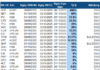

The Vietnamese stock market was recently stirred by a rare event as HLO, the stock of Ha Lo Technology Joint Stock Company, surged by an astonishing 40% in a single trading session. This dramatic rise equates to approximately seven years of bank savings, based on current interest rates. At the closing bell on August 11, 2025, HLO’s market price stood at 21,000 VND per share.

This unprecedented surge in HLO’s stock price can be attributed to the Regulations on the Organization and Management of the Unlisted Public Company Market at the Hanoi Stock Exchange (HNX), as stipulated in Decision No. 236 dated April 24, 2015, by the HNX General Director. According to these regulations, for stocks on the UPCoM that have not witnessed any trading activity for 25 consecutive sessions, the price fluctuation band on the first day of resumed trading is set at ±40% from the reference price.

Prior to this dramatic surge, HLO had experienced a prolonged period of stagnant trading activity. The last recorded transaction involving this stock occurred over a month ago, on June 30, 2025, when it witnessed an 11% decline to 15,000 VND with 1,500 shares traded.

Ha Lo Technology Joint Stock Company was established on October 16, 2014, with an initial investment capital of 10 billion VND and four founding shareholders. The company’s primary business activity is wholesale trading of unspecified products, encompassing export and import rights, and wholesale distribution of products such as metal surface treatment chemicals and industrial plastic resins. They also provide consulting and technical management services for electroplating, technology transfer for electroplating processes, manufacturing of machinery and equipment for technological systems, water filtration systems, emission control systems, and wastewater treatment systems. Additionally, they produce iron, steel, copper, and stainless steel hanging hooks.

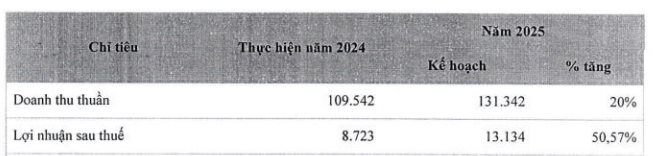

In terms of financial performance, HLO recorded a net revenue of 109 billion VND in 2024, reflecting an 8% increase compared to the previous year. After accounting for various expenses, the company reported a post-tax profit of over 8.7 billion VND, marking a significant 61% rise from 2023.

For the year 2025, HLO has set ambitious targets, aiming for a net revenue of 131 billion VND and a post-tax profit of 13.1 billion VND, representing increases of 20% and 51%, respectively, from the previous year. To achieve these goals, the company’s leadership has outlined a strategy that involves leveraging existing strengths and resources, enhancing product quality and customer service, and expanding their market reach to neighboring provinces. They also plan to maintain attractive customer incentive policies, tailor support for clients based on their actual conditions, and devise effective marketing plans and business solutions to boost the performance of their business segments.

To navigate market fluctuations and mitigate potential risks, HLO plans to closely monitor market trends and periodically evaluate their performance. They will also focus on cost control and make investment decisions based on practical needs while staying vigilant for favorable market conditions.

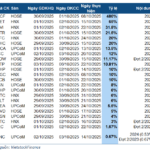

“Generous Cash Dividend Announcement: Nam Tan Uyen Shares 60% with Investors”

“Nam Tan Uyen plans to dish out nearly VND 144 billion in dividends for its shareholders, amounting to a generous 60% dividend payout ratio for the fiscal year 2024. Mark your calendars, as the registration deadline for this lucrative opportunity is set for August 25, 2025, with payments being made a month later on September 25, 2025. Don’t miss out on this chance to reap the rewards of your investments!”

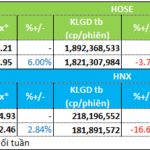

The Flow of Capital: Navigating the New Uptrend in the VN-Index

After a week of adjustments and corrections from July 28 to August 1, the Vietnamese stock market entered a new phase of growth in the week of August 4–8. However, the money flow exhibited a strong differentiation, even within individual sectors.

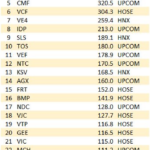

F88 Makes a Splashy Debut, Soaring to a High of 888,800 VND per Share

On August 8, 2025, over 8.26 million shares of F88 Investment Joint Stock Company (F88) were officially listed on the UPCoM exchange.