Since the end of July, shares of NAF, the leading dragon fruit exporter in Asia, have witnessed a remarkable surge. In less than two weeks, the NAF share price climbed by approximately 30%, approaching its historical peak achieved in August 2021. Consequently, the market capitalization of the company rose to nearly VND 1,600 billion.

This upward momentum in the stock price followed the company’s disclosure of its robust second-quarter financial results. During this period, NAF posted remarkable figures, with a revenue of over VND 680 billion, reflecting a 54% increase compared to the same period last year and marking the highest level since its establishment. This growth was driven by a surge in all product categories, including dragon fruit, crispy jackfruit, and pitahaya, among others.

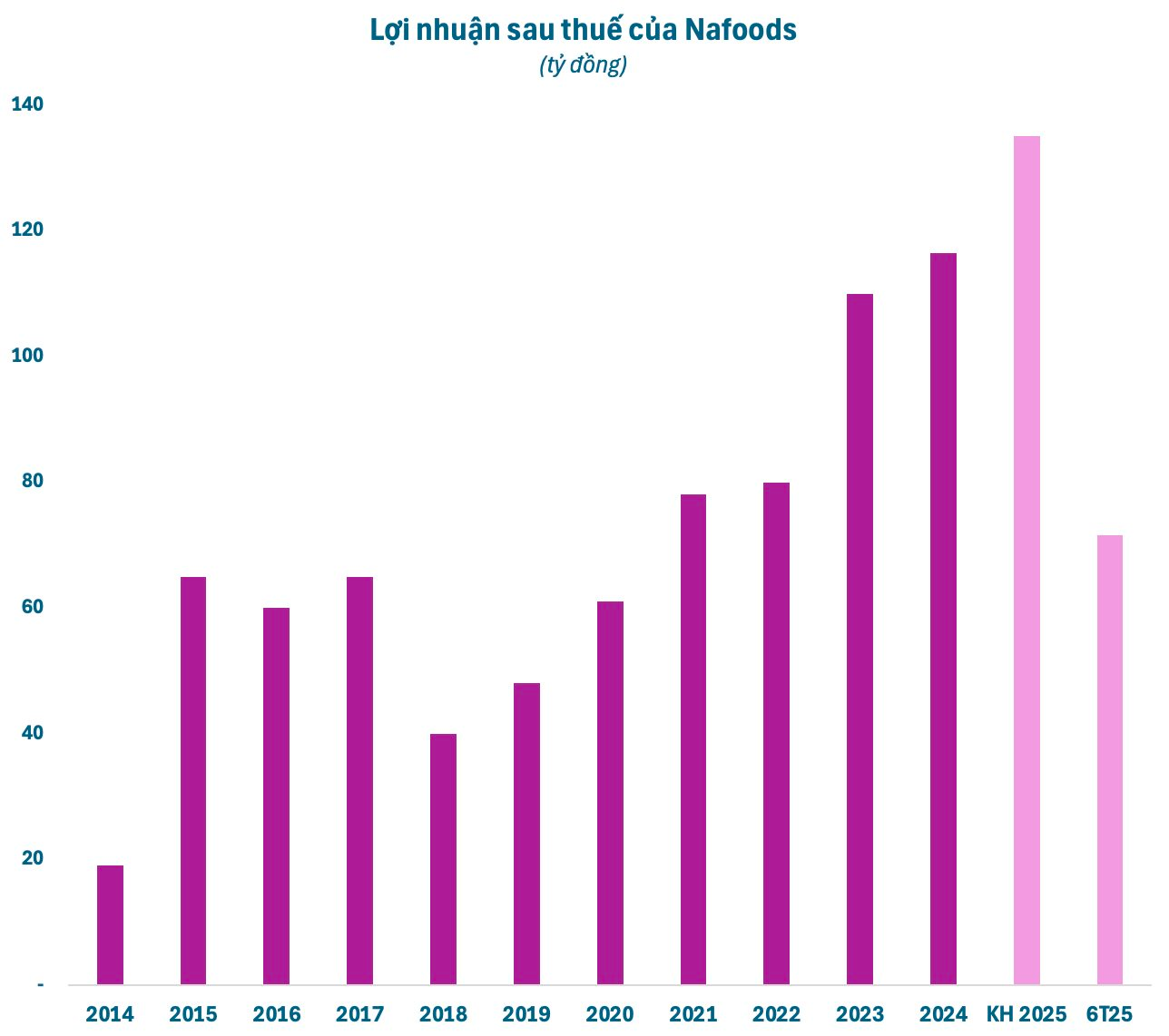

After deducting the cost of goods sold and expenses, NAF’s second-quarter profit after tax reached VND 58.7 billion, an increase of nearly 15% year-over-year, setting a new record since the company’s inception.

