The Prime Minister emphasized the requirement for a successful exhibition of the highest quality, befitting the 80th-anniversary milestone. Photo: VGP

Recently, the Government Office issued Document No. 418/TB-VPCP dated August 12, 2025, announcing the conclusions of the Government Standing Committee on the preparation for the Exhibition of National Achievements to celebrate the 80th anniversary of National Day.

The announcement clearly states that the Government Standing Committee requests the Ministry of Culture, Sports and Tourism to coordinate closely with Vingroup Corporation and international consultants to thoroughly review and absorb the opinions of the Government Standing Committee and meeting participants. They are also tasked with further refining the overall design concept to meet the requirements, inspire the entire nation, international friends, and tourists, and serve as a destination for the people and tourists during the exhibition.

Regarding advertising at the exhibition, the Government Standing Committee proposed that corporations and large companies such as Vingroup, Hoa Phat, Thaco, and Sungroup advertise their key products and projects within the exhibition space. If there is any remaining space, the Committee suggested offering it to large corporations, state-owned enterprises, and private groups for advertising, ensuring aesthetic appeal and harmony with the overall exhibition space.

Furthermore, regarding the private enterprise exhibition area, the Committee encouraged prominent businesses to participate in the “Startup for National Construction” section, in line with Resolution 68, which emphasizes the crucial role of the private sector in the national economy. Emphasizing that the exhibition should not only serve as a display space but also facilitate exchanges, cooperation, and contract signings, the Committee proposed allocating additional seminar rooms for domestic and foreign enterprises to meet, interact, and seal deals during the event.

The document also specified the duration of the exhibition as nine days, from August 28, 2025, to September 5, 2025.

“A significant, challenging, unprecedented, time-constrained, and demanding task”

The exhibition, “80 Years of Independence, Freedom, and Happiness,” will take place at the National Exhibition Center in Dong Anh, Hanoi. Photo: VNA

According to the Government Standing Committee, the exhibition, “80 Years of Independence, Freedom, and Happiness,” is a highly significant event with a grand scale and diverse content, presenting a significant challenge with no precedents, a tight timeline, and demanding requirements. Therefore, participating in and organizing this exhibition is an honor, a source of pride, and a responsibility for ministries, sectors, localities, and businesses.

Consequently, all ministries, sectors, localities, and businesses must proactively and actively participate in the exhibition with the highest sense of responsibility to match the magnitude of the 80-year struggle for national independence, unification, construction, and defense. This participation should embody comprehensiveness, objectivity, thriftiness, and efficiency.

