Global Capital on the Move

Amid fluctuations in global stock markets, particularly those heavily impacted by US President Donald Trump’s tariff policies, investors have witnessed a shift in global capital flow after a prolonged period of concentration in the US market. Data reveals that global investors are now restructuring their portfolios, with a notable shift towards net buying in Asian markets. Meanwhile, in the Vietnamese stock market, foreign investors have also started net buying again since July, with expectations for improvement in the coming months. Do these moves signal a potential shift in global capital towards emerging markets in the future?

At the Talk show Phố Tài chính (The Finance Street) on VTV8, Mr. Phung Minh Hoang, Director of Strategy at Phu Hung Asset Management (PHFM), shared his insights: “Firstly, let’s look back at the past five to six years. Global investment capital tended to flow out of emerging markets and back into developed markets, particularly the US. This was mainly due to the slowdown in China’s economic growth, the largest market in the emerging market basket, and the strengthening of the US dollar during those years. As a result, emerging stock markets underperformed compared to their developed counterparts.”

However, global investment flows are showing signs of reversal. We observe that foreign investors are tending to sell in developed markets like the US and return to emerging markets, especially China. This capital flow also tends to spill over to other emerging markets such as Taiwan, India, and other Southeast Asian countries. This trend has become more apparent in the last one to two months, following the preliminary trade agreements between China and Vietnam with the US. Major global financial institutions such as Goldman Sachs and JP Morgan have also recently upgraded their recommendations to increase investment allocations and hold positive views on emerging markets, including Vietnam.”

Mr. Phung Minh Hoang in discussion with host Mui Khanh Ly at the Finance Street Talk Show.

According to the Director of Strategy at PHFM, there are three main reasons for this structural shift in global equity investment flows:

Firstly, in terms of valuation, emerging markets currently have a projected P/E ratio of just over 12 times, significantly lower than the 19 times seen in developed markets.

Secondly, considering growth prospects, developed markets, specifically the US, face short-term economic uncertainties due to tariff policies imposed by President Donald Trump and declining expectations for profits of listed companies in the AI and technology sectors. As the market realizes that US dominance in these fields is challenged and faces strong competition from China, particularly after the launch of DeepSheek, this has impacted investment sentiments.

The third factor driving the strong shift in capital flow is the weakening of the US dollar, which has the most significant impact. The DXY index has fallen by over 10% in the first half of the year, the steepest drop in decades. As the dollar depreciates, investments and assets in the US also lose value when converted to other currencies. Consequently, major global investment funds have had to restructure their asset portfolios in the US, including selling US stocks to minimize this risk. Simultaneously, investors increase their purchases of assets in other countries, including emerging stock markets that offer more attractive valuations.

“With the aforementioned reasons, the drivers behind the net selling of assets in developed markets like the US and the shift towards emerging and frontier markets have structural implications and will likely persist in the medium term. Therefore, I believe that the trend of net selling US assets, including stocks, and shifting to other markets, particularly emerging and frontier stock markets, will continue in the foreseeable future.”

“However, the intensity of this trend depends largely on the unpredictable trade policies of the Trump administration, the outcomes of trade agreements between the US and emerging countries, and the ability of the US to reduce its budget deficit. These factors will influence the revaluation of the US dollar going forward,” added Mr. Phung Minh Hoang.

Foreign Investors Return to Vietnam’s Market

In Vietnam, a stronger foreign investment inflow was observed in July, positively impacting the market. According to Mr. Phung Minh Hoang, there are two prominent reasons for this trend. Firstly, Vietnam reached a preliminary trade agreement with the US on tariff rates. Secondly, the market anticipates that FTSE Russell will upgrade Vietnam to emerging market status in the year-end review or early next year. Additionally, Vietnam benefits from the global capital shift towards emerging markets.

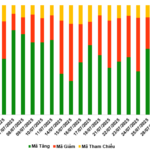

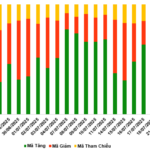

“Our observations indicate that foreign investment flows are primarily channeled through P-Notes (a derivative instrument issued by large financial institutions to foreign investors) of certain ETFs, with a focus on net buying liquid blue-chip stocks. This is an extremely positive signal, especially after periods of net foreign selling in previous years,” assessed Mr. Phung Minh Hoang.

Regarding the outlook for global capital inflows into the Vietnamese stock market, the Director of Strategy at PHFM shared, “Looking back at the statistics from the past five years, foreign investors have net sold approximately $5-6 billion in Vietnam’s stock market, a significant figure. In contrast, net buying in July reached only about $500 million, still modest. The trend of returning to emerging markets has just begun, so the Vietnamese stock market will continue to benefit from this momentum. Additionally, if FTSE upgrades Vietnam to emerging market status, it is estimated that we could attract an additional $2-3 billion.”

On long-term prospects, Mr. Phung Minh Hoang believes that the Vietnamese stock market remains attractive to foreign investors. The economy is in the early stages of a recovery and growth cycle, and the government is implementing unprecedented reforms. These include a strong focus on developing science and technology, promoting the private sector, and setting a target for double-digit growth. These policies will create a foundation for the country to enter a new era of progress, opening up numerous opportunities for domestic businesses to thrive.

“VPBank’s Expert Insight: VN-Index Enters a ‘Mega Uptrend,’ with a Prolonged Growth Tsunami Ahead.”

The market remains highly positive in the short term, bolstered by an incredibly robust flow of capital. Experts attribute this momentum to a confluence of factors, including favorable economic conditions and confident investors. This surge in liquidity has injected a sense of optimism into the market, with participants eagerly anticipating sustained growth.

How to Value Stocks of Securities Companies Ahead of TCBS’s IPO?

The brokerage stocks group is generally not a bargain basement, but there’s plenty of potential left and valuation is just one of the factors to consider when picking stocks.

Unlocking the Power of Language for TTC AgriS’ Investment Restructuring and Core Operations

TTC AgriS (HOSE: SBT) has announced plans to restructure its investment portfolio by divesting from two listed companies and four unlisted entities. This strategic move aims to sharpen the company’s focus on its core businesses.

![“The Ultimate Guide to Cross-Rate Calculations: Unlocking Accurate Tax Valuations [Infographic Included]”](https://xe.today/wp-content/uploads/2025/08/infographi-100x70.png)