For the first six months of the year, NAF recorded a consolidated revenue of nearly VND 1,030 billion and a profit after tax of VND 71.6 billion, representing a 37% and 12% year-over-year increase, respectively. With these impressive results, the company has achieved nearly 52% of its annual revenue target and 53% of its profit after tax goal for the full year.

NAF is renowned for being the top exporter of dragon fruit in Asia, accounting for 10% of the global supply. In addition to dragon fruit, the company also leverages its expertise in tropical fruits such as pitahaya, mango, pineapple, coconut, and papaya, offering a diverse range of products like dried fruits, concentrated fruit juices, and frozen fruits.

NAF’s products have successfully penetrated markets with stringent quality, quarantine, and food safety standards, including the United States, South Korea, China, Australia, France, Germany, the Netherlands, and Switzerland.

In a recent analysis report, Agribank Securities (Agriseco) predicted that NAF would enter a new growth phase, with 2025 marking a pivotal year for the company’s retail expansion, backed by:

1. Its sustainable competitive advantages

2. Plans for factory expansion and increased capacity in 2025-2026

3. The anticipated recovery in demand from key markets

According to Agriseco, NAF possesses a unique advantage with its factories strategically located in key raw material regions across the country, optimizing its supply chain. The company is deeply integrated into the value chain, with the capability to supply dragon fruit purple cultivars. Their diverse product portfolio, derived from these raw materials, has been exported to over 70 countries. NAF’s sustainable operating model enables the company to expand both vertically and horizontally within the value chain.

During the second quarter, NAF held a groundbreaking ceremony for the second phase of its Nasoco factory project in Tay Ninh province (formerly Long An). This project is expected not only to enhance the company’s capacity for deep processing of key industrial products, such as concentrated juices, purees, and IQF for the international market but also to open up opportunities for developing new product lines that cater to domestic and demanding international markets like Europe, North America, Japan, and South Korea.

In a related development, on June 30, 2025, NAF signed a contract to secure a USD 6 million secured loan from ResponsAbility Investments AG (RIAG), a reputable Swiss investment fund focusing on sustainable impact investing in emerging and developing markets.

“The receipt of investments from reputable international financial institutions like RIAG, IFC, and Finnfund, all of which prioritize sustainable development, underscores Nafoods’ credibility, transparent governance, robust financial health, and commitment to long-term sustainable growth. This also testifies to the company’s potential for long-term growth and its ability to positively impact the environment and community,” stated NAF in its press release.

“Record-breaking Revenue and Profits: Nafoods Commences Construction of NASOCO Phase 2”

Nafoods Group (HOSE: NAF) has reported record-breaking revenue and profits for the second quarter of 2025 and the first half of the year. Along with this impressive financial performance, the company is also embarking on an expansion journey with the second phase of the Nasoco project, positioning itself to capitalize on future growth opportunities.

“Samland Joins UPCoM on August 15th”

The Hanoi Stock Exchange (HNX) has announced that nearly 78.6 million SLD shares of Samland Corporation will commence trading on the UPCoM exchange from August 15, 2025, with a reference price of VND 9,400 per share.

“IDP Appoints New CEO Amidst Record Losses and Plummeting Stock Prices”

In a bid to turn around its fortunes, International Dairy Products Joint-Stock Company (IDP) has appointed Doan Huu Nguyen as its new CEO and legal representative. This move comes after the company reported a net loss of over VND 36 billion in Q2 2025, marking the first time it has fallen into the red in its history. Nguyen replaces Bui Hoang Sang, who took on the role just over a year ago.

The Big Pay Out: Industrial Real Estate Giant Declares 60% Cash Dividend After Robust Q2 Profits

With approximately 24 million shares outstanding, the company requires nearly VND 144 billion to pay dividends to shareholders.