In a recently published analysis report, VCBS Securities has upgraded the outlook for STB shares of Saigon Thuong Tin Commercial Joint Stock Bank (Sacombank, HOSE: STB), forecasting that the bank will accelerate in the pivotal year of its restructuring plan.

According to VCBS, Sacombank is one of the large-scale private joint-stock banks with an efficient core business in the banking industry. Following significant asset quality issues arising from the merger with Southern Bank, Sacombank has entered the final phase of its restructuring process under the supervision of the State Bank of Vietnam (SBV), and is expected to enter a robust recovery cycle in the coming years.

“We expect the process of handling Sacombank‘s non-performing assets to be expedited and completed in 2025-2026 as asset markets show signs of recovery,” VCBS said.

Echoing VCBS‘s sentiments, Vietcap Securities also highlighted the upside potential for STB shares due to the bank’s progress in addressing non-performing loans and realizing collateralized assets inherited from Southern Bank.

“These non-performing loans negatively impacted Sacombank‘s business results and equity scale during the 2016–2024 period. However, they also represent a significant potential profit source as Sacombank recovers these loans in the future,” Vietcap stated.

Overcoming Challenges, Affirming Strength

Sacombank commenced its restructuring journey in 2016, following the merger with Southern Bank. At that time, the bank faced a massive bad debt burden and stringent conditions from the restructuring plan, notably the restriction on increasing its charter capital. These challenges seemed to hinder Sacombank‘s development, but with a clear strategy and strong determination, the bank gradually overcame these obstacles, achieving impressive progress.

One of Sacombank‘s most notable achievements is its transparent and effective bad debt handling roadmap. As of the end of 2024, Sacombank had recovered and handled nearly VND 10,000 billion in bad debts and stagnant assets, bringing the total to VND 103,988 billion, of which VND 76,695 billion was under the restructuring plan. Consequently, the ratio of bad debts and stagnant assets to total assets decreased significantly from 28.1% to 2.4%, equivalent to an 80.5% reduction.

Notably, Sacombank has completed the handling of the entire VND 21,576 billion in accrued interest that was ring-fenced and fully provisioned for the remaining stagnant loan portfolio. The bank is currently awaiting the collection of proceeds from the successful auction of the Phong Phu Industrial Park project, along with the SBV’s approval and implementation of the handling plan for the debt secured by 32.5% of the capital stock owned by Mr. Tram Be and related parties. This will provide the basis for fulfilling the remaining obligations and initiating the necessary procedures to increase charter capital.

Along with bad debt handling, Sacombank‘s profit recovery has been robust and stable over the years. Surging from a pre-tax profit of only VND 156 billion in 2016 – right after the merger and the commencement of restructuring – Sacombank achieved a remarkable leap with a pre-tax profit of VND 12,270 billion in 2024, ranking among the Top 10 most profitable banks in the system.

This result has led to a cumulative retained profit after distribution of Sacombank as of the end of 2024 of VND 25,352 billion, more than 1.3 times its charter capital. This robust financial resource positions Sacombank to pay dividends to shareholders as soon as it obtains approval from the State Bank of Vietnam (SBV).

In addition to bad debt handling and profit recovery, Sacombank has also demonstrated its efficient capital utilization through significant growth in financial indicators. The ratio of earning assets has increased from 89.6% to 95.2%, indicating optimized resource allocation. Profitability indicators have also improved considerably: average pre-tax profit per employee increased by 34% to VND 696 million per employee per year; average return on assets (ROA) increased by 0.2% to 1.42%; and average return on equity (ROE) increased by 1.73% to 20.03%.

Notably, Sacombank‘s basic earnings per share (EPS) recorded an impressive growth of 47.7%, equivalent to VND 1,729, reaching VND 5,351 per share. This is an essential indicator that directly reflects the value that the shares bring to shareholders.

With these positive financial indicators, Sacombank has not only affirmed its business capabilities but also strengthened investors’ confidence in the long-term growth potential of the bank’s shares.

Top Choice for Investors

Accompanying its business performance, Sacombank‘s reputation and brand value have also been continuously enhanced in the international market. In 2024, Moody’s upgraded Sacombank’s credit rating by one notch, while Fitch Ratings assessed a “stable” outlook with long-term Issuer Default Ratings (IDR) of BB-, short-term IDR of B, and Viability Rating (VR) of B+.

These positive assessments not only reinforce Sacombank‘s position in the domestic market but also attract the attention of international strategic investment funds and earn the high trust of customers.

Currently, Sacombank serves over 19 million individual and corporate customers, an impressive figure that reflects the brand’s appeal and reach.

Sacombank‘s superior risk management capabilities are another bright spot. The bank has effectively applied risk management standards in accordance with Basel III and completed the preparation of financial statements according to IFRS 9 standards. These steps not only enable Sacombank to utilize capital efficiently to generate profits but also build a robust financial buffer to withstand unexpected market fluctuations.

With the outstanding achievements mentioned above, Sacombank has proven that even under the most challenging conditions, a sound strategy and strong determination can create remarkable successes.

For investors, Sacombank shares are becoming one of the most attractive choices in the Vietnamese stock market, offering sustainable profit potential. Upon completing the restructuring plan and lifting the restrictions on capital increase, Sacombank is expected to gain further momentum to expand its scale and enhance the value of its shares.

|

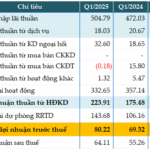

In the first quarter of 2025, Sacombank‘s pre-tax profit reached VND 3,674 billion, up 38% over the same period and ranking in the Top 10 banks with the highest pre-tax profit. Lending increased by 4.7%, achieving 33.3% of the plan. The non-performing loan ratio stood at 2.2%, lower than the industry average, amid a slow economic recovery and challenges in the real estate market. The bank also recorded more than VND 6,863 billion in net interest income, up 15% over the same period last year, ranking 8th in the Top 10 banks with outstanding net interest income. Service activities also generated a profit of nearly VND 728 billion, up 26%. Meanwhile, profit from foreign exchange trading remained stable at approximately VND 308 billion. |

– 16:20 05/07/2025

The Bank Dividend: Where Cash Flows Like Rain, or Not a Penny More

The shareholders are about to receive a windfall of cash dividends from the banks. While some banks generously distribute their profits, others retain substantial amounts of earnings, amounting to thousands of billions, without sharing this wealth with their investors.

“The CASA Growth Engine: Unlocking Sacombank’s Potential”

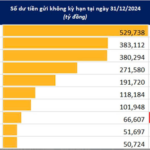

Sacombank has consistently ranked among the top 10 banks with the highest CASA, giving it a significant advantage of low-cost funding. This enables the bank to expand its lending activities, boost net interest income, and invest in developing a robust service ecosystem. Amidst a volatile interest rate environment and Sacombank’s ongoing restructuring journey, maintaining this position becomes even more crucial.

“SCB Bank Restructuring Enters a Crucial Phase”

The State Bank is refining the restructuring plan for SCB and will submit it to the appropriate authorities for approval.

“Forging a Green and Intelligent Future”: Sacombank Champions Sustainable Transport Initiatives.

“As a bank born and bred in Ho Chi Minh City, Sacombank is proud to stand alongside the city and is committed to contributing to its growth. Our financial products and services are designed to bring high, sustainable, and practical value to the people. A testament to this is the open-loop payment solution that Sacombank is implementing with the city’s transport industry,” said Ms. Nguyen Phuong Huyen, Director of Sacombank’s Retail Banking Division.