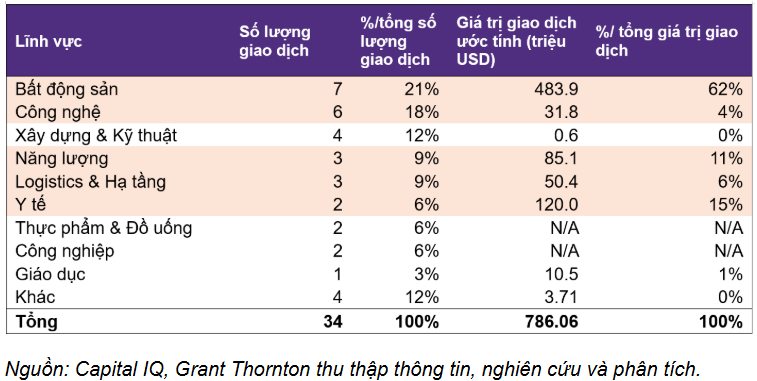

The first half of 2025, and particularly July, witnessed a robust recovery in M&A activities in the real estate sector after a period of stagnation. This recovery was primarily driven by positive signals from the macroeconomic environment, which bolstered the market’s absorption capacity for real estate products. The new Land Law, which came into effect in August 2024, also contributed to this rebound by enhancing transparency and fostering growth.

In tandem with the growth in real estate, the logistics, infrastructure, construction, and engineering sectors thrived, benefiting from expanded trade flows, infrastructure upgrade projects, and public-private partnerships.

Meanwhile, healthcare, energy, and technology continued to attract strong interest from both domestic and foreign investors. These sectors have been consistently hot in recent years, with July 2025 witnessing stable transaction activities as investors sought opportunities aligned with long-term consumer trends, a shift towards clean energy, and digital transformation.

|

M&A Deals in Vietnam in July 2025

|

Specifically, in the real estate sector, Vinaconex Group (HOSE: VCG) completed the sale of 70% of its shares in Vinaconex ITC (UPCoM: VCR), the investor of the Cat Ba Amatina tourism-urban project (172 ha, Hai Phong), to three domestic investors: Hanoi An Pha (23.06%), Imperia An Phu (24.1%), and Silver Field International Business JSC (22.5%).

The transaction was conducted through a private placement, and the value was not disclosed. However, based on the VCR share price at the time of valuation, the estimated value for 70% of the shares ranges from $250 to $300 million. Following this deal, Vinaconex still holds 24.5% of the shares but is expected to divest entirely in the future.

In another notable deal, UOA Vietnam Pte. Ltd., a subsidiary of United Overseas Australia Ltd (UOA Group), acquired 100% of VIAS Hong Ngoc Bao JSC for $68 million. The target company owns the development rights to a prime 2,000 sq. m land plot in the old District 1, Ho Chi Minh City, where it plans to construct a commercial office building with approximately 20,000 sq. m of floor space. This acquisition gives UOA Vietnam full control over this asset and strategically expands its real estate portfolio in Vietnam.

In the technology sector, GS Microelectronics (GSME), a North America-based corporation, acquired Sinble Technology Vietnam, the Vietnamese branch of a Singaporean startup specializing in chip design. This acquisition enhances GSME’s design capabilities for TSMC’s advanced semiconductor technologies, particularly in high-performance computing (HPC) and AI applications. It also expands the company’s technical presence in Asia and improves its global customer service capabilities.

Hay AI, a Vietnamese AI platform focused on the question-answering segment, raised $10 million in a Series A round led by Argor Capital, bringing its total funding to over $18 million. The new capital will be utilized to expand its super-localization AI toolkit to serve 100 million Vietnamese, aiming to deliver smarter, more localized, and user-friendly digital experiences.

