The Q2 2025 financial report of the Bao Viet Holdings Group (BVH) revealed a substantial financial investment portfolio of up to VND 241,914 billion as of June 30, 2025, an increase of VND 10,371 billion compared to the end of 2024, accounting for 91.6% of total assets.

Short-term financial investments stood at VND 116,615 billion, a rise of VND 12,717 billion or 12.2%, while long-term financial investments amounted to VND 125,299 billion, a slight decrease of VND 2,346 billion or 1.8%.

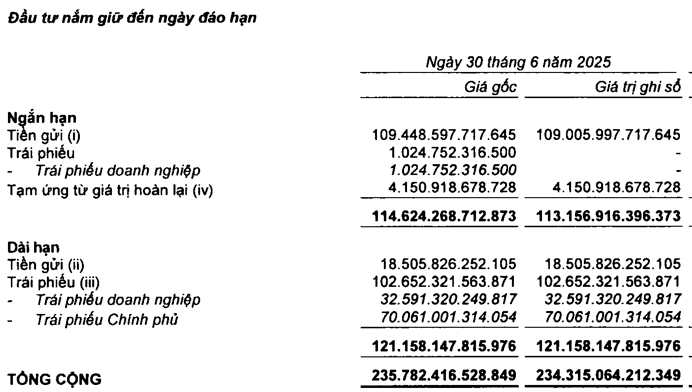

Delving into BVH’s investment portfolio, bank deposits constitute the largest portion. Specifically, as of June 30, BVH held nearly VND 127,512 billion in bank deposits, comprising VND 109,006 billion in short-term deposits and VND 18,506 billion in long-term deposits. This represents an increase of over VND 2,945 billion compared to the beginning of the year.

With this scale, BVH is currently the listed company with the largest amount of bank deposits on the stock exchange.

According to BVH, in addition to the overdue deposits at ALCII and VFC, the group has fixed-term deposits in Vietnamese dong at credit institutions with original terms of over 3 months, maturity of no more than 1 year, and interest rates of up to 9.0%/year. They also have fixed-term deposits in Vietnamese dong with maturities of over 1 year, earning interest rates ranging from 5.2% to 6.4%/year.

The second-largest component of BVH’s financial investment portfolio is bonds, totaling more than VND 102,652 billion, an increase of VND 7,364 billion or 7.7% compared to the beginning of the year. This includes VND 32,591 billion in corporate bonds and VND 70,061 billion in government bonds. The government bonds invested by the Group have terms ranging from 15 to 30 years, while the corporate bonds have terms of 7 to 10 years, with interest rates of up to 8.9%/year.

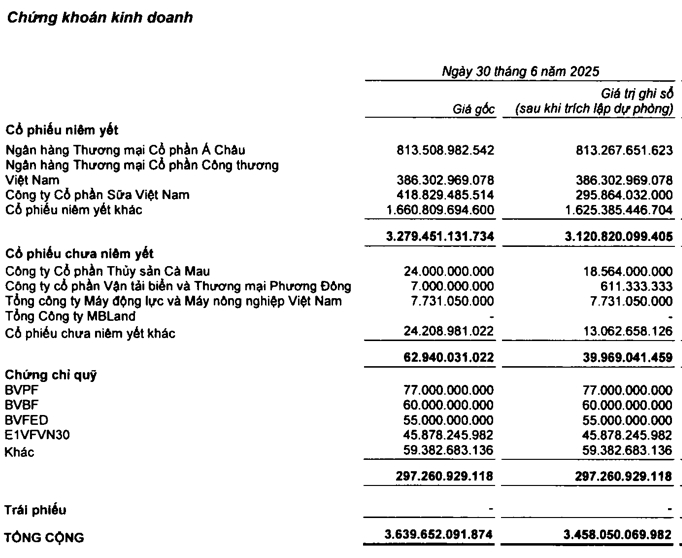

In addition to deposits and bonds, BVH also holds a significant amount of stocks and fund certificates, totaling VND 3,640 billion as of June 30, 2025. Listed stocks account for over 90% of this amount, amounting to VND 3,279 billion, an increase of more than 5% compared to the beginning of the year.

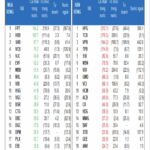

The listed stocks with the highest investment from BVH include ACB (VND 813 billion), CTG (VND 386 billion), and VNM (VND 419 billion). The unlisted stocks in BVH’s portfolio include Ca Mau Seafood Joint Stock Company, Oriental Maritime Transport and Trading Joint Stock Company, and Vietnam Engine and Agricultural Machinery Corporation, among others.

Moreover, Bao Viet also invests in joint ventures and associates such as BaoViet Bank (VND 1,560 billion), Trung Nam Phu Quoc (VND 431 billion), Tokio Marine Vietnam (VND 147 billion), PLT (VND 97 billion), Bao Viet SCIC (VND 70 billion), and Long Viet (over VND 29 billion) (values as of June 30, 2025).

Additionally, the Group has invested in CMC (VND 144 billion), International Steel Finance Project (VND 170 billion), SSG Group Joint Stock Company (VND 225 billion), and Vietnam Engine and Agricultural Machinery Corporation (VND 347 billion), among others.

With this extensive investment portfolio, BVH generated nearly VND 6,664 billion in revenue from financial activities in the first half of 2025. This includes interest income of over VND 3,463 billion, bond investment income of VND 2,540 billion, dividend income of nearly VND 157 billion, and investment and securities trading income of over VND 71 billion.

After expenses, BVH recorded a profit of VND 5,266 billion from financial activities, slightly lower than the VND 5,415 billion achieved in the same period last year.

However, thanks to the strong performance in the insurance business, with a gross profit of nearly VND 1,170 billion, BVH reported a consolidated after-tax profit increase of 31.5% compared to the same period in 2024, reaching VND 1,392 billion. For Q2 2025 alone, the Group’s after-tax profit was VND 705 billion, a growth of 60.7%.

The Soloist’s Sell-Off Symphony

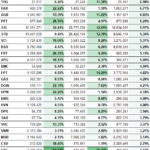

The proprietary trading arm was net sellers again today, offloading a total of VND637.3 billion, with VND215.8 billion in matched orders alone.

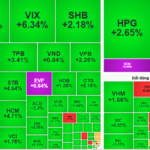

Stock Market Insights: Has the Tide Turned?

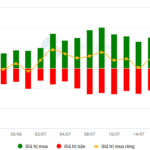

The VN-Index retreated, forming a Bearish Engulfing candlestick pattern as it encountered resistance at the psychological level of 1,500 points. This retreat indicates significant profit-taking pressure. Additionally, the Stochastic Oscillator has provided a sell signal within the overbought territory. Investors should exercise caution in the near term as a fall below this level could trigger increased short-term corrective pressure.

The Vietstock Daily: Record-Breaking Volumes Signal a Market Turnaround

The VN-Index plummeted over 64 points, accompanied by the emergence of a Black Marubozu candlestick pattern. Trading volume surged to a record high, and the number of declining stocks far outweighed those advancing, clearly reflecting the widespread panic and selling pressure across the market. As of now, the Stochastic Oscillator has given a fresh sell signal within the overbought region. Concurrently, the MACD is narrowing its gap with the Signal line, and the outlook will turn even more pessimistic if a sell signal is confirmed in the upcoming sessions.