The VN-Index closed Session 12/08 with a strong performance, gaining 11.36 points to 1,608.22, while the HNX-Index rose 0.01 points to 276.47. However, the UPCoM-Index fell 0.05 points to 109.2.

| VN-Index made a strong comeback in the afternoon session |

|

Source: VietstockFinance

|

Market liquidity reached over 50.2 trillion VND today, with VN-Index accounting for more than 45.3 trillion VND, similar to the previous session but lower than the recent average. In terms of volume, the market recorded more than 1.9 billion shares traded.

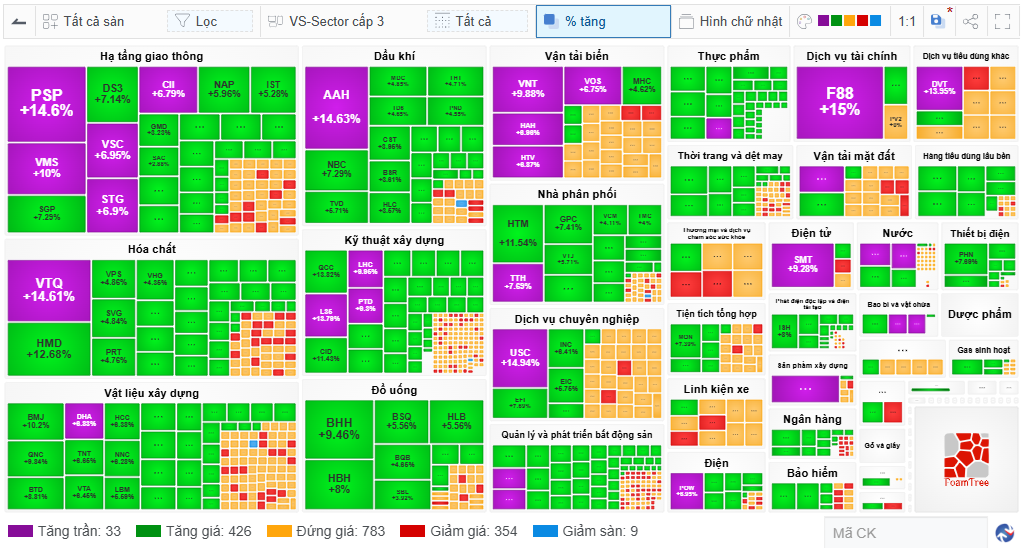

The market had 459 gaining stocks, including 33 that hit the ceiling price. The infrastructure group, including PSP, VMS, VSC, STG, and CII; the marine transportation group with VNT, HAH, HTV, and VDS; and the construction group with L35, LHC, and PTD, were among the top performers. The real estate sector also saw notable gains, with TAL and KDH hitting the ceiling price. In addition, F88 stood out with its third consecutive ceiling price session since its listing on UPCoM, reaching the 1,178,400 VND/share mark.

Source: VietstockFinance

|

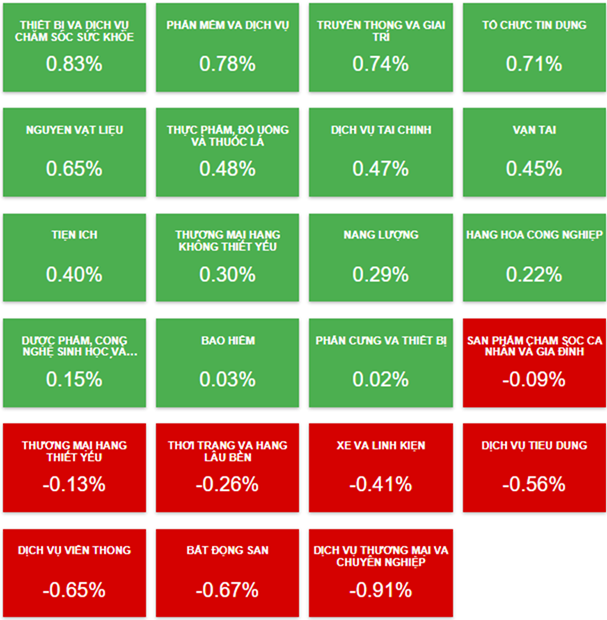

Green dominated 15 sectors, led by energy, which rose 1.94% on the back of BSR‘s 3.61% gain, PLX‘s 1.45% increase, and PVS‘s 1.34% climb.

