Hoang Anh Gia Lai Joint Stock Company (HAG stock code) has just announced two transactions involving insider trading and related parties.

Bầu Đức Sells HAG Stock, Son Buys

According to the announcement, Mr. Doan Nguyen Duc (Bầu Đức), Chairman of Hoang Anh Gia Lai, registered to sell 25 million HAG shares through a negotiated deal from August 15 to September 13, aiming to restructure his ownership.

If the negotiation is successful, Bầu Đức’s ownership in HAG will decrease from 31.2% to 28.84%, reducing his holdings from 329,950,533 shares to 304,950,533 shares.

On the same day (August 12), Bầu Đức’s low-profile son, Doan Hoang Nam, registered to purchase 27 million HAG shares through either negotiated deals or matching orders on the exchange, during the period of August 15 to September 13, with the intention of increasing his ownership.

Bầu Đức invites shareholders to enjoy durian grown by the company

Currently, Doan Hoang Nam does not own any HAG shares. If the transaction is successful, he will hold a 2.55% stake in the company founded by his father.

With the current HAG share price at VND 16,200/share, Bầu Đức is expected to earn nearly VND 400 billion, while his son, Doan Hoang Nam, will need to invest VND 437 billion to complete this transaction.

Company Turns Profitable, Making Stock Attractive?

This is the first time that Bầu Đức’s son has registered to purchase HAG shares. Previously, Doan Hoang Anh, Bầu Đức’s daughter, frequently registered for large-volume buy and sell transactions of HAG shares. Currently, Ms. Doan Hoang Anh holds 13 million HAG shares, representing a 1.23% stake.

Hoang Anh Gia Lai is currently an agricultural company specializing in fruit (bananas, durian) and livestock (pig farming) production. This year, the company plans to expand its crop portfolio by introducing Arabica coffee and silkworm trees.

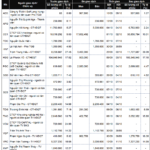

In the first six months of 2025, Hoang Anh Gia Lai reported revenue of VND 3,709 billion and a profit of VND 870 billion, reflecting a 34% and 74% increase, respectively, compared to the same period in 2024. As of now, the company has VND 400 billion in undistributed profits and has finally ended its long-standing accumulated losses.

The Telecom Titan: Mr. Lê Hải Đoàn’s Bold Double Squeeze Play

The Telecommunications Infrastructure Development Corporation (Telcom, UPCoM: TEL) has announced a delisting, following in the footsteps of HIPT Corporation (HIG). Simultaneously, Le Hai Doan, the largest shareholder in both companies, has significantly increased his holdings and has been exempted from public offering requirements, establishing a parallel control.