Following the list of Real Estate Companies, Securities Companies, and Insurance Companies, CafeF is proud to present the list of the Top 20 private banks with the largest budget contributions in Vietnam. This is part of the prestigious PRIVATE 100 and VNTAX 200 boards, which aim to honor the outstanding contributions of private banks to the state budget.

The banking industry has long been regarded as the most important pillar of Vietnam’s economy, not only through providing capital, creating jobs, and boosting economic growth but also through substantial budget contributions. Taxes and fees, including corporate income tax, personal income tax, VAT, and other taxes, are channeled into the national budget to support essential sectors such as education, healthcare, infrastructure, national defense, and social development projects.

Transparency and honesty in budget contributions not only strengthen trust from customers, shareholders, and the community but also affirm the credibility and position of banks in the market. These contributions are a testament to the banks’ sustainable business strategies, effective risk management, and long-term commitment to the country’s development.

The list of the Top 20 private banks with the largest budget contributions in Vietnam not only acknowledges the important role of banks in promoting economic development but also reflects their strong commitment to social responsibility and the sustainable development of the community.

The publication of this list also contributes to spreading the spirit of social responsibility, encouraging banks to continue contributing to the sustainable development of Vietnam.

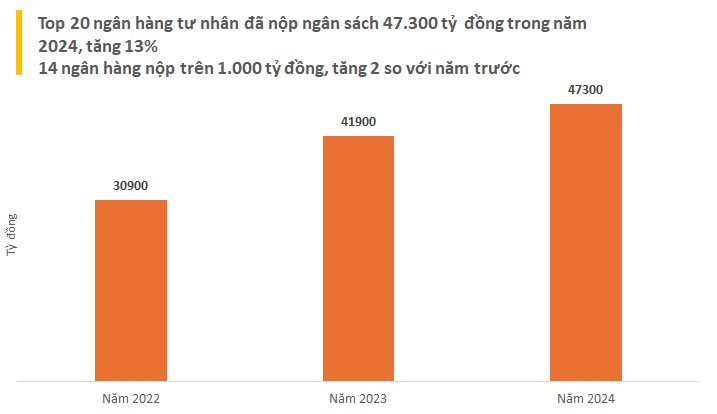

In 2024, the total budget contribution of the top 20 private banks exceeded VND 47,300 billion, an increase of over VND 5,400 billion (about 12.9%) compared to VND 41,900 billion in 2023, and one and a half times higher than the VND 30,900 billion in 2022. This growth occurred amidst positive economic growth in Vietnam, with flexible monetary policies and high credit demand, enabling banks to expand their operations and make significant contributions to the national budget.

The list of the Top 20 private banks with the largest budget contributions in Vietnam in 2024 is based on the actual contribution figures for the 2024 financial year.

Techcombank, for the third consecutive year, topped the list with a budget contribution of VND 6,775 billion last year. The bank’s leading scale and business results among private banks provide a solid foundation for Techcombank to maintain its high contribution to the state budget, second only to five state-owned commercial banks: Vietcombank, BIDV, Agribank, VietinBank, and MB.

With impressive business performance, HDBank contributed more than VND 6,000 billion to the budget last year, doubling its contribution from 2023. This propelled HDBank to become the second-highest budget contributor among private banks.

Along with Techcombank and HDBank, two other large private banks, VPBank and ACB, also contributed over VND 5,000 billion to the budget.

The group of banks contributing between VND 1,000 and 4,000 billion in 2024 includes other medium and large-sized private banks such as Sacombank, LPBank, VIB, SHB, TPBank, MSB, SeABank, Nam A Bank, OCB, and Eximbank.

In 2024, the Vietnamese banking industry faced challenges such as global financial fluctuations, inflationary pressures, and bad debt risks. However, thanks to the State Bank’s loose monetary policies, maintaining low operating interest rates, along with the strong recovery of the economy, banks seized the opportunity to expand credit, improve business efficiency, and enhance budget contributions.

Notably, many banks in the Top 10 recorded impressive budget contribution growth. HDBank, Sacombank, and LPBank stood out with increases of 101%, 80%, and 79.4%, respectively, compared to 2023.

However, some banks experienced a decrease in budget contributions compared to 2023, reflecting the challenges of maintaining growth in a volatile market. Nonetheless, these banks maintained their positions through robust risk management and significant investments in technology.

2024 witnessed a strong trend of digitization in the banking industry. Banks invested significantly in digital technology to enhance customer experience, reduce operating costs, and expand market share. Techcombank, TPBank, and VIB were pioneers in applying technology, offering innovative and convenient financial products.

Additionally, banks focused on bad debt handling, strengthened risk management, and complied with legal regulations. International cooperation and foreign investment attraction enabled banks to enhance their financial capacity, gain valuable experience, and access advanced technology, thereby improving their competitiveness in the regional and international markets.

The outlook for the Vietnamese banking industry in 2025 is positive, given the government’s determination to achieve economic growth of over 8%, flexible monetary policies, and high credit demand. Banks are expected to continue expanding credit, developing new financial products, and investing in technology to meet customers’ diverse needs.

However, challenges such as global financial market fluctuations, inflationary risks, and bad debt pressures require banks to maintain tight risk management. Enhancing asset quality, internal control, and legal compliance will be key to ensuring sustainable development.

CafeF Lists 2025 marks the return of two prestigious honor rolls:

PRIVATE 100 – Top private enterprises with budget contributions of VND 100 billion or more

VNTAX 200 – Top enterprises with budget contributions of VND 200 billion or more in the financial year

This list is compiled by CafeF from publicly available sources or verifiable data, reflecting the actual budget contributions of enterprises, including taxes, fees, and other payable amounts. The transparent compilation of public, accurate, and verifiable data not only acknowledges the financial contributions of enterprises but also spreads the spirit of social responsibility and affirms their position in the economy.

Some notable enterprises in the 2025 list, reflecting the actual contributions for the 2024 financial year, include Agribank, ACB, AIA, BIM Group, Coteccons, HDBank, LOF, Masan Group, MoMo, OCB, PNJ, Tasco, DOJI Group, Nam Long Group, TCBS, Techcombank, TPBank, Vingroup, VPBank, VNG Group, and VPS.

“Inspiring Businesses to Soar: The Made by Vietnam Forum Advantage.”

On August 8, 2025, at the Ho Chi Minh City Television Theater, the Plenary Session of the ‘Made by Vietnam’ event – honoring Vietnamese brands organized by Ho Chi Minh City Television – brought together leaders, experts, and enterprises to discuss solutions to help the business community thrive in this new era.

The Greener Industrial Park: Unveiling the $126 Million Transformation in Tay Ninh

On the morning of August 9, the People’s Committee of Tay Ninh Province inaugurated the Infrastructure Investment Project for Thu Thua Industrial Park. This is the first new industrial park project in Tay Ninh Province since the merger of Long An and Tay Ninh, marking an important step in the local industrial development strategy for the gateway connecting the Eastern and Western regions of Southern Vietnam.

Hue City Attracts Over VND 28,000 Billion in Investment

In the first seven months of 2025, the city of Hue attracted a total of VND 28 trillion in investment, with 35 new projects and a series of large-scale capital adjustment projects.