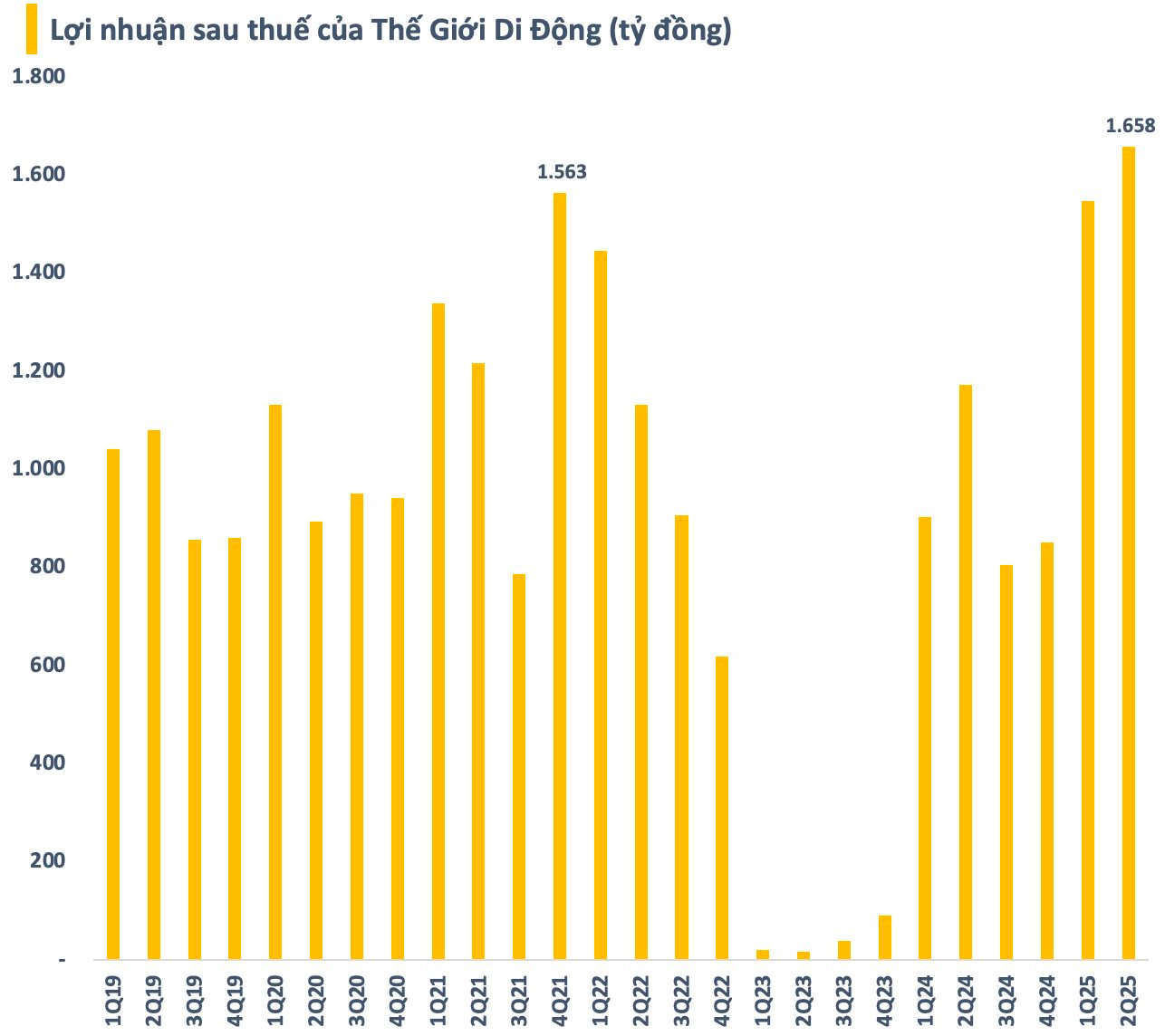

In Q2, The Gioi Di Dong Joint Stock Company (MWG) recorded a revenue of VND 37,620 billion, a more than 10% increase compared to the same period in 2024. After-tax profit increased by over 41% compared to the same period in 2024, reaching VND 1,658 billion. This is the highest profit ever recorded by Mr. Nguyen Duc Tai’s retail enterprise in a quarter since its operation.

