Massive Tax Debt: Turning Losses into Profits through Accrual Reversals

According to Announcement No. 1127/TB-TCS1 dated July 25, Tax Sub-Department 1 of Ho Chi Minh City disclosed information on 679 enterprises with tax debts and other budgetary obligations as of June 30, totaling VND 2,126 billion.

Among these delinquent entities, Danh Khoi Group Joint Stock Company (code: NRC, on HNX) stands out with an outstanding tax liability of VND 125.8 billion.

Additionally, its affiliate, Danh Khoi Southern Joint Stock Company, owes over VND 25 billion in taxes.

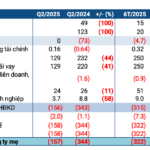

Amidst this massive tax debt, Danh Khoi Group continues to struggle financially. In the second quarter of 2025, the company generated a meager VND 4 billion in revenue, a decline of VND 2 billion from the previous year. After deducting cost of goods sold, gross profit stood at VND 3.8 billion, approximately VND 600 million lower than the same period last year.

Notably, during this period, NRC reversed over VND 22 billion in management expenses, primarily comprising provision expenses. Consequently, the company reported a post-tax profit of more than VND 4.1 billion in the second quarter of 2025, slightly lower than the previous year’s figure by VND 300 million.

For the first six months of 2025, Danh Khoi Group’s consolidated revenue reached VND 11 billion, a significant improvement of VND 8.5 billion compared to the corresponding period.

Despite the substantial increase in gross profit, it fell short of covering various expenses. However, the reversal of provision expenses resulted in a pre-tax profit of VND 8.8 billion, contrasting a loss of VND 1.8 billion in the previous year. The semi-annual post-tax profit stood at VND 4.8 billion, reversing a loss of over VND 10 billion in the first half of 2024.

NRC has set ambitious targets for 2025, aiming for consolidated revenue of VND 959 billion and a pre-tax profit of VND 25 billion. However, with only 19% of the profit target achieved in the first half, the company has a long way to go.

As of June 30, 2025, NRC’s total assets decreased by VND 34 billion to VND 1,895 billion. The company’s liquidity position is concerning, with less than VND 400 million in cash on hand, and inventories amounting to over VND 10 billion.

Short-term receivables stood at VND 411 billion, and investments in associated companies, specifically Danh Khoi TK Joint Stock Company, exceeded VND 105 billion.

On the liabilities side, short-term borrowings totaled VND 246 billion, including VND 160 billion in bonds, while long-term debt exceeded VND 45 billion.

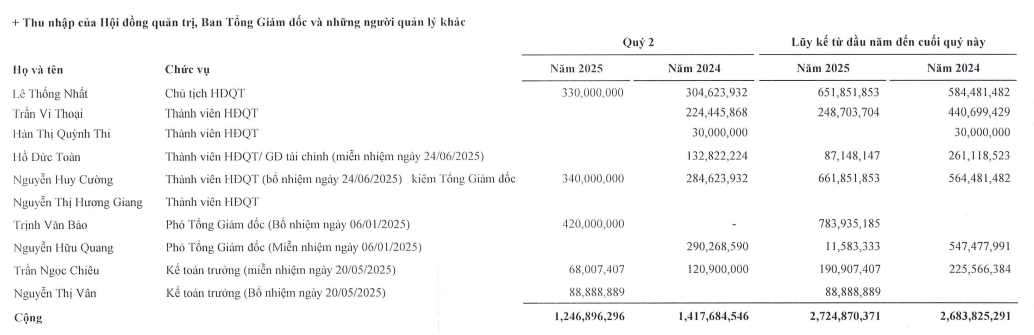

In the first half of 2025, Danh Khoi Group increased the remuneration for its leadership team. As a result, Chairman Le Thong Nhat earned VND 651.8 million in the first six months, a VND 67 million increase from the previous year.

Source: NRC’s Q2 2025 Consolidated Financial Statements

Nguyen Huy Cuong, Member of the Board of Directors and General Director, received nearly VND 662 million in the same period, an increase of almost VND 100 million compared to the previous year.

Rebranding and Business Diversification

In other developments, the 2025 Annual General Meeting of Shareholders of Danh Khoi Group, held on June 24, approved the change of the company’s name from “Danh Khoi Group Joint Stock Company” to “NRC Group Joint Stock Company,” with the abbreviated name being NRC Corp.

The management team justified this decision by associating the “Danh Khoi” brand with the company’s historical focus on real estate. With their new multi-industry direction, they believed a fresh brand identity was necessary.

As per the 17th Business Registration Certificate amendment dated July 31, 2025, Danh Khoi Group Joint Stock Company officially transformed into NRC Group Joint Stock Company (NRC Corp.).

Beyond the name change, NRC aims to strengthen its real estate business while venturing into new sectors, including high-tech agriculture, pharmaceuticals, medical supplies, and healthcare.

This strategic shift is driven by NRC’s recognition of the potential for expansion and the opportunity to leverage the conveniences offered by their invested or jointly invested projects.

The management team expresses confidence in generating revenue from these two new sectors—pharmaceuticals and medical supplies, and high-tech agriculture and food—in the latter half of the year.

The Real Estate Tycoon’s Background: Unraveling the Mystery of the $139 Million Tax Debtor in Ho Chi Minh City

With a staggering debt of over 3,239 billion VND, Thuân Việt Trading Construction Limited Company accounts for nearly 70% of the total debt on the list.

The Tax Debtor: Unraveling the Story of a 3.2 Trillion VND Tax Debt in Ho Chi Minh City

Among the 105 businesses in Ho Chi Minh City that owe taxes, a real estate company stands out with an outstanding debt of over VND 3,239 billion. This staggering amount has caught the attention of the local tax authorities and raises concerns about the financial stability and accountability of the company in question.

Raising $73 Million for the DatXanhHomes Parkview Project: An Ambitious Venture by Dat Xanh

“With a strategic move, Dat Xanh Group plans to offer 93.5 million private shares to raise an impressive VND 1,739.1 billion. This bold initiative aims to fuel the development of their flagship project, DatXanhHomes Parkview. This move underscores the company’s confidence and ambition in the Vietnamese market, as they seek to revolutionize the real estate landscape with this groundbreaking endeavor.”

A Challenging Second Quarter: PSH Reports a Loss of Over VND 300 Billion in the First Half of the Year

The repercussions of the forced tax invoice at the end of 2023 continue to plague the Petroleum Trading and Investment Joint Stock Company (UPCoM: PSH). The company reported yet another quarter of significant losses, this time for the second quarter of 2025, amounting to hundreds of billions of dong.

How Much Tax Arrears Will Result in a Departure Postponement?

The proposed threshold debt amount that would trigger a travel ban for individuals and legal representatives of businesses has sparked a flurry of diverse opinions. This controversial topic has led to a heated debate, with strong arguments being presented from all sides. As the discussion unfolds, the implementation of this policy is temporarily put on hold, allowing room for further consideration and refinement.