Masan MEATLife’s impressive performance in Q2 2025, with a 22.6% revenue growth rate and a 34% contribution margin, underscores the success of its strategy focusing on premium products and leveraging its internal consumer-retail ecosystem.

Market Volatility Drives Quality Consumption Trends

The fresh meat market is experiencing significant fluctuations. The re-emergence of African Swine Fever in some northern provinces has led to a decrease in hot meat supply, while piglet prices rose by 5-7% in July alone (according to the Livestock Department). These factors have made consumers more cautious about unclear food sources, thus promoting the trend of choosing branded meat with strict quality control and traceable origins.

This notable shift in consumer behavior is especially prominent as Vietnam’s economy is on a path to enhancing its standard of living. The goal of a per capita GDP approaching USD 5,000 is becoming increasingly feasible, with the figure for the first half of 2025 reaching approximately USD 2,625, up nearly 8% from the previous year (according to the General Statistics Office). As incomes rise, consumers are not only price-conscious but also demand high-quality and safe products, especially in essential food industries such as meat and beverages.

Against this backdrop, Masan MEATLife has emerged as a frontrunner in the trend of elevating meat consumption standards. The company’s processed meat segment recorded a 22.6% growth rate in Q2 2025, accounting for 34% of total revenue. This achievement reflects the successful strategy of shifting towards higher-value products that meet the market’s increasingly stringent demands.

Premium Product Strategy and Internal Collaboration: Keys to Sustainable Growth

Significant growth leverage also comes from the internal coordination model within the Masan ecosystem, between MML and the WinCommerce retail system (WCM), with over 4,100 WinMart and WinMart+ stores directly distributing chilled and processed meat products to consumers. The ownership of a closed-loop ecosystem enables MML to control the end-user experience while optimizing its portfolio for each customer segment, particularly the middle class and young families.

MML’s product strategy goes beyond market share expansion and focuses on value creation. The product lines are developed towards premiumization, emphasizing nutrition, standardized production processes, and convenience, meeting the ever-increasing and evolving demands of modern consumers.

However, it is essential to view the Q2 2025 financial results objectively. This quarter’s net profit included a non-recurring, non-cash income of VND 196 billion. This income is part of the benefit from renegotiating a long-term commercial contract with a supplier.

Nevertheless, MML’s prospects for the second half of the year remain positive. With a strategy focused on continuously enhancing and innovating its product portfolio, along with the support of its internal ecosystem and a trusted brand, MML possesses the key elements to sustain its growth trajectory in the upcoming quarters.

The Better Choice Awards: Nurturing a Green, Smart and Consumer-Centric Revolution

Better Choice Awards is more than just a technology award; it is a movement that is reshaping how brands connect with Vietnamese consumers. With a focus on three core tenets: Green, Smart, and Relevant, we are elevating the standard for businesses to engage and captivate their audience.

The Tasty Revolution: Masan’s Meat Segment Surges Ahead in the New Consumer Wave

The processed meat market is experiencing a robust growth phase, with consumers prioritizing food quality and safety alongside improved income. With a 23% revenue growth in Q2 2025 and a 34% contribution margin, Masan MEATLife is leveraging its strategic focus on premium products and efficient utilization of its internal consumer-retail ecosystem.

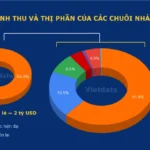

The Ultimate Recession-Proof Industry: A $70 Billion Behemoth, with Retail Giants Scrambling to Open Stores in Rural and Urban Areas Alike

The pharmaceutical retail market is often deemed “recession-proof”, owing to the consistent demand for pharmaceuticals, which remains imperative despite macroeconomic fluctuations. In the context of Vietnam, with its aging population and growing middle class, the demand for healthcare, and by extension, the pharmaceutical industry, is experiencing unwavering growth, as highlighted by Vietdata, a prominent provider of reports on the Vietnamese economy.