Among the gaining sectors, notable performers included large-cap sectors such as banks, up 0.96%; materials, up 0.57%; and real estate, up 0.22%. The real estate sector stood out as it ended the morning session as the second-worst performer with a 0.67% loss.

Despite the market’s gains, the map still showed mixed performances. While KDH and TAL hit the ceiling price, many other stocks closed in the red, including BCM, VRE, PDR, TCH, NLG, NVL, DXG, DIG, VPI, CEO, DXS, and notably VHM, which shaved off nearly 0.5 points from the VN-Index.

In terms of market capitalization, all groups, including Large Cap, Mid Cap, Small Cap, and Micro Cap, rebounded in the afternoon session after falling in the morning. Large Cap rose 0.69%, Mid Cap gained 0.66%, Small Cap climbed 0.29%, and Micro Cap advanced 0.61%.

The VN30, which provided significant support to the overall market during the challenging morning session, rose 0.77%, or 13.35 points, to 1,755.25.

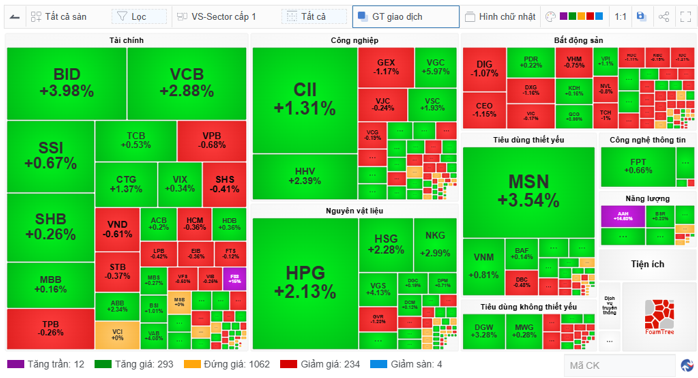

Many VN30 stocks were among the top positive contributors to the VN-Index today, led by BID, which added 2.2 points, followed by LPB with nearly 1.7 points, VCB with almost 1 point, MBB with nearly 0.9 points, and HDB with over 0.8 points. The top 10 positive contributors brought in nearly 9.6 points, close to the index’s gain.

| Top stocks influencing the VN-Index on August 12 |

Despite the market’s advance to a new milestone, foreign investors continued to offload holdings, with net sell orders totaling over 715 billion VND today. The most sold stocks were FPT, with net sell orders of more than 171 billion VND, followed by VHM with over 155 billion VND, SSI with nearly 125 billion VND, and HPG with almost 119 billion VND.

On the buying side, VPB topped with net buy orders of over 103 billion VND, followed by STB with nearly 84 billion VND.

| Foreign investors continued to net sell |

Morning Session: Quick Adjustment, Pillars Strive to Hold Ground

VN-Index experienced continuous fluctuations and twice encountered difficulties when approaching the 1,608-point threshold, only to quickly reverse and dip into negative territory. Amid these challenges, many pillar stocks strived to hold their ground.

Source: VietstockFinance

|

At the morning close, the VN-Index took a brief “lunch break” at 1,596.54, down 0.32 points. Meanwhile, the HNX-Index lost 2.03 points to 274.43, while the UPCoM-Index climbed 0.47 points to 109.72.

Compared to the initial green dominance, the market gradually turned red toward the end of the morning session. Overall, 408 stocks declined, including 5 at the lower limit, while 353 stocks advanced, with 20 hitting the ceiling price.

