|

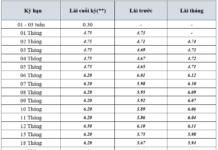

Bond issuance plunges after a shocking surge in June (Unit: VND billion)

Source: Author’s compilation based on HNX data as of August 11, 2025

|

In July, enterprises issued approximately VND 31.4 trillion in face value, down 22% from the same period in 2024 and 17% lower than July 2023.

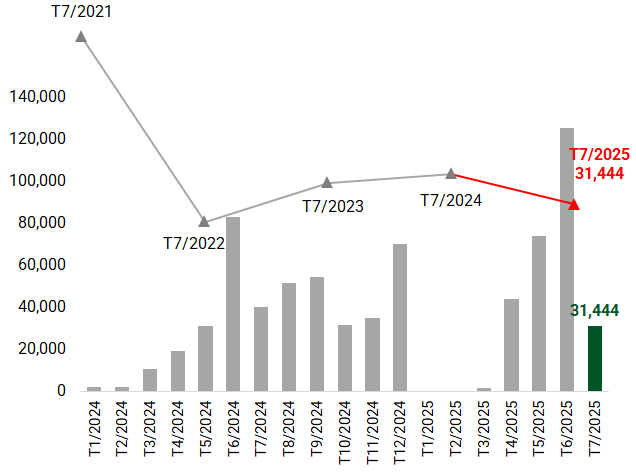

Banks continued to dominate, contributing 70% of the total value, equivalent to VND 22 trillion. However, notable big players such as Techcombank, TPBank, VietinBank, and VPBank did not participate in this round.

OCB led the market with 3 issuances totaling VND 5.3 trillion, a 3-year term, and an interest rate of 5.35-5.4%/year, bringing its total capital raised since the beginning of the year to about VND 16.2 trillion.

Ranking second was MBB with 6 issuances worth VND 2.65 trillion, an 8-10 year term, and an interest rate of 6.38%-6.48%/year, pushing its 2025 total to VND 18 trillion. BIDV added another VND 2.15 trillion, bringing its total to nearly VND 20 trillion.

Several other banks, including ACB, MSB, SHB, and Nam Á Bank, also participated. Notably, Agribank stood out with the largest issuance of the month, valued at VND 7.52 trillion, with a 2-year term and an interest rate of 5.2%/year. After just 3 rounds, this state-owned bank has raised VND 12.5 trillion.

|

Banks were less enthusiastic about capital raising in July

Source: Author’s compilation

|

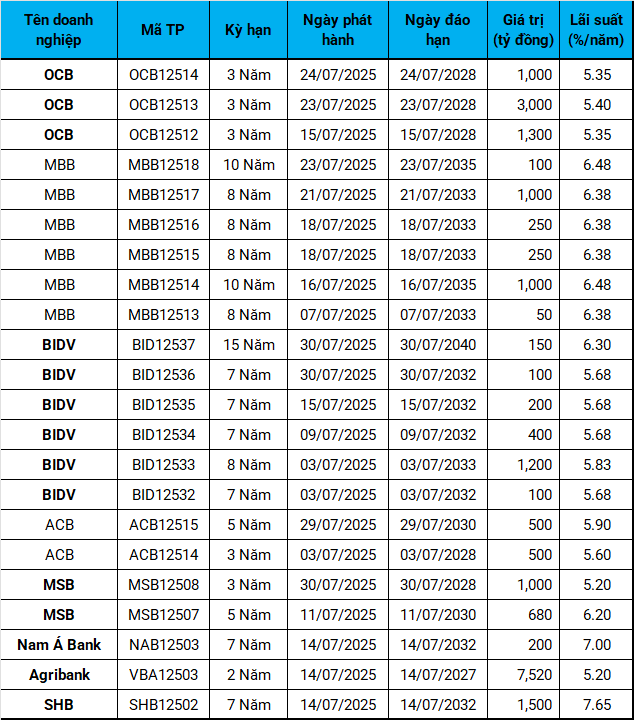

Consumer finance was subdued, with EVF returning after 3 years

Aside from banks, other financial sectors also witnessed limited activity.

In consumer finance, F88 Business Joint Stock Company consistently issued bonds with a VND 100 billion lot, maturing in 1 year, and an interest rate of 10%/year. This was the fourth consecutive month, bringing the total raised capital to VND 350 billion. The interest rate of 10%/year was also lower than the previous rounds’ 10.5%/year.

Electricity Finance Joint Stock Company (HOSE: EVF) attracted attention by returning to the market after more than 3 years of absence, issuing a VND 215 billion lot with a 3-year term and a 7%/year interest rate.

