The VN-Index closed at 1,596.8 points at the end of the 11-8 session.

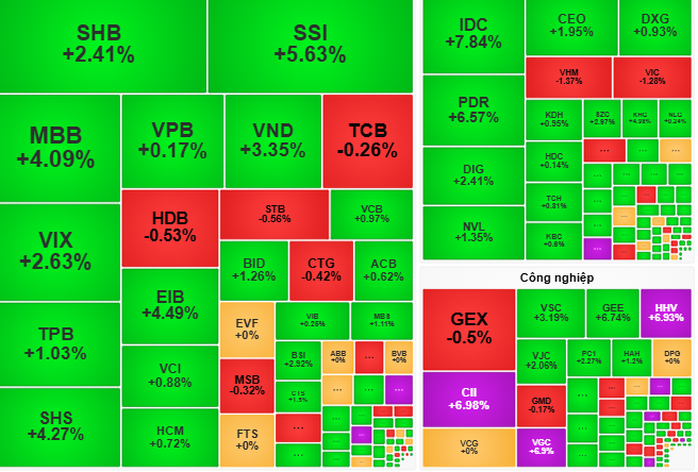

On August 11, the Vietnamese stock market opened with the VN-Index rising 6 points from the reference level, maintaining a stable upward trend. From the middle of the morning session, strong buying pressure emerged in large-cap stocks such as MSN, GVR, FPT, and banks (notably MBB and ACB), propelling the index to swiftly surpass the 1,600-point threshold. Investment and real estate groups (CII, HHV, DIG, PDR, and NVL) also witnessed positive cash flow.

In the afternoon session, the VN-Index’s upward momentum slightly eased due to profit-taking activities in some large-cap stocks in the banking and Vingroup sectors (VIC, VHM, etc.). However, towards the latter half of the session, buying pressure balanced out again thanks to a strong surge in certain tickers like SSI (up 5.63%), along with renewed cash flow in consumer and securities stocks. Consequently, the VN-Index managed to hold above the 1,595-point level. Market liquidity remained robust, surpassing VND 45,000 billion.

At the close, the VN-Index ended at 1,596.8 points, gaining nearly 12 points, equivalent to a 0.75% increase.

VCBS, the Securities Company of the Foreign Trade Bank, noted that active cash flow on August 11 showed signs of decreasing compared to previous sessions, even though the VN-Index briefly surpassed the 1,600-point mark.

Following an extended bullish phase, the index now faces the risk of correction due to profit-taking in stocks that have witnessed sharp rallies. Consequently, VCBS recommends that investors closely monitor market movements, continue holding stocks in their portfolios, and practice disciplined buying only when the market fluctuates, refraining from chasing stocks at high prices.

According to Dragon Capital Securities Corporation (VDSC), as the advantage tilts towards stock demand, the market may reach new highs, targeting the resistance levels of 1,620 points and 1,650 points in the coming period, interspersed with mild ups and downs.

“Investors can anticipate the market to extend its rally, but they should closely observe supply and demand dynamics and consider short-term profit-taking in stocks that have surged to resistance levels. When buying, investors should refrain from chasing stocks with high prices and instead focus on accumulating stocks with stable price increases,” VDSC advised.

“VPBank’s Expert Insight: VN-Index Enters a ‘Mega Uptrend,’ with a Prolonged Growth Tsunami Ahead.”

The market remains highly positive in the short term, bolstered by an incredibly robust flow of capital. Experts attribute this momentum to a confluence of factors, including favorable economic conditions and confident investors. This surge in liquidity has injected a sense of optimism into the market, with participants eagerly anticipating sustained growth.

Stock Market Conquest: Breaking the 1,600-Point Barrier

The VN-Index successfully surpassed the 1,600-point threshold despite facing strong volatility during the trading session. However, the emergence of long-shadow candles with fluctuating volumes in recent sessions indicates investor indecision. At present, the Stochastic Oscillator continues to climb deeper into overbought territory. Technical fluctuations are likely to persist in the short term as the index ventures into new highs.

Last Chance to Vote for the IR Awards 2025: Investors, Get Ready to Win a Whirlpool Dishwasher and a Xiaomi Robot Vacuum!

The IR Awards 2025 public voting is in its final stages, with just two days left to cast your votes before the polls close at 24:00 on August 14, 2025.