All capitalization groups retreated, with Large Cap down 0.04%, Mid Cap down 0.06%, Small Cap down 0.01%, and Micro Cap down 0.04%. However, the VN-Index only dipped slightly below the reference line thanks to the support of pillar stocks, as evidenced by the VN30-Index‘s 0.09% gain, or 1.56 points.

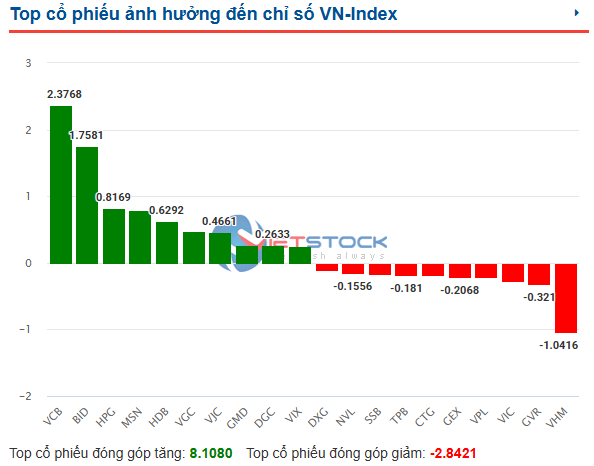

The top 10 stocks influencing the VN-Index reflected this dynamic, with VCB contributing nearly 2.4 points, BID adding almost 1.8 points, HPG gaining over 0.8 points, MSN contributing nearly 0.8 points, and HDB climbing over 0.6 points. In total, the top 10 positive contributors brought in more than 8.1 points to the index, while the top 10 negative contributors took away over 2.8 points.

Source: VietstockFinance

|

Market liquidity reached over 24.3 trillion VND, with HOSE accounting for nearly 22.3 trillion VND, a decrease compared to the recent average.

Foreign investors also scaled back their trading activities compared to previous sessions, with net sell orders totaling over 699 billion VND. The most sold stocks were FPT, with nearly 88 billion VND, and SSI, with over 83 billion VND.

10:30 AM: Real Estate Sector Weighs Down, Market Fluctuates

After an initial euphoric phase, the market showed signs of cooling as red hues spread to large-cap sectors, especially real estate.

Source: VietstockFinance

|

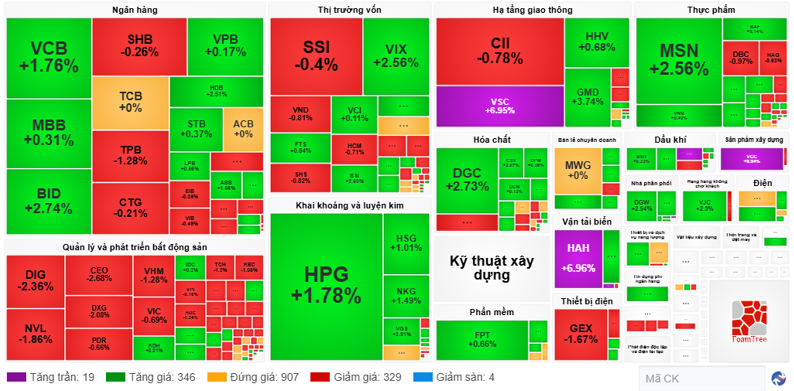

As of 10:30 AM, the market had 365 gaining stocks, including 19 at the ceiling price, but also 333 declining stocks, with 4 at the floor price. The remaining 907 stocks were unchanged. Market liquidity exceeded 15.6 trillion VND, a decrease compared to recent sessions.

In terms of index performance, the VN-Index narrowed its gain to 5.86 points, reaching 1,602.72, while the UPCoM-Index rose 0.15 points to 109.4. The HNX-Index remained in negative territory, down 0.72 points to 275.74.

Looking at the market map, red hues spread to large-cap sectors, notably banks, securities, and especially real estate.

In the banking sector, although VCB rose 1.76%, BID climbed 2.74%, HDB advanced 2.51%, and MBB gained 0.31%, many other stocks declined, including TPB, down 1.28%; CTG, down 0.21%; and SHB, down 0.26%. At that time, the banking sector was up 0.71%.