For the first six months, MWG recorded a revenue of VND 73,755 billion and after-tax profit of VND 3,205 billion, up 12% and 54%, respectively, compared to the same period in 2024. With these results, the company has achieved nearly half of its revenue plan and completed 66% of its annual profit target.

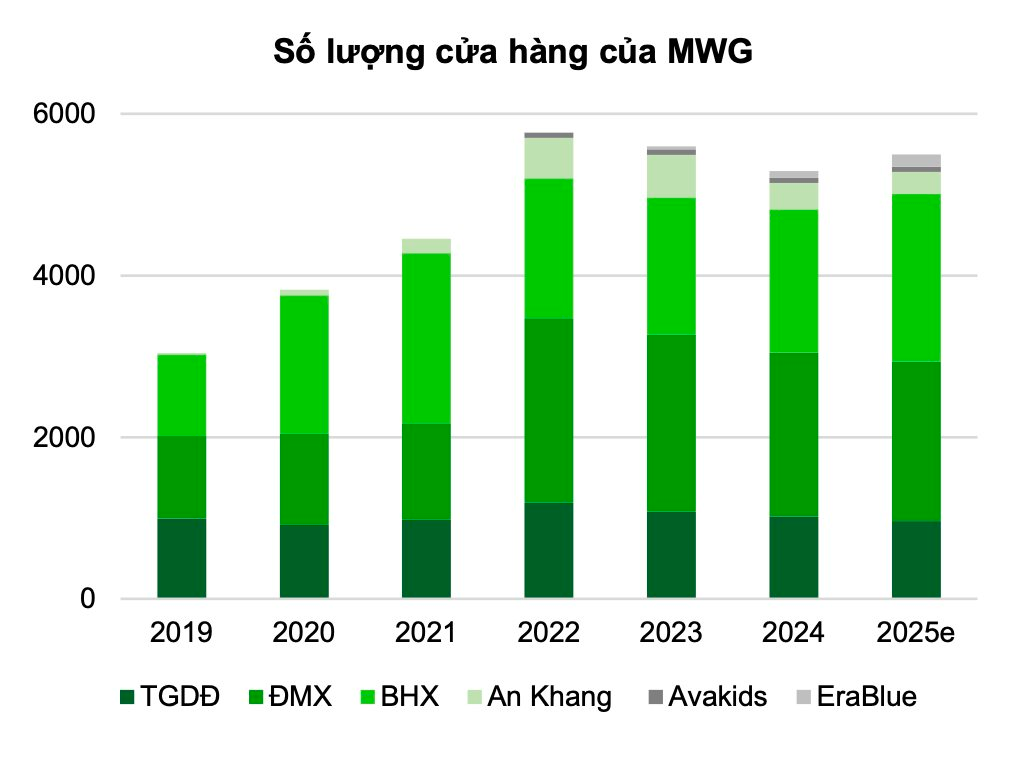

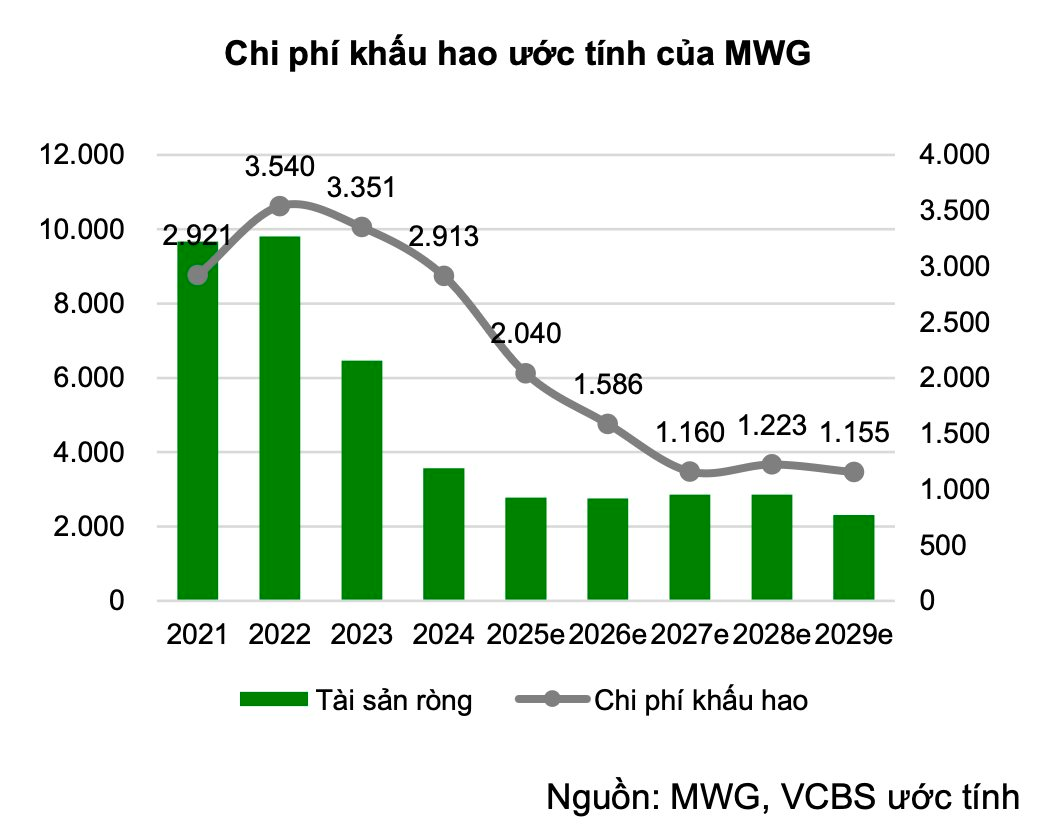

In a recent analysis report, Vietcombank Securities (VCBS) pointed out a factor that helped MWG improve its profit. Accordingly, the rapid expansion strategy from 2019 to 2022 helped MWG quickly increase its coverage with about 900 new stores each year, thereby consolidating its position and boosting revenue growth. However, along with growth comes cost pressure, especially depreciation expenses arising from large investments in premises and equipment.

Since 2023, when MWG proactively stopped expanding its system, depreciation expenses tend to decrease as many stores enter the final phase of their asset life cycle. In the first half of the year, depreciation was VND 1,000 billion, a decrease of VND 400 billion compared to the same period, reflecting the positive impact of the asset cycle. VCBS estimates that about 800 MWG stores will be fully depreciated this year, helping the company save about VND 900 billion in costs and significantly improving profit margins.

