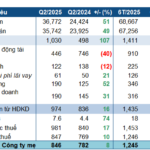

In Q2 2025, Novaland (NVL) narrowed its after-tax loss to VND 190 billion by ceasing to operate at a loss, compared to a loss of over VND 6,700 billion in the same period last year. In the first half of the year, NVL still incurred a loss of VND 666 billion, a significant improvement from the loss of over VND 7,300 billion in the previous year.

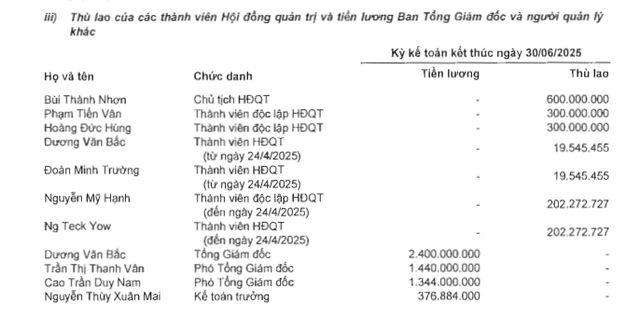

Amid the company’s ongoing losses, the members of Novaland’s Board of Directors forfeited their salaries and instead received a fixed allowance. Specifically, Chairman Bui Thanh Nhon opted out of a salary but received an allowance of VND 600 million for the six-month period. Other Board members, including Pham Tien Van and Hoang Duc Hung, each received an allowance of VND 300 million, while Ng Teck Yow was paid nearly VND 202.3 million (until April 24, 2025), and Duong Minh Truong received VND 19.5 million (from April 24, 2025). Nguyen My Hanh, an independent Board member until April 24, 2025, was compensated with an allowance of nearly VND 202.3 million.

Source: NVL

General Director Duong Van Bac received an allowance of VND 19.5 million as a Board member (from April 24, 2025) and a salary of VND 2.4 billion (equivalent to VND 400 million per month). Deputy General Directors Tran Thi Thanh Van and Cao Tran Duy Nam were paid approximately VND 1.44 billion and VND 1.34 billion, respectively.

In the second quarter of 2025, DIC Corp (DIG) reported an after-tax profit of over VND 52 billion, a 58% decrease from the previous year. However, due to reduced losses in the first three months, the semi-annual profit after tax increased by 70% year-on-year to VND 6.7 billion.

In the first half of this year, DIG spent VND 1.65 billion on Board allowances. Nguyen Hung Cuong, the Chairman of the Board, received VND 900 million, while Deputy Chairwoman Nguyen Thi Thanh Huyen was paid VND 600 million. The remaining Board members earned between VND 19 million and VND 90 million each for the six-month period.

Van Phu Invest (VPI) reported a net profit of nearly VND 6.7 billion in Q2 2025, a 75% decrease from the same period last year.

Thanks to the results achieved in Q1, the semi-annual profit after tax was VND 149 billion, up 56% from the previous year.

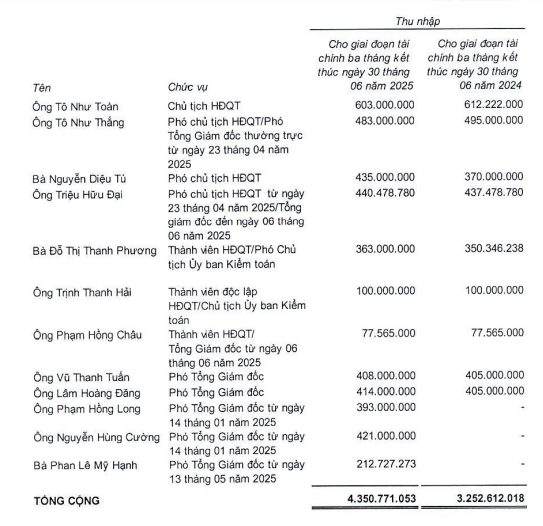

In Q2 2025, Chairman To Nhu Toan received an allowance of VND 603 million for three months. Deputy Chairman and Standing Vice President To Nhu Thang, from April 23, 2025, were paid VND 483 million, slightly lower than the previous year.