In the securities sector, SSI fell 0.4%, VND dropped 0.81%, SHS slid 0.82%, and HCM lost 0.71%. The gains in VIX (up 2.56%), VCI (up 0.11%), and FTS (up 0.84%) only helped the sector advance 0.47%.

The real estate sector faced the most significant pressure, with red hues spreading across the sector map. DIG fell 2.36%, NVL dropped 1.86%, CEO declined 2.68%, DXG slid 2.08%, PDR lost 0.65%, and notably, the duo of VHM (down 1.28%) and VIC (down 0.69%) weighed down the sector. At that time, the real estate sector was down 0.67%, ranking second in terms of losses.

On a positive note, many large-cap stocks in other sectors continued to support the market, notably HPG, up 1.78%; MSN, up 2.56%; and FPT, up 0.66%. Additionally, some stocks stood out with their ceiling prices, such as VSC and HAH.

|

Real Estate Sector Weakens and Puts Pressure on the Index

Source: VietstockFinance

|

9:30 AM: Euphoric Opening Thanks to Large Caps

VN-Index started the session on August 12 on a euphoric note, quickly surging 9.64 points in the first 30 minutes to reach the 1,606.5 level. This momentum was driven by large-cap stocks.

Similarly, the UPCoM-Index rose 0.48 points to 109.73. The HNX-Index was an exception, falling 0.62 points to 275.84 due to pressure from SHS and CEO…

Source: VietstockFinance

|

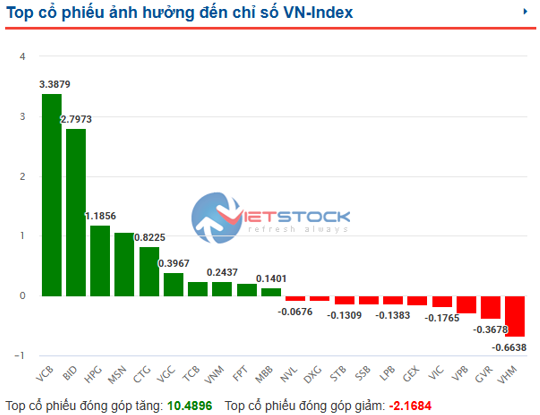

The top 10 stocks positively influencing the VN-Index included VCB, which contributed nearly 3.4 points, followed by BID with almost 2.8 points and HPG with approximately 1.2 points, indicating significant momentum from large-cap stocks.

Source: VietstockFinance

|

Market Beat on August 11th: Failing to Conquer the 1,600-Point Threshold.

The market closed with strong gains, as the VN-Index rose by 11.91 points (+0.75%), finishing at 1,596.86. The HNX-Index also climbed 4 points (+1.47%), ending the day at 276.46. It was a bullish day for the market, with 505 advancing stocks outpacing 297 declining ones. The VN30, a basket of Vietnam’s 30 largest stocks, mirrored this sentiment, as 21 stocks advanced against 9 declines.

The Ever-Changing Market: Strategies for Investors to Stay Ahead of the Curve

Contrary to expectations of a potential steep correction at the peak, the VN-Index has been consistently reaching new highs, leaving many investors scrambling to keep up.

Are Penny Stocks Worth the Risk Amid Market Volatility?

The VN-Index, after hitting a historic peak, is expected to face profit-taking pressures and experience further volatility. Experts advise investors to focus on stocks with strong fundamentals and robust earnings growth. While “speculative” stocks may surge, they carry the risk of a steep decline once the market enthusiasm wanes.

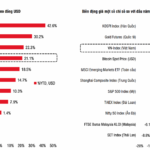

“A Plethora of Policies Support Vietnam’s Stock Market Surge to All-Time Highs”

The government and regulatory policies are fueling a new impetus, ushering in a prospective growth cycle for the stock market. With an aim to attract high-quality domestic and foreign capital, these policies are poised to foster the development of businesses and the economy alike.