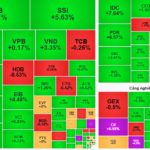

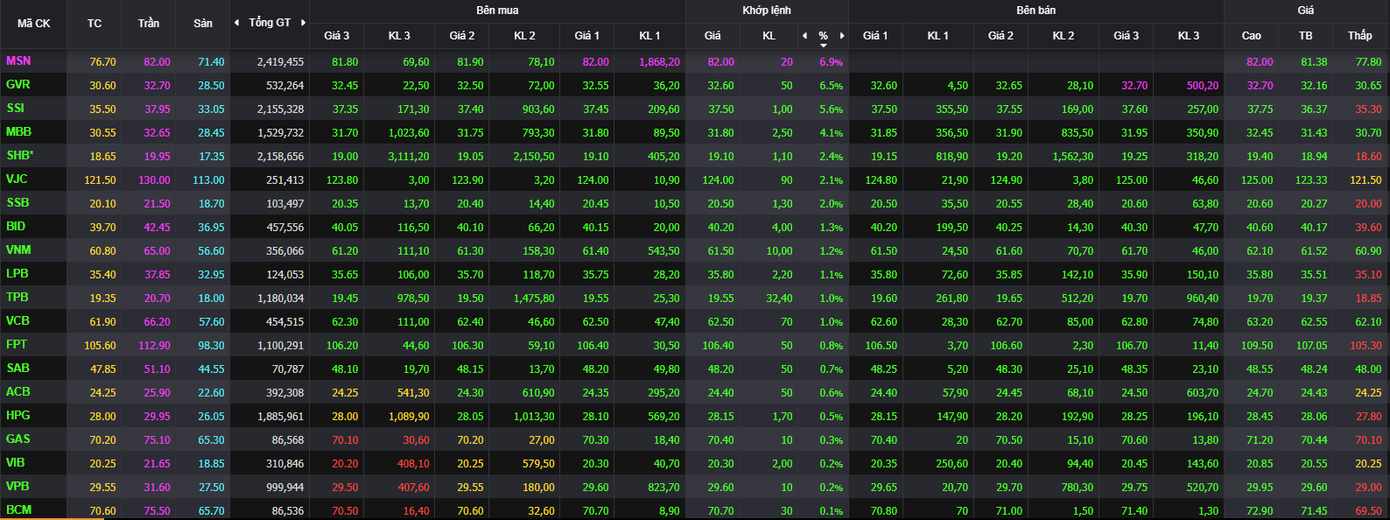

The VN30 group was awash with green, led by MSN‘s remarkable breakthrough to the ceiling price of 82,000 VND per share, making it the most significant contributor to the index. MSN’s liquidity also soared to over 2,400 billion VND, the highest on the exchange. Foreign investors net bought MSN with a value of nearly 90 billion VND.

Thanks to MSN’s impressive performance, the wealth of billionaire Nguyen Dang Quang, Chairman of the Board of Directors of Masan Group, increased by about 75 million USD, reaching 1.2 billion USD according to Forbes data, ranking 2,799th globally. Mr. Quang currently holds nearly 446.3 million MSN shares (31.19% of charter capital), along with significant shares in Techcombank (TCB) and Masan Consumer (MCH).

MSN hits the ceiling price, and GVR closes near it.

Apart from MSN, the market supporters included GVR, MBB, VCB, and SSI, each contributing over one point. SSI took the lead in the securities group’s gains and was the industry’s most traded stock, with over 2,155 billion VND in value, ranking third on the exchange, after MSN and SHB.

The “king” stocks of the banking group, including MBB, SHB, VCB, BID, LPB, and TPB, witnessed price increases. SHB is about to finalize the list of shareholders who will receive a 13% stock dividend on August 19, 2024. SHB will distribute 2024 dividends at a 13% ratio by issuing 528.5 million shares, raising its charter capital to over 45,942 billion VND. Previously, the bank had completed the first 2024 cash dividend payment at a 5% rate.

Real estate continued to attract capital flows, with IDC, PDR, DIG, and NVL appreciating. In contrast, the Vingroup cluster, comprising VHM and VIC, dragged the index lower as both stocks cooled off after a strong rally and entered a technical correction phase. VRE also witnessed a slight decline.

At the close of the trading session, the VN-Index climbed 11.91 points (+0.75%) to 1,596.86 points. The HNX-Index rose 1.47% to 276.46 points, while the UPCoM-Index gained 0.65% to reach 109.25 points.

Liquidity was maintained at a high level, with over 51,000 billion VND invested, equivalent to nearly 1.9 billion shares changing hands. Foreign investors continued to net sell over 652 billion VND but recorded net buying in several pillar stocks.

Stock Market Outlook for Tomorrow, August 12: Avoid Buying Stocks at High Prices

Despite the surge in stock prices, leading brokerage firms are urging investors to refrain from chasing stocks at these elevated levels. The recommendation is to exercise caution and avoid buying at these highs to mitigate potential risks.

“VPBank’s Expert Insight: VN-Index Enters a ‘Mega Uptrend,’ with a Prolonged Growth Tsunami Ahead.”

The market remains highly positive in the short term, bolstered by an incredibly robust flow of capital. Experts attribute this momentum to a confluence of factors, including favorable economic conditions and confident investors. This surge in liquidity has injected a sense of optimism into the market, with participants eagerly anticipating sustained growth.

Stock Market Conquest: Breaking the 1,600-Point Barrier

The VN-Index successfully surpassed the 1,600-point threshold despite facing strong volatility during the trading session. However, the emergence of long-shadow candles with fluctuating volumes in recent sessions indicates investor indecision. At present, the Stochastic Oscillator continues to climb deeper into overbought territory. Technical fluctuations are likely to persist in the short term as the index ventures into new highs.

What Stocks Should You Watch in August?

SSI Research maintains an optimistic forecast for 2025, anticipating a 13.8% year-over-year growth in post-tax profits, which translates to a substantial 15.5% increase in the latter half of the year.