The two sons of Mr. Nguyen Xuan Quang, Chairman of Nam Long Investment Corporation (NLG), have reported their recent transactions involving NLG shares.

According to the report, Mr. Nguyen Hiep and Mr. Nguyen Nam each purchased 500,000 NLG shares out of the planned acquisition of 1 million shares.

The transactions were executed through a matching method from July 10 to August 8. The reason for the partial completion of the transaction was due to unexpected market fluctuations.

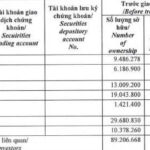

As a result of these transactions, Mr. Nguyen Nam’s holdings increased from 2.18 million shares (0.57%) to 2.68 million shares (0.7%). Mr. Nguyen Hiep’s ownership also rose from 2.85 million shares (0.74%) to 3.35 million shares (0.87%).

Mr. Nguyen Xuan Quang, Chairman of Nam Long

On the other hand, Dragon Capital has made a move to surf NLG shares shortly after regaining its position as a major shareholder in Nam Long on August 1.

Dragon Capital, through two member funds, sold a total of 850,000 NLG shares in the session on August 6. Norges Bank sold 350,000 shares, while Amersham Industries Limited offloaded 500,000 shares.

Following these transactions, Dragon Capital’s ownership decreased from 19.59 million shares (5.08%) to 18.74 million shares (4.86%), causing it to exit its position as a major shareholder in Nam Long.

Recently, Nam Long witnessed a change in its shareholder structure as Ibeworth Pte. Ltd. (a subsidiary of Keppel Land) fully divested its stake. The new investor, Fiera Capital (UK) Limited, a Canadian investment fund, purchased 10 million NLG shares, increasing its ownership to 5.71%. The transaction date that led to this change in ownership ratio was July 25, 2025.

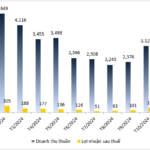

In terms of business performance, according to the consolidated financial statements for the second quarter of 2025, Nam Long recorded a gross revenue of VND 773 billion, triple the figure from the same period last year. After deducting the cost of goods sold, gross profit increased by 158% to VND 332 billion.

During this period, NLG’s financial income plummeted by 83% to just over VND 43 billion. Profit from joint ventures and associates also halved to over VND 20 billion. In contrast, selling expenses surged by 185% to VND 121 billion.

Consequently, Nam Long reported a post-tax profit of VND 97.5 billion, a 39% decrease compared to the previous year. NLG attributed the difference in profit sources between the two periods, with the second quarter of 2025’s profits mainly derived from real estate and apartment sales, while the previous year’s profits were primarily from financial activities.

For the first six months of 2025, Nam Long achieved impressive results, with a gross revenue of VND 2,064 billion and a post-tax profit of VND 207 billion, representing a fourfold and threefold increase, respectively, compared to the same period in 2024. This outstanding performance was largely driven by the strong results in the first quarter of the year.

Looking ahead to the full year 2025, Nam Long aims to attain a gross revenue of VND 6,794 billion and a post-tax profit of VND 701 billion. With the results achieved in the first half of the year, the company has accomplished 30.4% of its revenue target and 29.6% of its profit goal.

“The Appointment of a New Leader: Mr. Lê Anh Tuấn Takes the Helm as CEO of a Billion-Dollar Foreign Fund”

Dragon Capital Vietnam Fund Management JSC (DCVFM) is pleased to announce the appointment of Dr. Le Anh Tuan as its new Chief Executive Officer, effective October 1st, 2025.

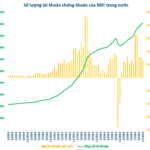

The Stock Market Shakes: New Account Openings Hit 5-Month Low

As of the end of November, there were close to 9.1 million domestic individual investor accounts, equivalent to approximately 9% of the population. This highlights a significant portion of individuals actively engaging in the country’s financial landscape.