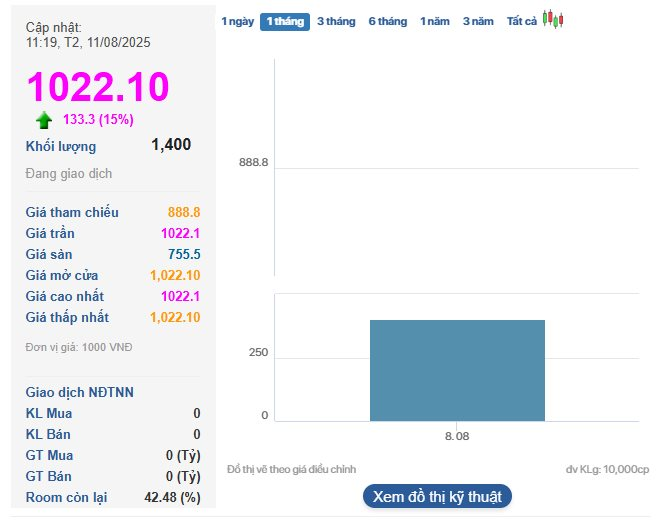

In a shocking turn of events on the stock market, shares of F88, owned by F88 Investment JSC, soared to new heights with a daily limit gain, pushing the market price to over 1,022,000 VND per share. As of the morning session on August 11th, the matched volume reached 1,400 units, with a massive buy surplus of more than 43,000 units at the ceiling price.

This marks the second consecutive ceiling-hitting session for F88 since its debut on UPCOM, catapulting it to the top in terms of market price across the entire market, far surpassing its competitors. As a result, the company’s market capitalization surged past 8,447 billion VND.

Prior to F88, the last time Vietnam’s stock market witnessed a share price surpassing the million-dong mark was in early 2023. VNG Corporation’s VNZ shares, which listed in January 2023, experienced an 11-session ceiling-hitting streak, pushing its price to a peak of 1,358,700 VND per share on February 15, 2023. However, the share price has since plummeted to 400,000 VND, reflecting a staggering 70% loss in value.

F88’s meteoric rise was foreshadowed by its performance in the OTC (over-the-counter) market, where it was traded among investors at prices hovering around 1,000,000 VND per share.

In terms of financial performance, F88 posted impressive results for the second quarter of 2025, with revenue reaching 925 billion VND, a 30% increase, and pre-tax profit soaring to 189 billion VND, a 220% surge compared to the same period last year. This remarkable performance can be attributed to the Company’s strategic move to increase disbursement by 47% and expand its outstanding loan balance by approximately 45%, coupled with its steadfast commitment to risk management discipline.

For the first half of 2025, F88 achieved remarkable milestones, including the operation of 888 stores, fulfilling 100% of its annual expansion plan. The company’s net debt stood at 5,543 billion VND, with total revenue reaching 1,744 billion VND and a pre-tax profit of 321 billion VND, equivalent to 48% of the yearly plan.

According to the prospectus, as of December 31, 2024, F88 had six foreign shareholders, including four institutional investors and two individual investors, collectively holding nearly 4.8 million shares, equivalent to 57.52% of F88’s charter capital. The two founders, Phung Anh Tuan and Ngo Quang Hung, owned 12.1% and 10.9% of the shares, respectively, as of June 30, 2025.

Expert Insights: Equities Enter a Phase of Stabilization and Acceleration, with Potential Short-Term Adjustments

“With a consistent upward trajectory over the last four months, a short-term market correction in August is not out of the question. This breather could be necessary to build momentum for conquering new heights,” opined the expert.

The Real Estate Rush: Firms Flock to Convert Bonds to Stocks

“The issuance of additional shares will dilute existing shareholders’ interests in the short term, but it is a necessary step for real estate businesses to restructure, alleviate cash flow pressures, and enhance their financial safety margins. This move strikes a balance between the interests of bondholders and the company’s long-term viability.”

The Vietstock Daily: Upward Momentum Persists

The VN-Index extended its winning streak for the sixth consecutive session, hovering near the upper band of the Bollinger Bands. However, the index’s movement warrants attention as it approaches the pivotal psychological resistance level of 1,600 points. A decisive breakthrough above this level, fueled by robust buying pressure, would bolster the index’s upward trajectory. Additionally, the bullish crossover on the Stochastic Oscillator and the upward trajectory of the MACD, following a buy signal, reinforce the potential for sustained upside momentum in the near term.