Dual boost for ICT segment

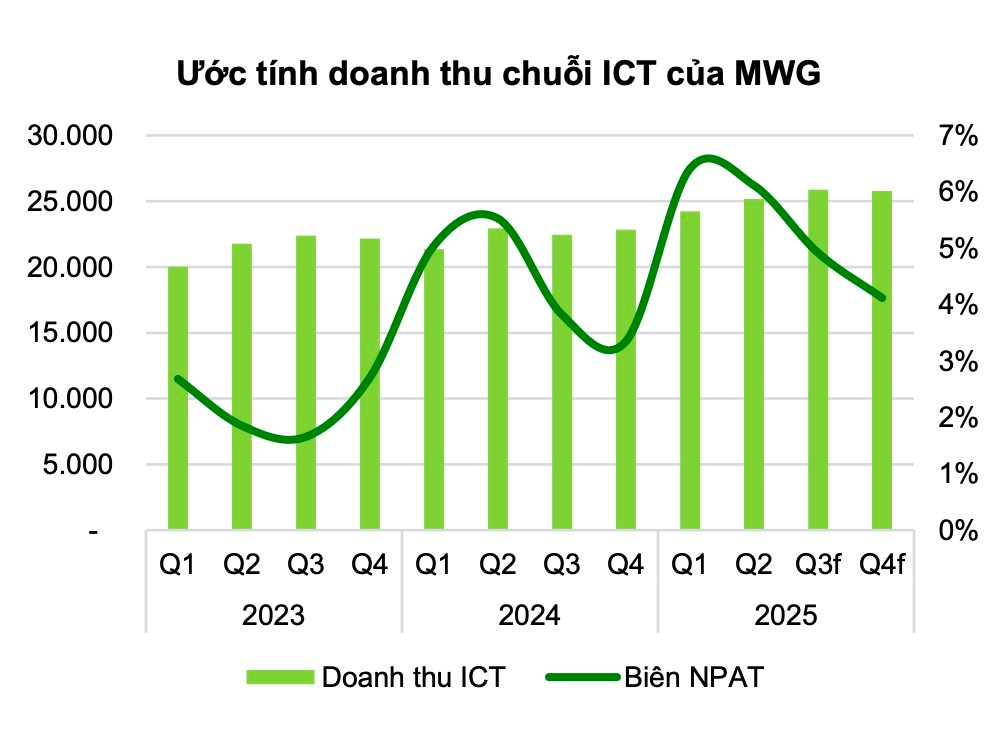

Since the beginning of 2025, Vietnam’s e-commerce market has witnessed a strong “purge” wave as more than 80,000 stalls left the floor, mainly due to tightened regulations on tax declaration and payment, as well as increased operating cost pressure, especially for personal accounts. On the contrary, the group of genuine stalls (Shop Mall) still grew strongly, showing that consumers are increasingly prioritizing reputable brands.

This development, along with the need to upgrade laptops to meet the hardware requirements of Windows 11 (as Windows 10 will no longer be supported from October 2025) and the seasonal “back to school” factor from late July to mid-September, creates a dual boost for laptop sales, especially in the mid-range and high-end segments.

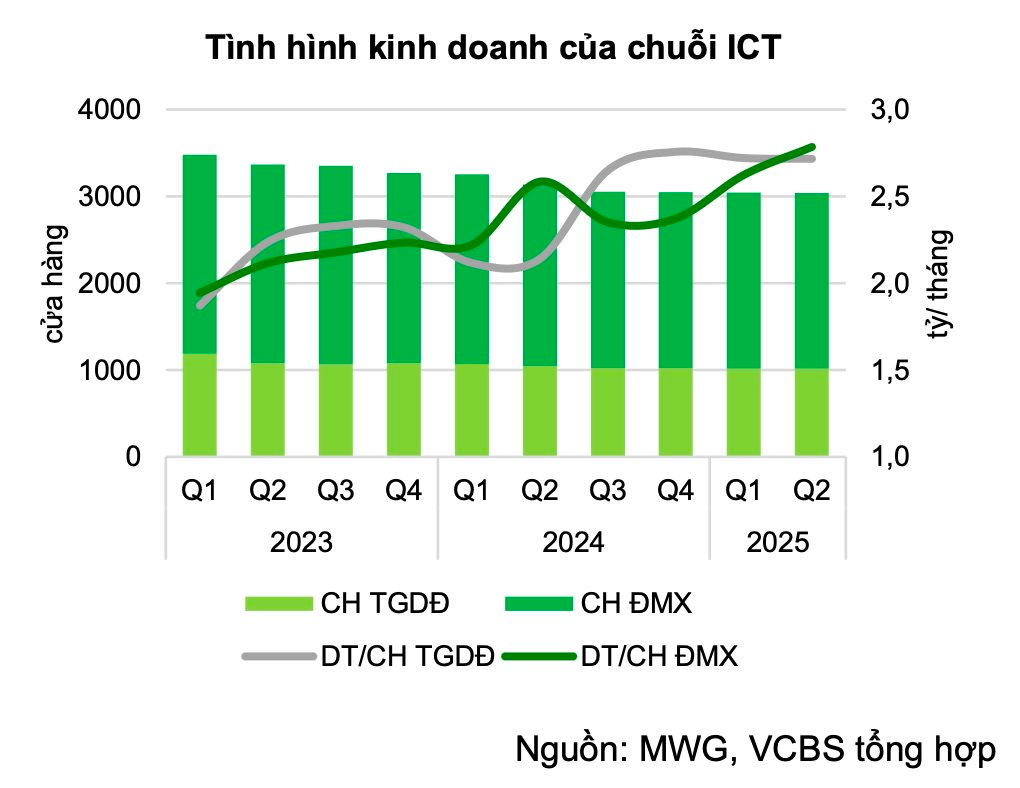

VCBS believes that this is a great opportunity for retailers such as The Gioi Di Dong/Dien May Xanh (TGDĐ/ĐMX) to simultaneously boost their online presence to capture e-commerce market share and take advantage of the strong tech spending during the back-to-school season.

