The Gia Nghĩa – Chơn Thành Expressway project is approximately 124 km long and passes through Lâm Đồng and Đồng Nai provinces, with over 101 km in Đồng Nai.

The project is invested by a consortium of Vingroup Joint Stock Company and Techtra Infrastructure Investment and Development Joint Stock Company. The total investment capital for the project is VND 19,965 billion, including more than VND 12,100 billion mobilized by the investor (excluding VND 989 billion in loan interest) and over VND 6,840 billion in state capital.

According to the plan, the expressway will have six lanes and a designed speed of 120 km/h. In the first phase, the expressway will have four completed lanes.

Gia Nghĩa – Chơn Thành Expressway Illustration

The Gia Nghĩa – Chơn Thành Expressway consists of five component projects, with land clearance separated as a standalone project. Currently, component project 5 (compensation, support, and resettlement) in Đồng Nai province is being expedited to pave the way for the construction of the investment project (valued at VND 19,965 billion) to commence on August 19, 2025.

According to the approved project adjustment decision, component project 5 has a total investment of nearly VND 4,000 billion.

According to the Đồng Nai Province Project Management Authority, to construct the expressway, Đồng Nai will carry out land retrieval, compensation, and clearance of over 1,000 hectares of land, affecting more than 2,100 households and organizations.

Preliminary statistics indicate that over 1,000 households in the project area are eligible for resettlement. To resettle these households, Đồng Nai province will build six resettlement areas in Bù Đăng, Đồng Tâm, Tân Lợi, Bình Phước, and Chơn Thành wards.

The total area of the resettlement areas serving the project is over 26 hectares, and the expected number of resettlement land lots in these areas is over 990.

As of early August 2025, the provincial authorities had issued land retrieval notices for over 2,100 out of 3,700 plots of land in the project implementation area.

It is known that after issuing the land retrieval notice, the authorities conducted an inventory of houses, structures, and crops on the land.

In the future, when completed, the Gia Nghĩa – Chơn Thành Expressway will hold significant importance in connecting localities, expanding development space, and creating new momentum for the entire region.

At the same time, the project will reduce travel time, lower logistics costs, boost trade, and attract investment.

A Closer Look at Hanoi’s Most Complex Interchange Project

The Tan Van Interchange, the most complex component of Ho Chi Minh City’s Ring Road 3, is currently under fast-paced construction. This vital transport link will serve as a critical connection point between Ho Chi Minh City and Dong Nai, facilitating smoother travel and trade between these important regions.

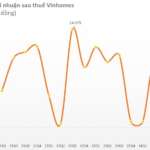

Unveiling the Mastery of Craftsmanship: Vinhomes’ Assets Surpass Half a Trillion Ahead of Vietnam’s Historic Stock Market Deal

For the nine-month period ended September 30, Vinhomes recorded a consolidated net revenue of VND 69,910 billion. The company’s consolidated after-tax profit stood at VND 20,600 billion.

The Long Wait: 14 Years and Counting for Hanoi’s Road Expansion Project

The expansion project for Nguyen Hoang Ton Street, stretching from the Tay Ho District Party Committee to Pham Van Dong Street, and passing through the districts of Tay Ho and Bac Tu Liem, was approved to commemorate the 1000th anniversary of Thang Long – Hanoi. However, nearly 15 years have passed, and the project remains stagnant, yet to be implemented.

High-Speed Handover: TP HCM – Moc Bai Expressway from April 2025

The estimated cost for compensation, support, and resettlement for the project’s Component 3, which covers the city, is 7,102 billion VND, an increase of 1,832 billion VND from the previous figure. This significant rise in expenditure underscores the project’s complexity and scope, requiring meticulous planning and execution to ensure a successful and seamless transition for those affected.