The other two Vice Chairmen, Nguyen Dieu Tu, and Trieu Huu Dai, each earned over VND 400 million. The Deputy General Directors also received approximately VND 400 million each for the quarter.

An Gia (AGG) achieved positive results in Q2 2025, but its cumulative net profit for the first six months reached only VND 90.3 billion, a 58% decrease from the previous year.

In this context, Chairman Nguyen Ba Sang received a total of VND 1.24 billion in allowances and income, an increase of VND 500 million from the previous year. Deputy General Director Nguyen Mai Giang was paid VND 680 million, an increase of VND 180 million, and Chief Accountant Nguyen Thanh Chau received VND 625 million, an increase of VND 86 million.

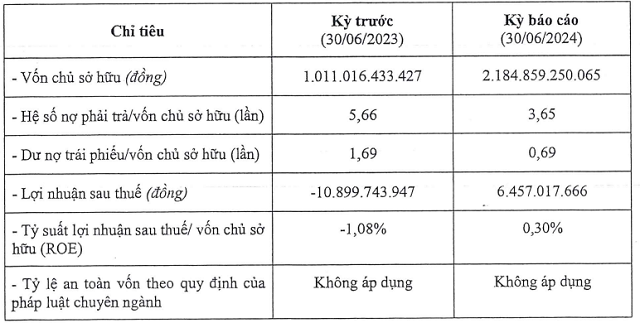

Meanwhile, Danh Khoi Group, now known as NRC Corp (NRC), turned a profit in Q2 2025 due to the reversal of provision expenses. For the first six months of 2025, NRC reported a consolidated profit after tax of VND 4.8 billion, compared to a loss of over VND 10 billion in the same period last year.

NRC aims to achieve consolidated revenue and pre-tax profit of VND 959 billion and VND 25 billion, respectively, for the full year 2025. Thus, the company has accomplished only 19% of its profit target so far.

In the first half of 2025, Danh Khoi increased the allowances paid to its leadership team. As a result, Chairman Le Thong Nhat earned VND 651.8 million, an increase of VND 67 million compared to the same period in 2024.

Nguyen Huy Cuong, a member of the Board and the General Director, had a total income of nearly VND 662 million for the six-month period, an increase of almost VND 100 million from the previous year.

“DIC Corp Refines Plans for its Public Offering of 150 Million Shares”

In their public offering of 150 million shares, DIC Corp has made adjustments to their proposed utilization of the expected proceeds amounting to VND 1.8 trillion.

Extraordinary General Meeting 2025: Novaland Approves Share Issuance to Swap Over $360 Million Debt

On August 7, 2025, the extraordinary General Meeting of Shareholders of Novaland Investment Corporation (Novaland, HOSE: NVL) took place at NovaWorld Phan Thiet. The meeting approved a plan to issue private shares to swap debt for equity and bond principal debt. The shareholders also approved a convertible loan agreement and elected additional members to the Board of Directors.

“Novaland Proposes Extraordinary General Meeting to Discuss the Issuance of Over 168 Million Private Placement Shares to Settle Debt”

The Board of Directors of No Va Real Estate Investment Group Joint Stock Company (HOSE: NVL) has unveiled two proposals for private placements to be discussed at the upcoming extraordinary general meeting on August 7. The proposals involve issuing shares to swap debt and execute a convertible loan facility.

A Profitable Second Quarter: BSR Surpasses Annual Targets

The upward trajectory of crude oil prices compared to the downward trend in the same period last year has resulted in a positive impact on the performance of Binh Son Refining and Petrochemical Joint Stock Company (HOSE: BSR). This quarter, the company witnessed a significant growth in its business, surpassing its annual profit plan just within the first six months.