Fractional Pricing

The Vietnamese stock market is experiencing a buoyant trading phase, with the VN-Index setting new records while liquidity surges. Most recently, on August 11th, during the first trading session of the week, the VN-Index reached the psychological milestone of 1,600 points for the first time in history. Although it couldn’t maintain this level by the end of the session, closing at 1,596.86 points, it has still risen by 25.77% since the beginning of the year. This is the highest level in the 25-year history of Vietnam’s stock market.

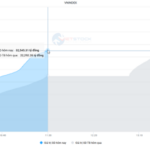

In addition, large volumes of money are being poured into the stock market, with billion-dollar matching sessions becoming more frequent. In fact, in recent days, the overall market liquidity has regularly reached $2 billion per session, including a record-breaking session on August 5th, with continuous matching value reaching VND 86,000 billion.

The surge in market capitalization is partly due to the strong growth of some leading stocks in the market, such as VIC, SHB, CTG, SSI, and VIX, among others.

In terms of market valuation, while the VN-Index has risen over 25% since the beginning of the year, its P/E ratio stands at 14.4 times, which is on par with the average of the past 3-5 years and still quite far from the hot peaks of 2018 (P/E of 22 times) and 2021 (P/E of 18 times).

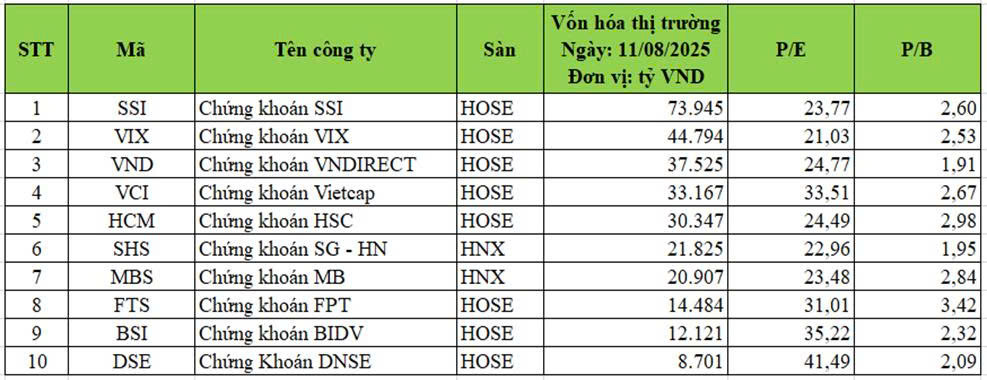

Along with the positive momentum in the recent period, the valuations of securities companies’ stocks have also changed significantly. According to statistics, the average P/B ratio of securities companies is estimated at around 2 times, while the average P/E ratio is around 23 times. This is significantly higher than the average of the past five years. However, not all securities stocks are currently at high valuations.

The P/E ratio (Price to Earnings Ratio) is a commonly used financial indicator for stock valuation, reflecting the relationship between a stock’s market price and the company’s earnings per share (EPS).

A high P/E ratio indicates that investors are willing to pay a higher price for each unit of the company’s earnings, often seen in businesses with strong growth potential or industries that are “hot.” However, an excessively high P/E ratio may also suggest that the stock is overvalued.

On the other hand, a company with a low P/E ratio at a given time could be due to its improved operational efficiency compared to the previous period, resulting in increased earnings per share (EPS) and, consequently, a lower P/E ratio. In this case, it can be said that the stock is undervalued and presents a buying opportunity.

Looking at the P/E ratios of securities stocks at present, compared to the industry average of 23 times, there are still some stocks that are considered “cheap.”

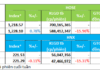

Top 10 Securities Companies by Market Capitalization (as of August 11, 2025) (Source: Based on Financial Statements of Securities Companies)

With impressive profits in the second quarter of 2025, VIX is among the companies with the lowest P/E ratios in the industry (around 21 times). In the last quarter, VIX recorded after-tax profits of VND 1,301.6 billion, a more than tenfold increase compared to the same period last year. For the first half of the year, the company’s after-tax profit reached VND 1,673.8 billion, a 5.8-fold increase over the same period.

The favorable stock market conditions have boosted VIX’s revenue streams, especially proprietary trading. Profit from financial assets recognized through profit and loss (FVTPL) brought in VND 2,056 billion for VIX, more than seven times the profit from the previous year. The proprietary trading portfolios of securities companies show that VIX, VCI, and SHS are currently making the most profits from this activity…

Meanwhile, the P/B ratio (Price to Book Ratio) is a financial indicator that reflects the relationship between a stock’s market price and the company’s book value. It is a popular tool to assess whether a stock is overvalued or undervalued compared to the company’s net asset value.