Dragon Vietnam Securities Joint Stock Company (HOSE: VDS) was the only securities firm. The company raised an additional VND 800 billion with a fixed interest rate of 8%/year. In total, VDS has mobilized nearly VND 2 trillion so far.

|

The non-bank financial group was also subdued

Source: Author’s compilation

|

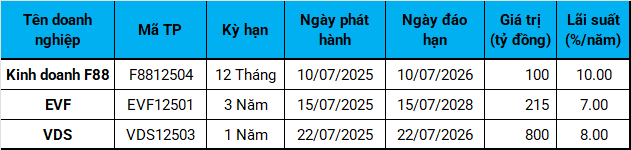

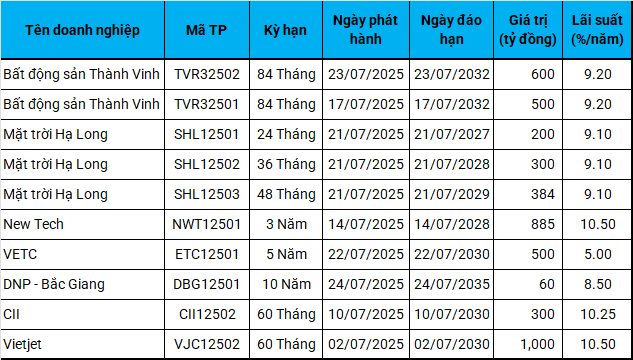

Real estate was also lackluster

Other sectors performed equally subdued. In real estate, the market witnessed a newcomer, Thanh Vinh Real Estate Investment Joint Stock Company, which raised VND 1.1 trillion through 2 lots with a term of up to 7 years and an interest rate of 9.2%/year. This enterprise was once 90% owned by HANO-VID Real Estate when it was first established.

Mặt trời Hạ Long, the investor of Ha Long Ocean Park, collected VND 884 billion through 3 lots in one day, with a term of 2-4 years and an interest rate of 9.1%/year. New Tech Investment and Construction Joint Stock Company—which was recently acquired by Van Phu Investment Joint Stock Company (HOSE: VPI)—issued VND 885 billion in 3 years, with an interest rate of 10.5%/year, to implement a commercial apartment project in District 7, Ho Chi Minh City (former name).

Aside from real estate, Vietjet Aviation Joint Stock Company (HOSE: VJC) added VND 1 trillion through a 5-year bond with an interest rate of 10.5%/year, bringing its total capital raised in 2025 to VND 2 trillion. Ho Chi Minh City Technical Infrastructure Investment Joint Stock Company (HOSE: CII) completed the second lot worth VND 300 billion, with the same 5-year term and an interest rate of 10.25%/year, bringing the total to VND 500 billion.

In the transport infrastructure sector, VETC—the unit in charge of Tasco’s (HNX: HUT) non-stop toll collection segment—received VND 500 billion from IFC (a member of the World Bank) through convertible bonds with a 5-year term and an interest rate of 5%/year.

In the water supply industry, DNP – Bac Giang Water Infrastructure Investment Joint Stock Company, a member of DNP Holding (HNX: DNP), issued a VND 60 billion lot with a 10-year term and an interest rate of 8.5%/year.

|

July saw the absence of familiar names like Vingroup and VinFast

Source: Author’s compilation

|

– 13:00, August 12, 2025

The Vietnam M&A Market: A Busy July with 34 Deals Closed

According to data from Grant Thornton, July 2025 saw a total of 34 M&A deals completed in Vietnam, with an impressive estimated value of $786 million. The top 5 sectors leading in terms of deal activity and value were Real Estate, Technology, Energy, Logistics & Infrastructure, and Healthcare.

The Thriving World of Listed Real Estate Ventures: Buying and Selling Projects

In the first seven months of 2025, there was a notable buzz in the real estate sector, with a flurry of mergers and acquisitions among listed companies. The varied nature and scope of these transactions reflected a clear trend of portfolio restructuring as businesses navigated a market that was regaining its vibrancy.

Prime Real Estate Auction: 100sqm Lot Reaches 7.7 Billion VND, Almost Quadruple the Reserve Price

The auction of 18 land plots in the residential area south of Tran Hung Dao Street, in Dong Hoi ward, was a resounding success, generating nearly VND86 billion. The auction witnessed an enthusiastic response, with winning bids for several plots reaching twice to 2.7 times the starting price, and in one exceptional case, a plot was secured for nearly four times the reserve price.

“North Ninh Authorities Request Police Intervention Regarding Illegal Real Estate Transactions”

The Bac Ninh Department of Construction has requested the coordination of the Public Security Agency to verify, prevent and handle the act of posting inaccurate information with signs of profiting from buying and selling, mobilizing capital, and attracting people to participate in real estate transactions when they are not eligible as prescribed.