Through its strategy of optimizing operating costs, improving sales efficiency, inventory control, and reducing price competition pressure, MWG has improved its net profit margin to 4.7% in the first half of the year, an almost 1% increase compared to the same period, laying the foundation for sustainable profit growth in the coming quarters.

According to the newly announced 2030 strategy, MWG stated that the TGDĐ/ĐMX chain (MW) is ready to break free, shatter market saturation perceptions, and open up new horizons. This is the perfect time to continue the legacy and lead MW’s new growth journey toward 2030, as well as a springboard to expand into Southeast Asia. The company aims to double its 2025 profit by 2030, maintaining a growth rate of over 15% per year.

MWG is ready to take on the big challenge of realizing MW’s 2030 IPO journey. “The IPO is not aimed at raising capital but is a strategic step for MW to operate independently, transparently, and appropriately for each stage and chain. This is the golden opportunity for investors to accompany MW, with its solid foundation and regional vision,” MWG’s leadership emphasized.

Bach Hoa Xanh shifts focus to profit optimization

Regarding the Bach Hoa Xanh (BHX) chain, MWG’s management evaluates that this is the time for BHX to accelerate the realization of its 2030 vision and listing goals. The Vietnamese market for food and FMCGs is worth 60 billion USD, with ample room for growth.

The rapid rise of a new generation of consumers with new shopping behaviors is reshaping the market: customers prioritize convenience, speed, and health and safety concerns. This is driving the shift from traditional to modern retail channels.