According to the latest quarterly financial reports, many large-cap stocks in the securities sector, such as SSI (2.6 times), VCI (2.67 times), MBS (2.84 times), and VIX (2.53 times), among others, have valuation ratios higher than the average P/B ratio of securities companies, estimated at around 2 times. A high P/B ratio indicates that the stock is expected to perform well in the market, reflecting investors’ willingness to pay a premium for the company’s assets, anticipating an increase in their value in the future.

According to experts, the stocks of many securities companies are likely to continue their upward trajectory in the short and medium term. The main drivers include the potential FTSE market upgrade in September 2025, sustained market liquidity, and manageable margin debt levels at securities companies due to capital raising activities.

If the market upgrade is approved, it could attract a significant amount of capital, estimated at $800 million to $1 billion from passive funds that mimic the FTSE index, and this figure would be even higher when considering other indices. Notably, the inflow of capital from active funds is expected to be even more robust, potentially reaching $4-6 billion.

This is a very positive factor for the stock market in general and securities companies in particular in the new wave of the market. Securities companies will directly benefit from increased profits and transaction fees.

Notably, abundant liquidity is a direct driver of market growth, supported by loose monetary policies and low-interest rates. According to several financial institutions, there is a high likelihood that the US Federal Reserve (Fed) will cut interest rates twice by the end of 2025. This would positively impact global financial and stock markets.

Domestically, in the first half of 2025, deposit interest rates fell to levels lower than during the COVID-19 pandemic, making the stock market an attractive investment channel. As of July 2025, the credit growth of the entire system was 9.64%, resulting in abundant market liquidity and pushing liquidity to new highs.

Growth Potential in Margin Debt

The influx of money into the market is also evident in the margin debt at securities companies. In the second quarter of 2025, over 20 securities companies had margin debt exceeding VND 1,000 billion. TCBS was the leading lender, with over VND 33,192 billion in margin loans. SSI was the second-largest lender, with over VND 32,820 billion. VPBank S’s margin lending nearly doubled in six months, rising from over VND 9,400 billion to VND 17,653 billion, an increase of VND 8,206 billion since the beginning of the year. As of the end of the second quarter of 2025, VIX had utilized VND 9,274 billion for margin lending, an increase of nearly VND 3,500 billion in just six months. If this growth trajectory continues, VIX could join the top 5 lenders in the third quarter. Moreover, VIX’s margin lending is impressive, with a margin/equity ratio of 52%.

According to regulations, the total margin lending of a securities company must not exceed 200% of its equity. With the rapid growth in the past period, many large companies are approaching this threshold, including HSC, MBS, Mirae Asset, and KIS…

The booming margin market is a significant driver for the securities industry, but a clear differentiation is expected in the 2025-2026 period, favoring securities companies with more room for lending. In this context, it is positive to see many securities companies increasing their charter capital, enhancing their margin lending capacity, and improving risk management capabilities. This enables the market to absorb margin money proactively and efficiently.

Moreover, the digital asset sector is gradually being regulated in Vietnam, opening up opportunities for a reassessment of securities companies in a vast, large-scale, and potential market.

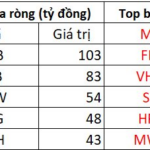

The Foreign Sell-Off Continues: Over $30 Million in Net Selling as Banks See Buying Spree

The foreign investors’ sell-off trend continued in the Vietnamese market, with FPT stock witnessing the largest net sell-off, totaling an enormous VND 1.71 trillion.

Market Beat: VN-Index Hangs on at 1,611 Points, Foreigners Sell FPT en Masse.

The market closed with positive gains, as the VN-Index rose by 3.38 points (+0.21%), reaching 1,611.6. Similarly, the HNX-Index climbed 3.22 points (+1.16%) to 279.69. The market breadth tilted towards the bulls, with 397 advancing stocks against 387 declining ones. However, the large-cap VN30 index painted a different picture, with 16 stocks in the red, 11 in the green, and 3 unchanged.

Market Mayhem: Navigating the Storm

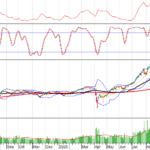

The VN-Index experienced vigorous tug-of-war action with above-average trading volume. The MACD indicator continues its upward trajectory, providing a buy signal and reinforcing the positive short-term outlook. However, intense fluctuations within the session are likely to persist as the index forges new peaks.

“Technical Analysis for August 13: Proceeding With Caution”

The VN-Index and HNX-Index both witnessed a decline during the morning session, with an increase in trading volume. This indicates a cautious sentiment among investors, who are carefully navigating the market and assessing their investment strategies.