinacontrol: Trusted Advisor in Greenhouse Gas Inventory for Numerous Enterprises

In 2024, the company was designated as a technology appraisal organization under Decision 29/2023/QD-TTg, a promising prospect given Vietnam’s stringent scrutiny of public investment efficiency and preference for green, clean, and modern technologies in projects.

Fast forward to 2025, and Vinacontrol stands as the first and only entity in Vietnam capable of conducting elevator safety testing, a testament to the company’s research prowess and service development in technically demanding fields.

Strategic Restructuring for Sustainable Development

Vinacontrol is also actively reshaping its strategic direction, quietly joining the digital transformation race and embracing big data analytics. The launch of Effitranz, a comprehensive energy management digital platform, underscores Vinacontrol’s commitment to sustainability. Effitranz empowers businesses to monitor, analyze, and optimize energy efficiency in real time while integrating greenhouse gas emission calculations and cost-benefit analyses. By aiding enterprises in reducing energy costs by 5% to 30%, Effitranz is not merely an operational tool but a pivotal solution propelling organizations toward green development and international ESG standard compliance.

Effitranz: Optimizing Energy Efficiency, Boosting Profits, and Advancing Sustainability

Vinacontrol’s investment in intellectually intensive technology products like Effitranz showcases its long-term vision of evolving from a traditional technical service provider to a strategic partner for businesses navigating the digital and low-carbon era.

Consistent Dividends, Robust Finances, and Long-Term Potential

Contrary to its perception as a speculative stock, VNC boasts a relatively robust financial foundation. The company maintains a consistent annual dividend policy, ranging from 15% to 19%.

According to annual reports, Vinacontrol has consistently turned a profit over the years, refrains from risky financial leverage, and holds industrial real estate and fixed assets in major cities—a significant advantage amid the government’s push for industrial infrastructure development.

Benefitting from Stimulus Policies and Green Exports

As part of Vietnam’s economic recovery and growth strategy, the government targets a GDP growth rate of 6.5-7% annually, bolstered by public investment and green transformation. Enterprises offering quality control, goods inspection, and sustainability consulting services, such as Vinacontrol, are poised to directly benefit from this strategic shift.

Moreover, Vinacontrol’s expansion of international cooperation, export enterprise support, product evaluation, traceability, and ESG assessment are poised to become new growth drivers in the near future.

VNC: A “Mature” Stock with Enduring Allure

In essence, VNC is a rare stock that blends traditional sustainability with new growth potential, thanks to its well-directed strategic restructuring. The stable growth trajectory witnessed in recent times is a testament to Vinacontrol’s enduring transformation over the decades.

Amid a stock market that increasingly favors long-term, discerning investments, VNC—a “mature” yet “contemporary” stock—presents an attractive opportunity for investors seeking a balance between intrinsic value, stability, and substantive growth prospects.

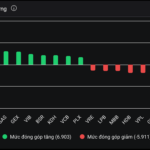

The Vietstock Daily: Upward Momentum Persists

The VN-Index extended its winning streak for the sixth consecutive session, hovering near the upper band of the Bollinger Bands. However, the index’s movement warrants attention as it approaches the pivotal psychological resistance level of 1,600 points. A decisive breakthrough above this level, fueled by robust buying pressure, would bolster the index’s upward trajectory. Additionally, the bullish crossover on the Stochastic Oscillator and the upward trajectory of the MACD, following a buy signal, reinforce the potential for sustained upside momentum in the near term.

“Experts at VPBankS: The Market Still Has Upside Potential, But Caution is Needed to Avoid Being ‘Overwhelmed’ by the Waves.”

The Vietnamese stock market remains robust in the short term, bolstered by highly active trading activities. However, investors should be vigilant and keep an eye out for potential risk factors in August.

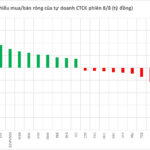

The Stock Market Tug-of-War: Pawn Shop IPO Debuts

The domestic stock market witnessed a tug-of-war during the weekend session (8/8) as large-cap stocks faced corrective pressures. Today, F88’s stock debuted, marking the first time a pawnshop business listed and traded on the stock exchange.