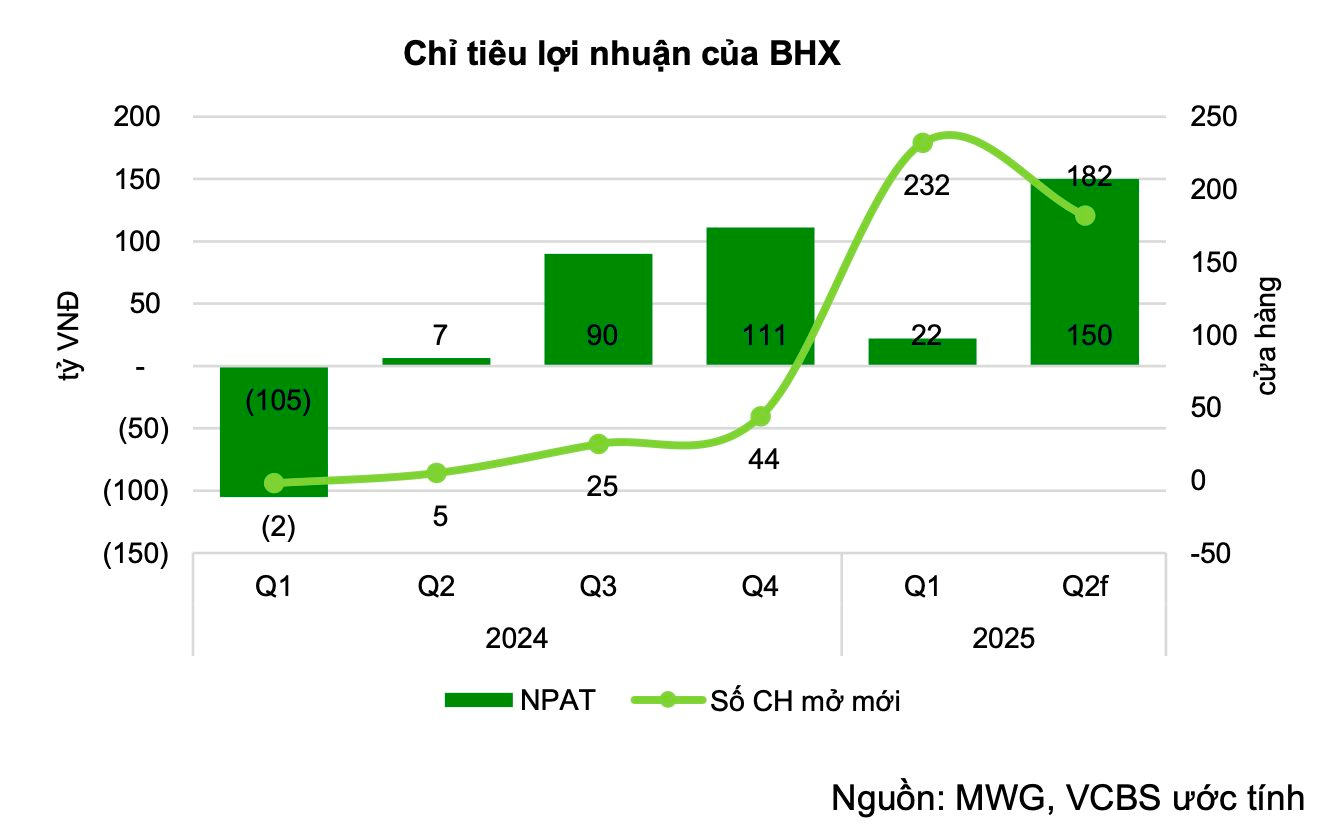

VCBS expects BHX to significantly increase its profit in the second half of 2025 after accelerating its expansion in the first half, with 414 new stores, exceeding the plan of 400 stores for the entire year. After experiencing investment cost pressure in the first quarter, the chain is estimated to have recorded about VND 150 billion in after-tax profit in the second quarter, thanks to the superior performance of Central region stores and improved profit margins.

In June 2025, the number of newly opened stores decreased to only 6, reflecting a shift towards optimizing operations and improving net profit margins for new sales points. According to VCBS estimates, BHX can achieve an after-tax profit of VND 547 billion in 2025, with a net margin of about 1.1%, supported by the year-end peak consumption season, which contributes the most to the chain’s revenue and profit.

