At the National Assembly’s thematic supervision forum on socio-economic development on August 6, Dr. Tran Du Lich, a veteran expert in finance and budgeting, drew a thought-provoking analogy about Vietnam’s real estate market:

“Currently, the market is like an airplane that only has business and first-class cabins, with no economy class.” Can an economy where middle and low-income earners cannot dream of owning a home be sustainable?

He warned that land prices are rising too rapidly, outpacing the affordability of the majority of the population. The real estate bubble continues to grow, this time fueled not only by speculation but also by a fiscal policy heavily reliant on land-related revenues.

Soaring Land Revenue

Never before has the state budget been so flush with land-related revenues as it is today. In just the first six months of 2025, land-related revenues reached VND 243,644 billion, equivalent to 96% of the full-year estimate and a more than 2.6-fold increase compared to the same period in 2024. This unprecedented surge in land revenues stands as the most remarkable highlight in this year’s fiscal performance.

This windfall is not only benefiting the central government but also trickling down to numerous provinces and cities. Nghe An province, for instance, garnered VND 10,270 billion from land, accounting for a substantial 66% of its total local budget revenues of VND 15,553 billion. Da Nang city also exceeded its plan, collecting VND 4,000 billion from land, contributing to a total revenue of over VND 31,599 billion for the first seven months, well surpassing the full-year target of VND 30,000 billion.

The budget “pie” this year has grown larger thanks to the surge in land revenues across localities. Photo: Hoang Ha

|

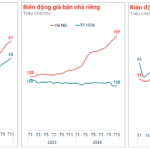

Hanoi and Ho Chi Minh City, the country’s economic powerhouses, have also been at the forefront of land revenue generation. Hanoi collected VND 86,751 billion from land and properties in the first half, marking a staggering 539% increase compared to the previous year; with land use fees alone accounting for approximately VND 74,000 billion, a more than 600% surge. Ho Chi Minh City also raked in over VND 65,000 billion from land, achieving 90.7% of its annual plan within just six months.

On the surface, the fiscal picture appears bright. However, a crucial question looms: where is this substantial “land rent” coming from, and who will ultimately bear the cost?

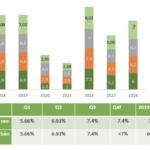

Budget Surplus at a Record High

For the first seven months, the state budget revenue stood at VND 1,577,500 billion, reflecting a 27.8% increase compared to the same period in 2024—the highest growth rate in the last four years. In 2024, the seven-month budget revenue reached VND 1,188,100 billion, equivalent to 69.8% of the annual estimate, and a 14.6% increase from 2023. Prior to that, 2023 witnessed a 7.8% decline compared to 2022.

The stellar performance in 2025 is not only evident in the magnitude of revenue but also in the pace: with over 80% of the annual plan accomplished within seven months, the budget is on track to “reach the finish line” ahead of schedule, a rare feat.

This success is partly attributed to enhanced tax administration, expedited public investment disbursement, and the recovery of production and exports. However, the data also reveals that the primary source of this surge is land-related revenues, propelled by soaring land prices and vigorous auction activities.

Every square meter of land sold at a “market-aligned” price—essentially, a price inflated by speculation—contributes to the state coffers, but it also burdens businesses and citizens. Housing, production, and living costs are all escalating.

Dr. Tran Du Lich cautioned that the conversion of agricultural land for project auctions has pushed land prices beyond the economy’s capacity to bear. When incomes fail to keep pace with land prices, instability becomes inevitable.

Do Surging Revenues Reflect Economic Robustness?

While the impressive budget figures cannot be denied, neither can the sobering reality: during the first seven months of this year, 144,400 businesses exited the market—an average of 20,600 closures per month, a 15.1% increase compared to the same period last year. The total tax arrears and other payable amounts have climbed to nearly VND 240,000 billion, vividly illustrating the challenges faced by the production and business sector.

The surge in land revenues has endowed the state with additional resources for healthcare, education, and welfare—a positive development. Nonetheless, if the budget relies too heavily on “land rent,” it becomes a short-sighted and risky strategy. High land prices lead to elevated housing, service, and business operation costs, ultimately resulting in reduced investment and weakened competitiveness.

A more significant risk lies in the potential bottleneck in the real estate market: depleted purchasing power, a land price bubble, supply-demand imbalances, and capital outflows once prices hit their ceiling.

The warning about an “airplane without an economy class” underscores the implications of an economy that excludes middle and low-income earners from homeownership. Such an economy fosters inequality and lacks sustainability. When businesses are compelled to exit the market due to high land costs, the sustainability of budget revenues is jeopardized.

Towards a Sustainable Budget Strategy

It is high time to reconsider: as budget revenues increase, are the economy and its citizens genuinely thriving in tandem?

We need a budget strategy anchored in tangible production, investment, and consumption, rather than land prices. We require a land policy that incentivizes development instead of merely extracting land rent. And we need a healthy real estate market where most citizens can afford economy-class homes, and businesses can access land for production and operations, rather than gazing at the business cabin from the ground.

Tu Giang

– 05:30 12/08/2025

The Great Property Inventory Surge: Navigating the Market’s Imbalance

In the second quarter of this year, real estate businesses witnessed a significant surge in their inventory levels. The primary culprit behind this phenomenon was the mismatch between the offerings of various projects and the actual demands of both end-users and investors. This discrepancy occurred amidst a market desperately yearning for affordable options.

The Expert’s Paradox: When Supply Increases, Prices Should Decrease, But Not in This Case.

Mr. Nguyen Van Dinh, Vice President of the Vietnam Real Estate Association, shared his insights on the country’s real estate market. He noted that it is unlikely for property prices to decrease and that there are indications of rising prices. Interestingly, he pointed out a contradiction where an improvement in supply should, in theory, lead to lower selling prices. However, in the current market, supply is increasing, but prices remain high.