The State Securities Commission (SSC) recently announced a series of administrative sanctions for violations in the securities field.

Specifically, on August 8, the SSC issued Decision No. 186/QD-XPHC, fining EIP Industrial Park Development Investment Company VND 92.5 million ($3,909) for failing to disclose information as required by law.

The company did not send the following documents to the Hanoi Stock Exchange (HNX): Report on the implementation of commitments made by the issuing organization to bondholders in 2022, Periodic Report No. 4 for 2022 on the use of proceeds from bond issuances that are still outstanding and audited by a qualified audit organization (reporting deadline: March 31, 2023), Audited Semi-annual Report for 2023 on the use of proceeds from bond issuances, and Audited Annual Report for 2023 on the use of proceeds from bond issuances.

Also, on August 8, the SSC issued Decision No. 190/QD-XPHC, fining CVS Holdings Joint Stock Company VND 85 million ($3,603) for failing to disclose information as prescribed by law.

The company did not disclose the following information to HNX: Semi-annual and Annual Financial Statements for 2024; Report on the implementation of commitments made by the issuing organization to bondholders in 2023, Semi-annual 2024, and 2024; Audited Semi-annual and Annual Reports for 2023, Semi-annual 2024, and 2024 on the use of proceeds from bond issuances; Semi-annual and Annual Reports for 2024 on interest and principal payments for bonds; Semi-annual and Annual Reports for 2024 on principal and interest payments for CVSCH2225001 bonds at maturity.

Earlier, on August 7, the SSC issued Decision No. 184/QD-XPHC, fining a company based in Nha Trang VND 85 million ($3,603) for failing to disclose information as required by law.

Specifically, the company did not send the following documents to HNX: Report on the implementation of commitments made by the issuing organization to bondholders in 2022, Periodic Report for 2022 on the use of proceeds from bond issuances that are still outstanding and audited by a qualified audit organization (reporting deadline: March 31, 2023); The company sent the following periodic disclosure documents to HNX after the prescribed deadline: Semi-annual Financial Statements for 2022; Semi-annual Report for 2022 on the use of proceeds from bond issuances; Semi-annual Report for 2022 on interest and principal payments for bonds.

Also, on August 7, the SSC issued Decision No. 183/QD-XPHC, fining Danh Viet Trading and Services Joint Stock Company VND 92.5 million ($3,909) for failing to disclose information as required by law.

Specifically, Danh Viet Trading and Services JSC did not send the following documents to HNX: Report on the implementation of commitments made by the issuing organization to bondholders in 2022, Semi-annual Report for 2023 on the implementation of commitments, Audited Annual Report for 2023 on the use of proceeds from bond issuances, Audited Semi-annual Report for 2024 on the use of proceeds from bond issuances, Annual Financial Statements for 2024, Annual Report for 2024 on principal and interest payments, Report on the implementation of commitments made by the issuing organization for 2024; The company sent the following periodic disclosure document to HNX after the prescribed deadline: Audited Semi-annual Report for 2023 on the use of proceeds from bond issuances.

According to the periodic financial statements for the first six months of 2024, Danh Viet Trading and Services JSC reported a post-tax loss of nearly VND 49 billion, while in the same period last year, the company made a profit of over VND 500 million.

As of the end of the second quarter of 2024, the company’s equity was approximately VND 1,009 billion. Total liabilities were recorded at VND 3,047 billion, of which bond debt accounted for VND 1,534 billion.

On the same day, the SSC issued Decision No. 182/QD-XPHC, fining Tan Hoan Cau Ben Tre Joint Stock Company VND 92.5 million ($3,909) for failing to disclose information as required by law.

The company did not send the following documents to HNX: Report on the use of capital for 2020, Report on interest and principal payments for bonds for 2020, Financial Statements for 2020, Periodic Report for 2022 on the use of proceeds from bond issuances that are still outstanding and audited by a qualified audit organization, Semi-annual Report for 2023, Semi-annual and Annual Report for 2024, and Financial Statements for 2024. The company sent the following disclosure documents to HNX after the prescribed deadline: Disclosure of early bond repurchase for codes BTCCH2133002 and THCBTH2032002; Semi-annual Financial Statements for 2023 and 2024; Semi-annual and Annual Reports for 2023 and 2024 on the implementation of commitments made by the issuing organization; Semi-annual and Annual Reports for 2023 and 2024 on interest and principal payments for bonds; Disclosure of Administrative Sanction Decision No. 155/QD-XPHC dated June 7, 2023; Resolutions of bondholders of THCBTH2032002, THCBTH2032001, BTCCH2133001, and BTCCH2133002; Amendments to the terms and conditions of THCBTH2032002, THCBTH2032001, BTCCH2133001, and BTCCH2133002 bonds; Extension of the maturity period, adjustment of the periodic bond repurchase schedule, and amendments to certain terms and conditions of THCBTH2032002, THCBTH2032001, BTCCH2133001, and BTCCH2133002 bonds; Resolutions of bondholders of THCBTH2032002 and THCBTH2032001 regarding interest rates.

According to the latest periodic financial statements, Tan Hoan Cau Ben Tre JSC reported a net loss of over VND 21 billion in the first half of 2024, an improvement from the loss of over VND 177 billion in the same period last year.

As of June 30, 2024, the company’s equity was recorded at nearly VND 1,823 billion. Total liabilities as of the same date were nearly VND 4,977 billion, of which bond debt accounted for more than VND 2,200 billion.

“HAGL Faces Sanctions for Failing to Disclose Bond-Related Information”

HAG failed to disclose information on the HNX system regarding the following documents: Report on the usage of proceeds from bond issuance for bonds with outstanding debts audited by qualified auditors in 2023 and 2024, as well as the semi-annual report for 2024.

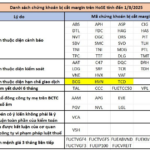

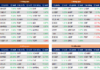

HOSE Updates August Margin Cuts: 62 Tickers Including HAG, NVL, LDG, BCG, and HVN Make the No-Margin List.

“As per the new regulations, investors will no longer be able to utilize the margin credit facility provided by brokerage firms to purchase these 62 specific stocks. This means that investors will have to rely on their own funds or other sources of financing if they wish to invest in these particular securities.”

Unveiling the Unlawful: 42 Houses Built Without Permission, Developer Vanishes.

The Khang Thi neighborhood project is strategically located on the main road in the heart of Vinh Long province. With 42 townhouses illegally built on agricultural land, the project initially faced legal troubles. However, instead of criminal prosecution, local authorities opted for procedural solutions, allowing the project to continue. The current challenge lies in the absence of the investor’s representative from the area, creating a roadblock in the already complex situation.

The New Proposal for Penalties Regarding Electronic Invoicing

The Vietnam Chamber of Commerce and Industry (VCCI) has proposed that businesses should not be penalized for violations regarding the new e-invoice regulations. This proposal comes in light of the challenges and confusion many businesses face when transitioning to the new electronic invoicing system, especially those who are less tech-savvy.