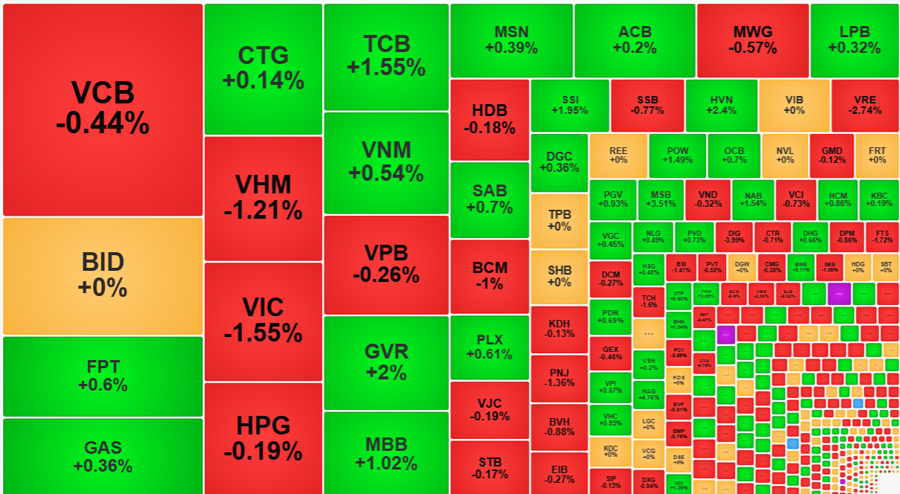

Stock Market Outlook for Tomorrow, August 8: As VN-Index Hits New Highs, What Should Investors Do?

Despite the sell-off pressure in the session on August 7-8 not being too significant, Dragon Vietnam Securities Joint Stock Company forecasts that the session on August 8 will see strong competition between supply and demand for stocks.

TCBS Announces IPO Price at VND 46,800 per Share, Valuing the Company at Over USD 4 Billion

The Board of Directors of Techcom Securities Joint Stock Company (TCBS) approved a resolution on August 5th to adjust and replace certain contents of the previous IPO plan outlined in the resolution of July 9th. Notably, the company announced a sale price of VND 46,800 per share, corresponding to a valuation of approximately 4.1 billion USD.