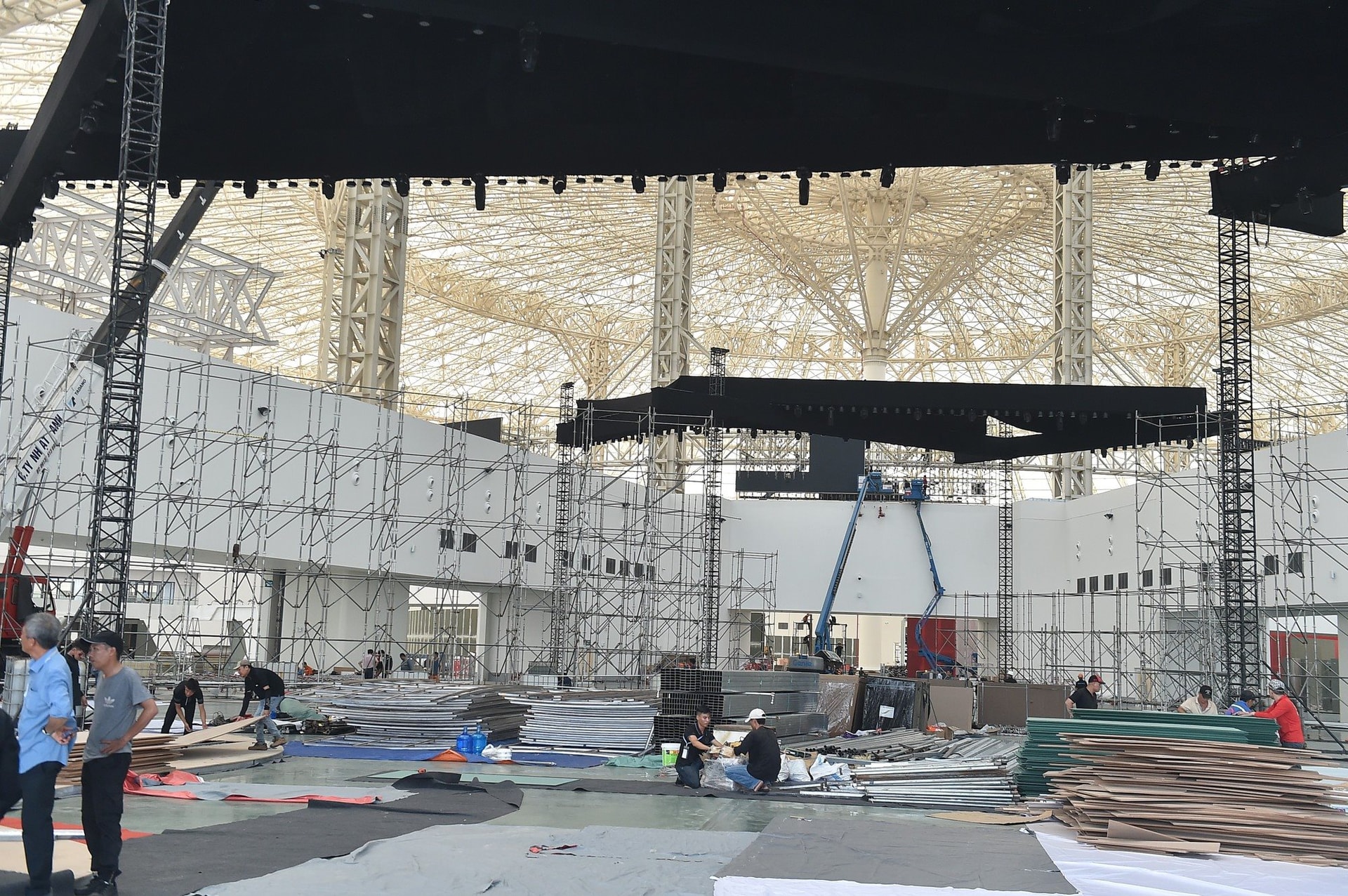

Construction units working on the exhibition as of August 11. Photo: VGP

At a meeting on August 11 with relevant ministries, sectors, and units regarding issues related to the exhibition of achievements for the 80th anniversary of National Day, Deputy Minister of Industry and Trade Nguyen Sinh Nhat Tan shared that out of the 90 enterprises under the ministry’s responsibility, 85 had committed to completing their booths by the deadline of August 15. The ministry and the Trade Promotion Agency are closely monitoring the progress of the remaining five enterprises and their construction units, working around the clock to ensure timely completion in line with the overall exhibition schedule.

The nine-day exhibition, “80 Years of Independence, Freedom, and Happiness,” will showcase the outstanding achievements of Vietnam in various fields, including industry and technology, investment and trade, agriculture and rural development, security and defense, foreign affairs, healthcare, education, culture, sports, and tourism.

Alongside the exhibition, a diverse range of artistic performances, ethnic shows, film screenings, conferences, and seminars will transform the venue into a vibrant cultural and entertainment hub for the people of Hanoi and tourists during the National Day celebrations on September 2, 2025.

“Vice-Prime Minister Ho Duc Phoc Leads a Meeting with Ministries on Crucial Matters Concerning the Securities Law”

Vice Prime Minister Ho Duc Phoc gave specific instructions regarding the following matters: Maximum foreign ownership ratio; commercial banks acting as clearing members in the underlying securities market, central counterparty (CCP) clearing mechanisms; financial institutions guaranteeing bonds; and trading accounts.

Unveiling NCB’s August Release: The Pride Collection’s Next Chapter

“Following the success of the Thong Nhat Visa card, the National Commercial Joint Stock Bank (NCB) is set to launch two new special cards in its ‘Pride’ series this August, coinciding with the grand celebration of the 80th National Day.”

The Two ‘Living Treasures’ Beneath Vietnam’s Seas: A Plea for Their Protection

For the first time, an in-depth survey along the coastal and estuarine areas of Southeast Vietnam has led to the discovery of two new species of snake eels (family Ophichthidae), adding to our knowledge of Vietnam’s rich marine biodiversity. This groundbreaking finding expands our understanding of the region’s unique aquatic life and underscores the importance of exploring and documenting these fragile ecosystems.