VPBank’s Emotional Connection Strategy: A Marketing Masterstroke

In celebration of its 32nd anniversary (August 12, 1993 – August 12, 2025), Vietnam Prosperity Joint-Stock Commercial Bank (VPBank) created a financial market sensation with a grand-scale music festival featuring K-pop superstars, including the highly anticipated G-Dragon.

The momentous event, held at My Dinh with over 40,000 enthusiastic fans braving the rain, became a powerful brand statement for VPBank. It represented a comprehensive communication strategy, effectively harnessing the power of digital platforms, fan culture, and community emotions to engage their target audience, especially Millennials and Gen Z.

The VPBank K-star Spark concert was a strategic move by the bank

The concert provided existing customers with an enhanced brand experience, solidifying their emotional connection, trust, and loyalty to VPBank. Meanwhile, younger audiences were drawn to VPBank as a bridge to their idols, identifying with their style and lifestyle, gradually transforming initial curiosity into lasting brand affinity.

VPBank’s choice of G-Dragon went beyond a mere promotional campaign; it was a strategic move to reposition the bank’s image as youthful, modern, and global. G-Dragon embodies creativity, innovation, and individuality—values that VPBank embraces in its digital transformation journey and expansion into the youthful customer segment. This diverse approach has enabled VPBank to create a vibrant, engaging, and sustainable brand ecosystem.

Segmentation Strategy: Personalization for Differentiation

VPBank has long embraced a “segment-focused” strategy with a personalized, differentiated, and sustainable approach. For younger customers, there’s Prime; for the middle and upper-class segments, Diamond and Diamond Elite cater to their needs, and for the super VIP segment, VPBank offers Private. This strategy not only ensures effective customer engagement but also underscores the brand’s vision: putting customers at the heart and building long-term value.

VPBank’s “segment-focused” strategy puts customers at the heart of their brand

VPBank’s segmentation strategy goes beyond tailored financial products. The bank is committed to enhancing service quality and ensuring maximum customer satisfaction. As part of its 32nd anniversary celebrations, VPBank inaugurated a new flagship branch in Hanoi, marking a significant step in its comprehensive digital transformation journey and elevating the customer experience.

Additionally, VPBank expanded its focus on the business household customer segment, introducing CommCredit after over a decade of dedicated service through a separate channel.

By developing its brand across diverse segments, VPBank not only expands its market share but also forges deep and lasting connections with each customer group. Each segment represents a unique journey, and VPBank chooses to accompany, understand, and create value every step of the way.

32nd Anniversary: A Celebration of Gratitude

VPBank’s 32nd anniversary is also an occasion to express gratitude to millions of customers for their loyalty over the past 32 years. Known as a leading credit card issuer in Vietnam, VPBank has designed a credit card ecosystem centered around three main pillars: Shopping (Smart Shopping) – Travel (Experiential Travel) – Wellbeing (Self-Care and Development).

The bank tailors its credit card offerings to match diverse needs and lifestyles, crafting a comprehensive benefits map that enables customers not only to make convenient payments but also to fully embrace a modern and dynamic lifestyle.

VPBank’s 32nd anniversary brings a plethora of exciting offers

To commemorate its 32nd birthday, VPBank launched a range of exclusive credit card promotions. Specifically, VPBank is offering an iPhone 16 to the first 10 customers who spend at least 50 million VND using their VPBank Mastercard credit cards on August 15.

From now until December 31, 2025, customers can enjoy discounts of up to 50% or cashback of up to 1,500,000 VND when using VPBank credit cards for dining, e-commerce, electronics, travel, and more. Additionally, VPBank offers cashback of up to 50% on platforms like ShopeeFood, Be, and Grab.

For new credit cardholders who spend 3 million VND within the first 30 days, VPBank offers an Evoucher from Urbox worth up to 700,000 VND. Those who open a new VPBank YoJo Visa Platinum credit card and spend 2 million VND in the first 30 days will receive 5,500 Skypoint rewards points.

Furthermore, VPBank introduces a special program with a lowered maintenance threshold of 0 VND for customers participating in Super Profit on VPBank NEO. New customers will have this threshold automatically set to 0, and they can choose to activate and customize their preferred threshold directly on the VPBank Neo app. This program is offered in three batches, each lasting three days from Tuesday to Thursday, starting from August 12 to August 28, 2025.

VPBank also presents an attractive savings interest rate promotion for customers from now until August 21. For deposits of 32 million VND or more in flexible terms of one month or longer, customers named Việt, Nam, Thịnh, or Vượng, or those born on August 12 or in 1993, will enjoy an additional interest rate of 0.5%/year over the listed rate. For minimum balances of 100 million VND and terms of one month or longer, all customers will receive an additional 0.32%/year over the listed rate.

As VPBank turns 32, it not only marks a milestone but also signifies its readiness to soar to new heights. With a spirit of constant innovation, VPBank pledges to continue crafting exceptional financial experiences, accompanying customers on their life journeys, and empowering them to thrive.

For detailed information about VPBank’s 32nd-anniversary promotions, please visit: https://go.vpbank.com.vn/xin-chao-32

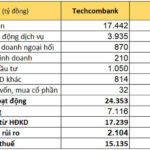

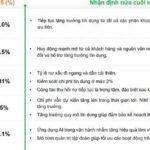

Why Techcombank’s Profitability Soars Despite Similar Asset Sizes with Other Banks

The diverse business strategies of Vietnam’s two largest private banks have led to a profit gap, despite their similar asset scales. With a focus on expanding their securities and insurance sectors, both banks aim to become the country’s leading financial groups.

“FE Credit Bounces Back: VPBank Confident in 2025 Plan as GPBank Turns a Profit”

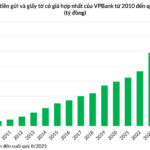

In the first half of 2025, VPBank recorded a consolidated profit of over VND 11,200 billion and successfully mobilized a record loan of $1.56 billion. Based on the results of the first half and the 4-pronged strategy, the leadership affirmed their confidence in achieving the set business goals for the year.

“VPBank Secures a Monumental $350 Million Agreement for Sustainable Growth.”

“VPBank joins forces with renowned global development institutions, SMBC, BII, EFA, FinDev Canada, and JICA, in a groundbreaking partnership. Together, they have secured a landmark loan, a pivotal step towards financing Vietnam’s sustainable and eco-friendly future. This collaboration marks a significant milestone in the country’s journey towards a greener tomorrow.”

“VPBank Secures $350 Million Loan to Boost Sustainability Efforts”

On July 29, 2025, VPBank (HOSE: VPB), one of the leading joint-stock commercial banks in Vietnam, announced the successful signing of a syndicated loan worth USD 350 million. This loan was made possible through a collaboration with Sumitomo Mitsui Banking Corporation (SMBC) and prominent development finance institutions (DFIs), including British International Investment (BII), Export Finance Australia (EFA), FinDev Canada, and the Japan International Cooperation Agency (JICA). SMBC acted as the coordinator and authorized co-lead arranger for this significant financing endeavor.