OKXE Vietnam, an e-commerce platform for motorbikes, also secured $14.5 million in funding from Kwangju Bank, JB Financial Group, and The Invention Lab. These funds will be used to expand its store network in Hanoi and Ho Chi Minh City and implement AI initiatives in pricing, vehicle inspection, after-sales services, and insurance, aligning with OKXE’s strategy to become the leading digital platform for two-wheelers in Southeast Asia.

In the logistics and infrastructure sector, VETC, Vietnam’s leading operator of non-stop toll collection systems (ETC), received a $19.2 million investment from the International Finance Corporation (IFC) in the form of a 5-year convertible bond with a 5% annual interest rate. These funds will be utilized to expand VETC’s ETC network, upgrade intelligent transportation infrastructure, and develop a cashless payment platform.

Currently, VETC, a subsidiary of Tasco Group, operates 133 toll stations, accounting for approximately 75% of the national market share. Additionally, the parent company will contribute an additional $19.2 million in equity to foster growth.

In the education sector, Vietnamese education technology company Galaxy Education raised nearly $10 million in a funding round led by East Ventures, along with other investors. Galaxy operates well-known platforms such as HOCMAI and FUNiX, serving over eight million learners in Vietnam and 34 other countries. Having achieved positive EBITDA since April 2024, Galaxy intends to utilize the new capital to accelerate the nationwide implementation of its AI-powered English language program, targeting under-resourced public schools to address teacher shortages and enhance the quality of education.

In the healthcare sector, Dale Investment Holdings, a Singapore-based company affiliated with Quadria Capital (Asia’s largest healthcare-focused PE fund), acquired 73.15% of Tam Tri Medical JSC, a private hospital chain in Vietnam. The transaction included a 37.8% stake purchased from Vietnam Opportunity Fund (VOF) of VinaCapital, with the remaining shares acquired from other shareholders. While the transaction value was not disclosed, based on the information that VOF’s investment accounted for approximately 5.5% of its NAV as of April 2025, valued at around $51 million, the total deal value is estimated to be in the range of $100-120 million, consistent with Dale Investment Holdings’ typical investment size.

Lastly, in the energy sector, EnQuest PLC (UK) finalized the acquisition of Harbour Energy’s Vietnam business, including a 53.13% interest in the producing Chim Sao and Dua oil fields offshore Vung Tau, for $85.1 million. Leveraging its expertise in managing assets in the later stages of their life cycle, EnQuest plans to extend the development area and optimize operations to prolong the production of these fields beyond November 2030.

– 15:44 12/08/2025

Introducing the New Toll Plaza: HCMC – Long Thanh Expressway, Operational from August 19th.

From August 19, the Vietnam Expressway Services Engineering Joint Stock Company (VEC) will implement toll collection for the use of the Hochiminh City – Long Thanh – Dau Giay Expressway at the toll station located at Vanh Dai 3 intersection. The toll rates will range from VND 9,000 to VND 413,000 per trip, depending on the vehicle type and distance traveled.

A Proposal to Deregulate 16 Restricted Business Sectors

“In a recent communication to the Ministry of Finance, the Vietnam Chamber of Commerce and Industry (VCCI) proposed the abolition of conditions for 16 business sectors. This bold suggestion aims to foster a more dynamic and inclusive business environment, unleashing the potential of Vietnam’s diverse economic landscape.”

The Thriving World of Listed Real Estate Ventures: Buying and Selling Projects

In the first seven months of 2025, there was a notable buzz in the real estate sector, with a flurry of mergers and acquisitions among listed companies. The varied nature and scope of these transactions reflected a clear trend of portfolio restructuring as businesses navigated a market that was regaining its vibrancy.

Prime Real Estate Auction: 100sqm Lot Reaches 7.7 Billion VND, Almost Quadruple the Reserve Price

The auction of 18 land plots in the residential area south of Tran Hung Dao Street, in Dong Hoi ward, was a resounding success, generating nearly VND86 billion. The auction witnessed an enthusiastic response, with winning bids for several plots reaching twice to 2.7 times the starting price, and in one exceptional case, a plot was secured for nearly four times the reserve price.