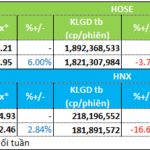

Hanoi Stock Exchange (HNX) has published a periodic disclosure on the status of principal and interest payments on bonds by No Va Real Estate Investment Group Joint Stock Company (Novaland, stock code: NVL) for the first half of 2025.

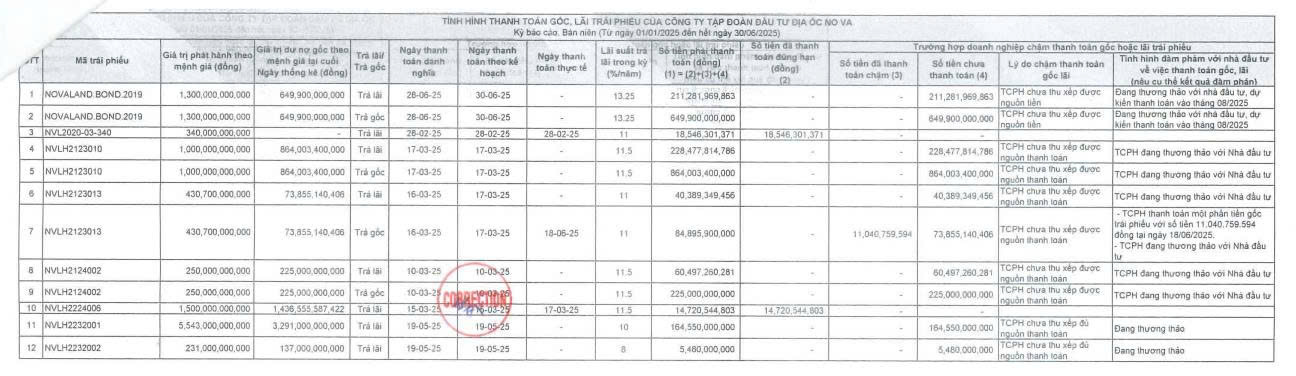

According to the disclosure, as of the end of the first six months of 2025, Novaland was unable to repay VND 2,523.4 billion in principal and interest across six bond batches, while successfully making interest payments of over VND 33.2 billion for one batch.

Specifically, the company delayed payments for the following batches: NOVALAND.BOND.2019 bonds with a value of nearly VND 861.2 billion; NVLH2123010 bonds worth nearly VND 1,092.5 billion; NVLH2123013 bonds worth nearly VND 114.3 billion; NVLH2124002 bonds worth nearly VND 285.5 billion; NVLH2232001 bonds worth nearly VND 164.6 billion; and NVLH2232002 bonds worth nearly VND 5.5 billion.

Source: HNX

Novaland attributed the delay in payments to a lack of available funds and ongoing negotiations with investors regarding the settlement of these bond debts.

The company successfully made interest payments for two batches: NVL2020-03-340 bonds with a value of over VND 18.5 billion and NVLH2224006 bonds with a value of over VND 14.7 billion.

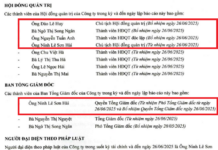

In other news, at the recent extraordinary general meeting of shareholders held on August 7, 2025, Novaland’s shareholders approved several important matters pertaining to personnel, debt restructuring, and financial consolidation.

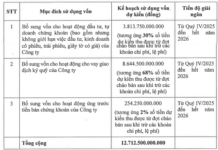

Notably, Novaland plans to issue nearly 320 million shares (approximately 16.4% of the total outstanding shares) in exchange for debt totaling over VND 8,719 billion.

Of these, 168 million shares will be privately issued at a price of VND 15,746.67 per share to settle VND 2,645 billion in debt to three creditors: NovaGroup (VND 2,527 billion), Diamond Properties (VND 111.7 billion), and Ms. Hoang Thu Chau (VND 6.7 billion). The exchange price is determined based on the average closing price of NVL shares over the 30 trading days from June 19 to July 30, 2025. The ratio of the number of shares issued to the total number of outstanding shares is 8.616%.

The issuance is expected to take place in the fourth quarter of 2025 or the first quarter of 2026, pending approval from the State Securities Commission (SSC).

Additionally, NVL intends to issue 151.85 million shares at a price of VND 40,000 per share to settle VND 6,074 billion in principal debt of 13 bond codes issued from 2021 to 2022. This plan is expected to be implemented in 2026, subject to SSC approval.

Another notable resolution passed at the meeting was the approval of a maximum borrowing limit of VND 5,000 billion. This loan is convertible into common shares of the company within five years from the disbursement date, with repayment due at maturity.

The lender has the right to request the conversion of all or part of the principal debt into common shares of the company. The conversion period is after 12 months from the final disbursement date up to 30 days before the maturity or early repayment of the loan. The conversion price is determined based on market principles, balancing the interests of all parties.

Regarding personnel changes, Novaland appointed Ms. Pham Thi Hong Nhung as a member of the Board of Directors for a five-year term starting August 7, 2025. Prior to this appointment, Ms. Nhung did not hold any position in the company.

Conversely, Mr. Doan Minh Truong was relieved of his duties as a member of the Board of Directors effective August 7, 2025, based on his resignation letter.

Sovico Group Repays 1.1 Trillion VND in Bonds

Sovico has just made a full early repayment of 1.1 trillion VND in principal for 10 lots of bonds issued in 2020.