Among the banks that HSC analyzes, Vietnam Technological and Commercial Joint Stock Bank (TCB) stands out with its attractive long-term story and strong recovery in 2024.

A promising outlook with many bright spots

According to Pham Lien Ha, Director of Financial Services Research at HSC, sharing at the “Outlook for the banking industry in 2024” workshop, the banking landscape in 2024 has many favorable factors, but short-term risks still remain. Positive factors come from the stable liquidity of the system with low interest rates, the economy is recovering from the fourth quarter of 2023, and GDP in 2024 is expected to maintain positive growth above 6%. On the other hand, the conditions to maintain accommodative monetary policy are more favorable, in the context of controlled inflation and pressure on the decrease of the VND and some support policies such as Circular 02 on maintaining debt structure can be extended, and Circular 16 on trading corporate bonds by credit institutions will be amended.

From these favorable factors, HSC experts expect credit demand to recover to help credit growth outperform in 2024. The growth momentum in the first half of the year could come from public investment, exports and imports, or the FDI customer group. Although slower, individual customer demand for consumption and investment will rebound strongly in the second half of the year.

Regarding Net Interest Margin (NIM), after decreasing by an average of 50 basis points in 2023, the expert expects a slight recovery of about 20-30 basis points. Fee-based activities also have certain growth compared to last year, with recovery from the bancassurance segment.

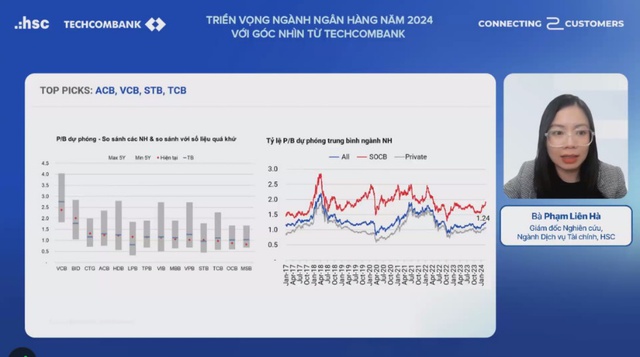

With the potential and still attractive valuation, the banking stock group is expected to attract strong capital inflows in 2024. With a relatively strong price increase in the first two months of the year, Pham Lien Ha believes that the recovery prospects of the banking industry have been partly reflected in the valuation.

The forecast price-to-book ratio for 14 banks is currently 1.25 times, higher than the 1.05 times at the end of 2023, but still lower than the long-term average.

To select banking stocks, HSC experts suggest considering several factors such as industry prospects, fundamental platform, position, and the individual story of each bank, as well as the overall valuation of the industry and that bank. Among the analyzed banks, Vietnam Technological and Commercial Joint Stock Bank (TCB) stands out with its attractive long-term story and strong recovery in 2024.

Four special advantages of Techcombank

Techcombank’s prospects are emphasized by Phung Quang Hung, Deputy CEO of Techcombank, through four special advantages:

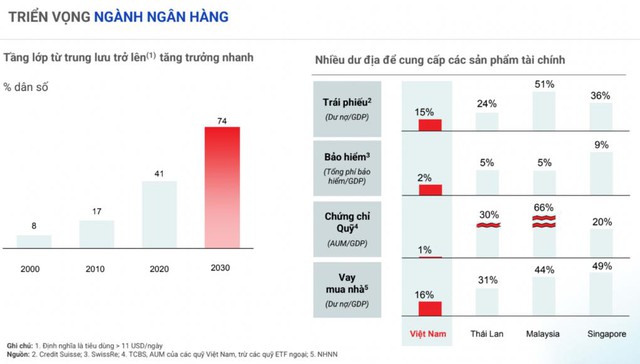

Firstly, cooperation with Techcom Securities Company (TCBS) as a pioneer in the asset management sector. In this field, Techcombank is the bank with assets under management of nearly VND 600 trillion, ranking first in bond issuance and distribution, ranking third in stock brokerage market share on HOSE. With the forecast of an increasing proportion of high-income population, the bank will continue to offer new products to develop this segment.

Secondly, Techcombank also has the advantage of diversified revenue sources. Techcombank is the bank with the highest proportion of fee income to total income. In the segment of individual customers, Techcombank is in the top regarding card payment market share. In 2023, despite many key markets slowing down, the bank’s fee income still grew. With the recovery of exports and imports, infrastructure construction, income from fees of corporate customers will continue to grow, and this will be an important driving force for Techcombank.

Fourthly, Techcombank continues to diversify and develop new customer segments. With high-end customer base, superior data capability and technology, the bank will continue to expand its target customer base to lower segments while maintaining profit margins.

“These are the strengths that we will continue to leverage to create growth momentum for Techcombank in 2024 and in the long term,” said Phung Quang Hung, Deputy CEO of Techcombank.

Answering investors’ concerns about issues related to the corporate bond market, the investment in corporate bonds issued by Techcombank, Nguyen Xuan Minh, Director of Techcombank’s Investment Banking Division, Chairman of the Board of Directors of Techcombank Securities Joint Stock Company (TCBS), said that the recovery of the bond business for Techcombank and TCBS is taking place very strongly, with more impressive timing than the period before the liquidity crisis in 2022.

“Currently, the average daily demand to buy bonds issued by TCBS is about VND 250-300 billion, which is the record high of TCBS in 8 years of issuing bonds. This is an encouraging signal and TCBS expects a stronger recovery in 2024,” said Nguyen Xuan Minh, Chairman of Techcombank Securities Joint Stock Company.

Growth momentum driving the market

Sharing about business prospects in 2024, Phung Quang Hung expects Techcombank’s total operating income and pre-tax profit to grow well thanks to several factors.

Regarding capital sources, the CASA ratio will continue to recover, thereby affecting the cost of funding and NIM, which may recover around 4% – 4.5%, after being lower at a low level in 2023. In particular, interest income continues to grow as the bank expands its customer base, and the important focus here is fee income – the main focus of Techcombank, which will continue to grow.

In addition to a stable business platform, Techcombank also has healthy asset quality. The bad debt ratio at the end of 2023 of the bank was 1.19%, the bad debt ratio for real estate business was zero, and the bad debt ratio for home loans was 1.5%. These are healthy bad debt levels for the banking industry in difficult conditions like last year.

Regarding credit growth, a representative of Techcombank said that the bank will take advantage of the approved credit growth limit. Techcombank’s credit growth after the first two months of the year increased by about 3-4%, and the corporate customer segment has strongly recovered by nearly 7% thanks to a strong performance in exports.